May 2017 | Signature Research

State of Advanced Metering Infrastructure (AMI) and Data Analytics Adoption

In a world of ever-increasing, real-time information and mounting demands from informed consumers, water utilities face exponentially greater difficulty when making business decisions

Water utilities typically operate and invest in a risk-averse fashion, prioritizing proven technologies that reduce operational and regulatory non-compliance risk. Water utility stakeholders welcome this, but it has the unintended consequence of limiting investment in technologies that can benefit consumers and communities alike. Water utilities have been slower to adopt AMS than their electric or gas counterparts.

This slower pace of adoption increases the difficulty for water utility executives to meet the increasing demands from consumers. Today’s executives are starved for insightful operational data that can help them drive customer satisfaction and operational efficiency and meet continually evolving expectations.

In 2016, West Monroe conducted a comprehensive study on the state of AMS and advanced data analytics within the U.S. water utility industry. The intent of this research was to:

-

Understand the drivers and inhibitors for water utilities’ adoption of AMS and data analytics

-

Determine existing implementation rates and complexity of data analytics offerings used by water utilities

-

Highlight how early adopters are using data analytics to run their businesses

-

Examine the depth and breadth of vendor offerings available in the marketplace

-

Assess the gap between the functionality utilities want and what is available

-

Provide insight to water utilities seeking to use analytics to address business goals

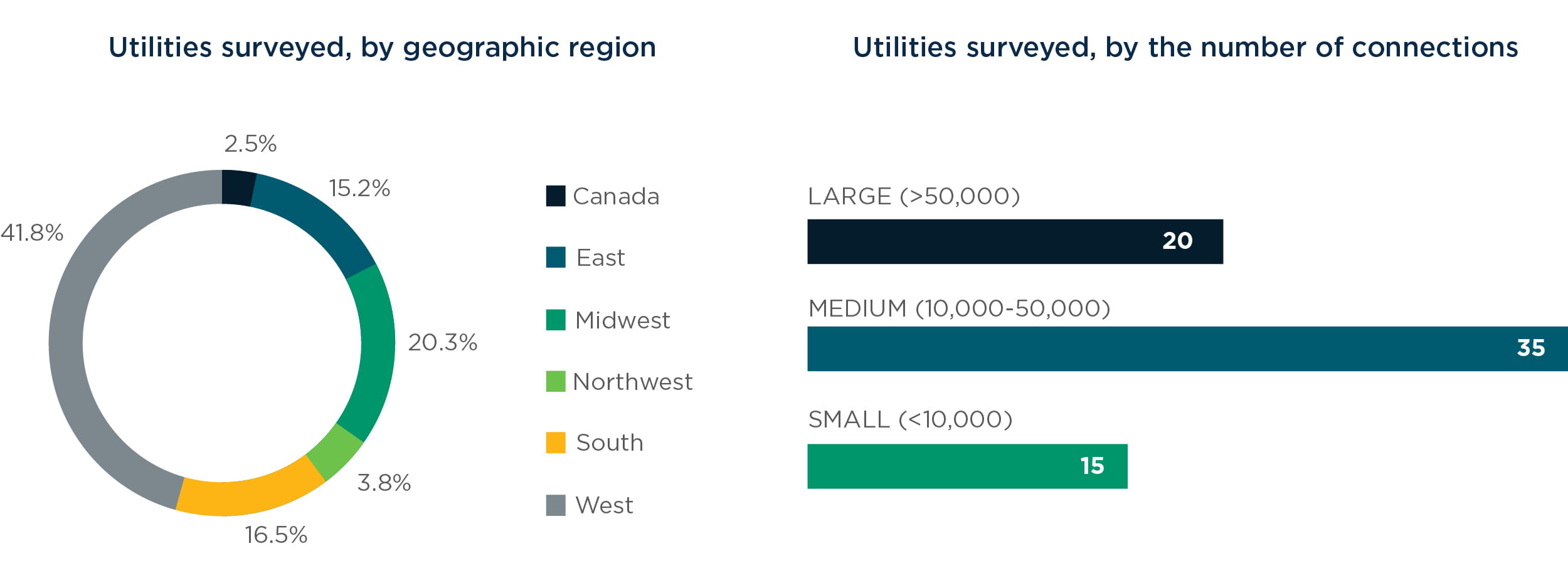

The study included surveys from and interviews with more than 70 water utilities of all sizes across the United States. In addition, it included secondary research to map the landscape of analytics solutions available today.

Introduction

In a world of ever-increasing, real-time information and mounting demands from informed consumers, water utilities face exponentially greater difficulty when making business decisions. Water utility executives are starved for more insightful operational data. As a result, many water utilities are considering or investing in automated metering systems (AMS) and related analytics capabilities.

West Monroe completed a detailed study in 2016 that provides an overview of water utility leaders’ perspectives on AMS implementation, data availability, and data analytics, as well as an analysis of solutions currently available in the market. The study provides valuable insight for water utility leaders who are assessing the business case for advanced metering technologies.

Chapter 1: Findings from the analysis of U.S. water utilities

The following pages present the survey findings, answering three key questions for water utility leaders considering analytics: why, where, and what. It also discusses peer perspective and barriers to adoption, and it provides executives designing an AMS and analytics business case with a set of tools with which they can work to build an effective case for change.

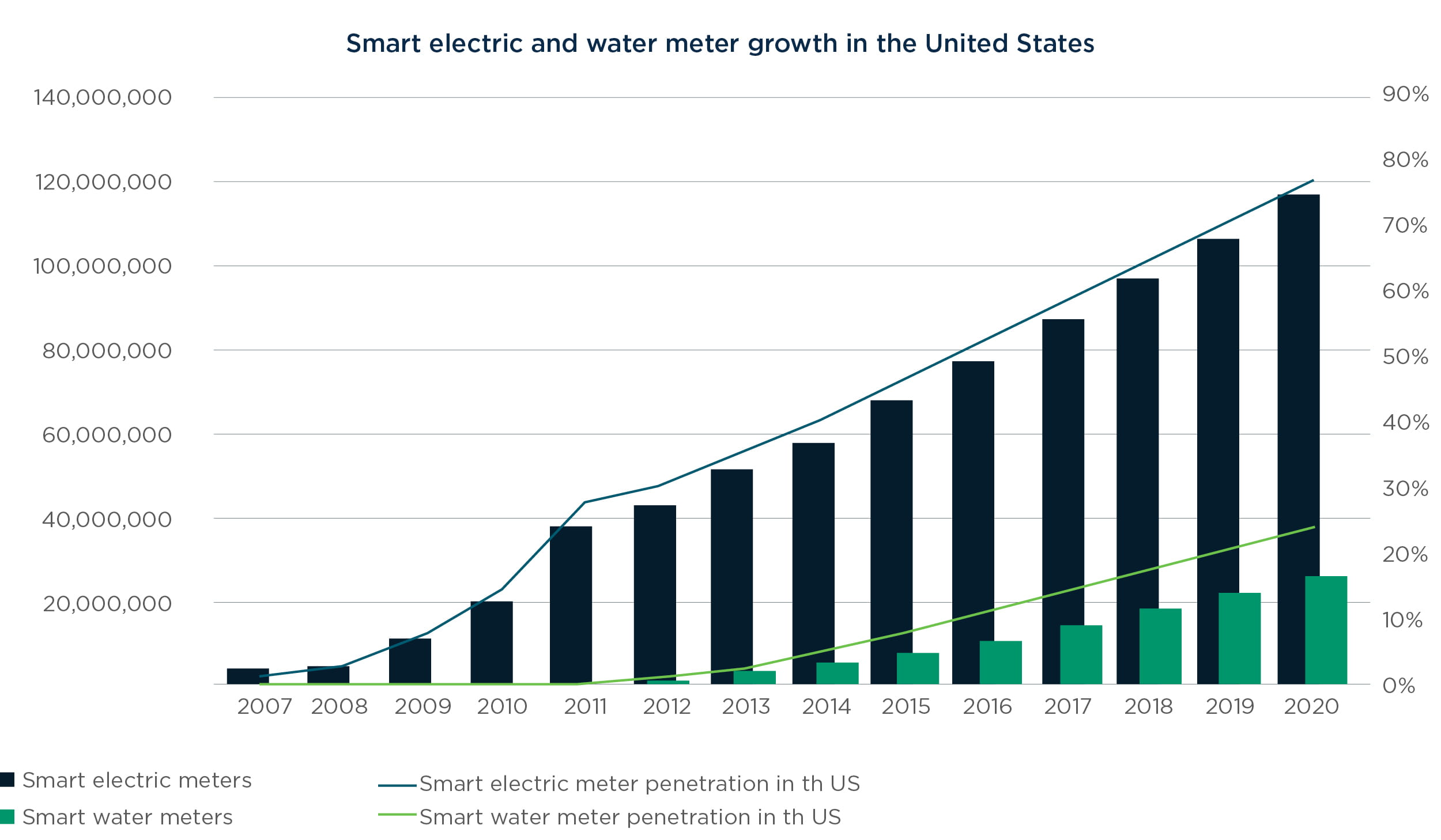

Growth of smart water meters and smart electric meters. This study analyzed the water and electric smart meter market. The resulting forecast of electric and water smart meter deployment and adoption was based on multiple sources. The desire was to better understand where the water industry is relative the electric industry with respect to smart meter deployment.

Figure 1 shows the growth of smart electric meters and smart water meters in the United States, along with market penetration. This analysis shows that water industry is about seven years behind the electric industry to achieve the same penetration. The growth of AMS in water is a key driver in the growth of analytics at water utilities. This research indicates that the deployment of analytics after smart meter deployments will not be as long for future water deployments as was seen in the past with electric utilities.

Adoption of AMS and use of analytics. The study found that approximately 35 percent of U.S. water utilities have adopted AMS. Most (60 percent) of those that have not adopted AMS, however, are considering doing so soon. Of the utilities that have adopted AMS, only 45 percent state they have implemented some form of analytics.

Those that have not implemented analytics offered various reasons for not doing so:

- Cost

- Benefits are unclear

- Lack of expertise

- Lack of time

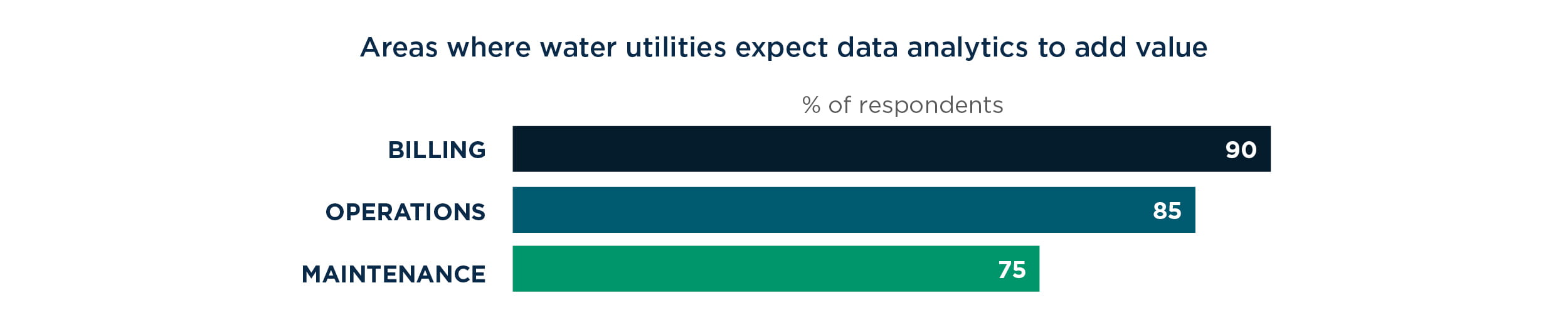

Utilities surveyed see multiple opportunities to generate value by using data analytics (Figure 2). More than 70 percent of participants, for example, expect positive value in the billing, operations, and maintenance functions. This underscores an essential consideration for water utility leaders: How will an investment in AMS and/or analytics bring greater value to stakeholders?

Water utility leaders will need to ask and answer several key questions when developing a business case and plan for using AMS and analytics: Why implement AMS and or analytics? Where is the utility located, and how do regional stressors affect use of AMS/analytics? What features are important to the utility? The research results provide some insight for addressing these key questions of why, where, and what.

Why implement AMS and/or analytics? A water utility leader who wants to advance the case for an AMS investment must begin with answering the question: Why would we do this? The answer then frames the utility’s strategy and areas of specific focus as the utility builds out its AMS plans.

The research provided some insights on why utilities are investing in AMS and analytics, based on “primary consideration” segmentation described in the research methodology. For example, when utilities consider meter replacement (hardware) as the primary consideration for adopting AMR/AMS and analytics, analytics functionality often takes a back seat. The study found that these utilities are 24 percent less likely than others to consider system-monitoring capabilities. This makes sense in that this driver is principally built on enhancing revenue through meter-accuracy improvements.

Utilities with cost as their primary consideration tend to adopt specific analytic solutions that are geared toward the reduction of non-revenue water and operational expenses. For example, they are 10 percent more likely to consider leak- detection capabilities. In addition, cost-driven utilities are more likely to consider the integration and use of billing management and data storage solutions.

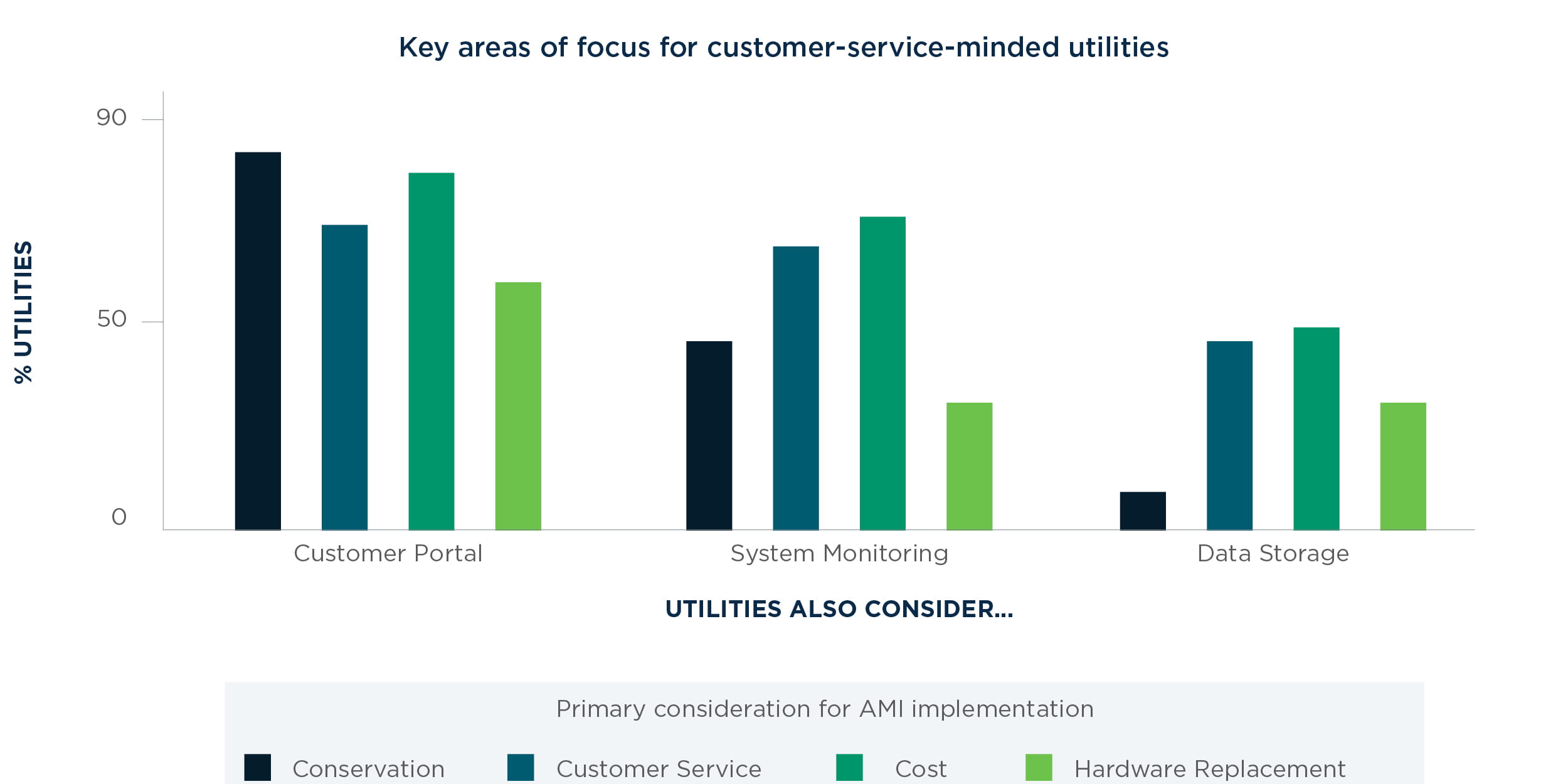

Customer-service-minded utilities take advantage of portals, report cards, and other customer- facing tools to engage customers and increase satisfaction (Figure 3). Customer-service-minded utilities are 18 percent more likely to consider system-monitoring capabilities to provide customers with more information about water usage, leaks, etc. These capabilities can help address billing and reduce customer concerns.

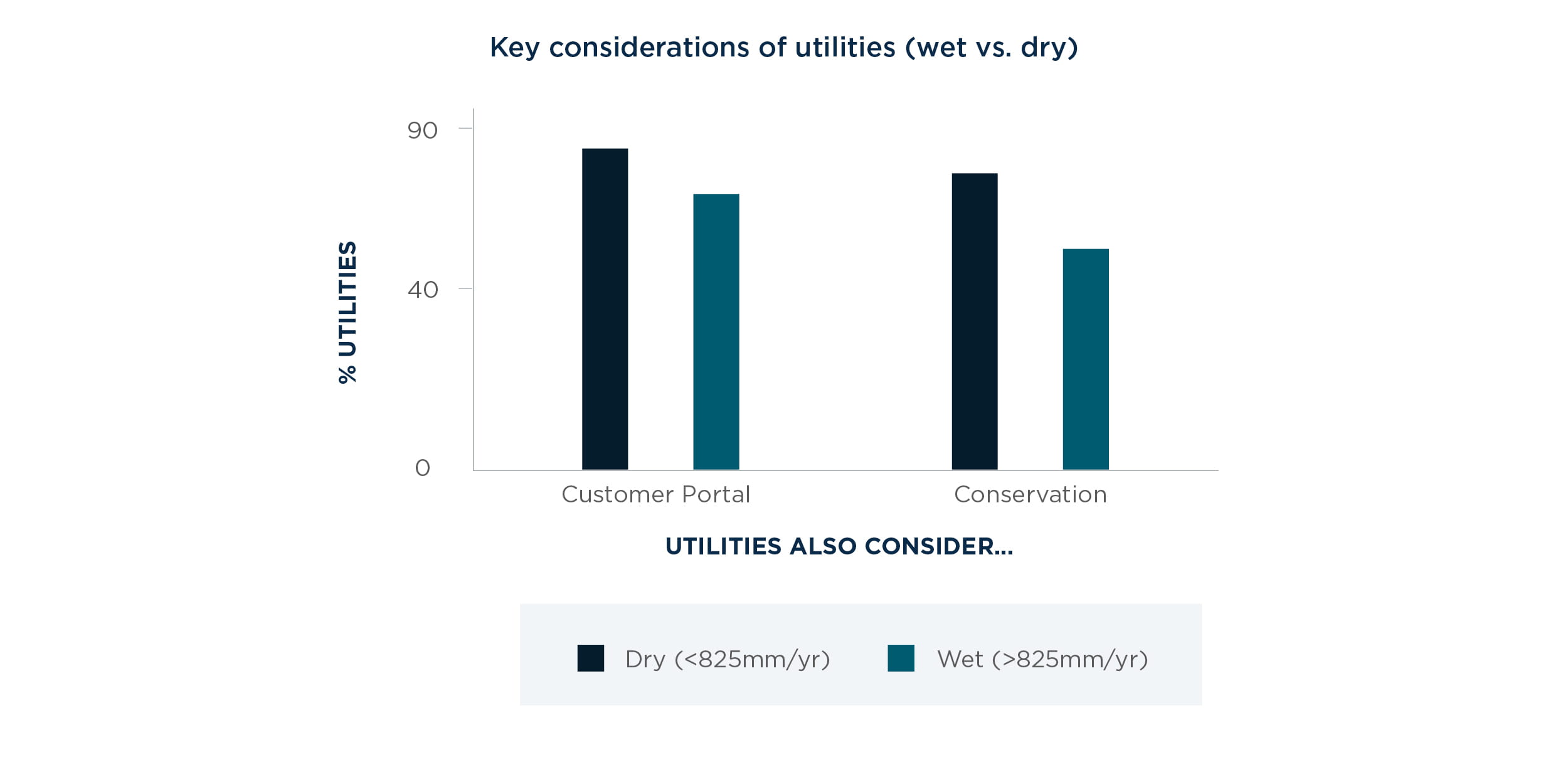

A water utility’s physical location may affect its reasons for considering an AMS and the benefits it expects to derive from system data. It is important to recognize regional stressors, so the researchers segmented this consideration by dry and wet utilities as determined by level of rainfall in the utility location. Research results showed that utilities in drier regions with scarce rainfall (less than 825 mm of rainfall per year) tend to maximize conservation and engage customers. These “dry” utilities showed 13 percent greater interest in conservation and 7 percent greater interest in implementing a customer portal than “wet” utilities (Figure 4).

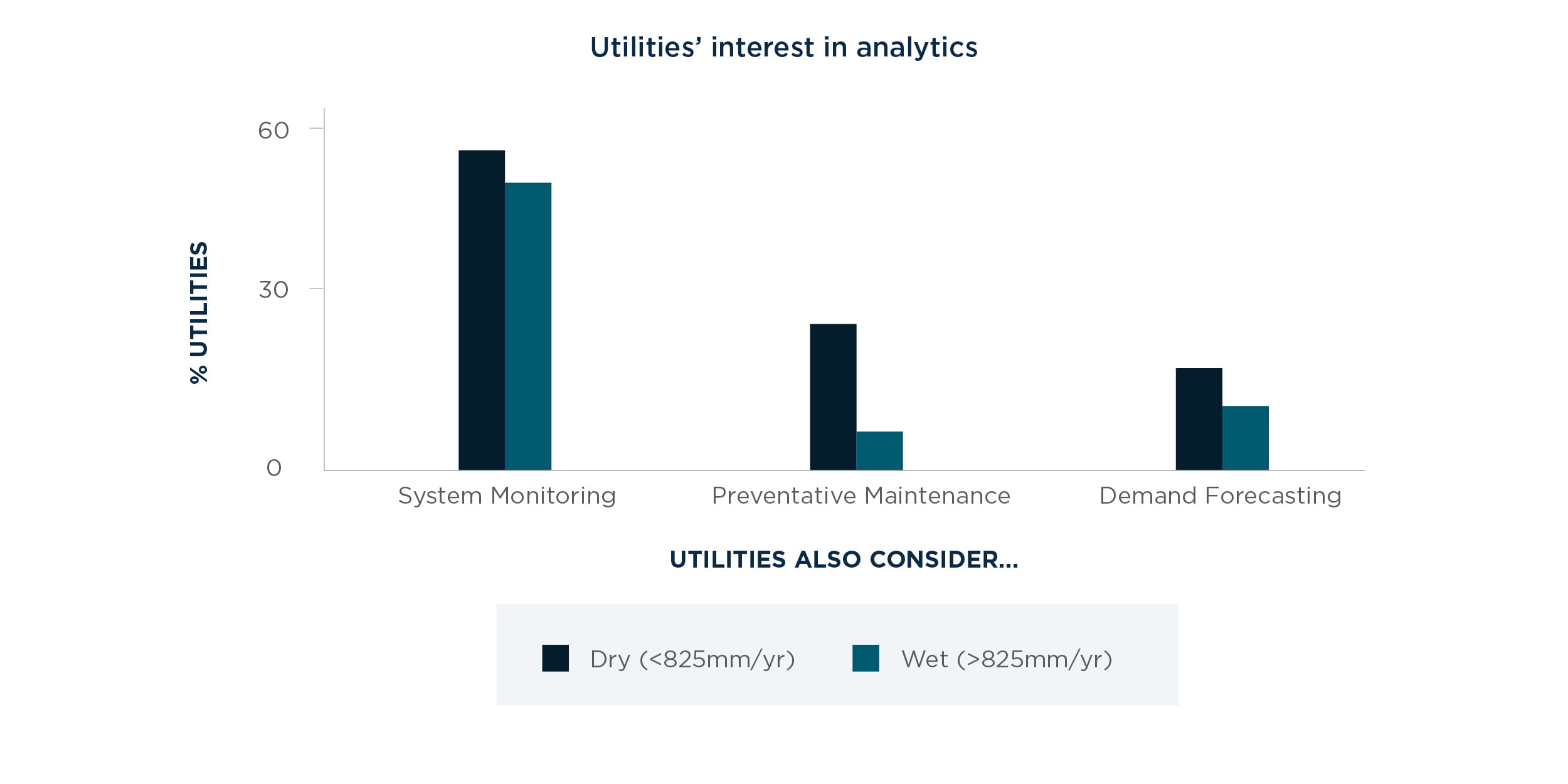

Additionally, as dry utilities have more incentive to decrease water usage, they are more likely to invest into certain advanced analytics functionalities (Figure 5). This is intuitive but important, because beginning the AMS journey knowing that conservation is the key driver will help in building a case for how conservation impacts customers, operations, and utility finances over time. In other words, knowing the drivers helps create a better AMS vision and business case.

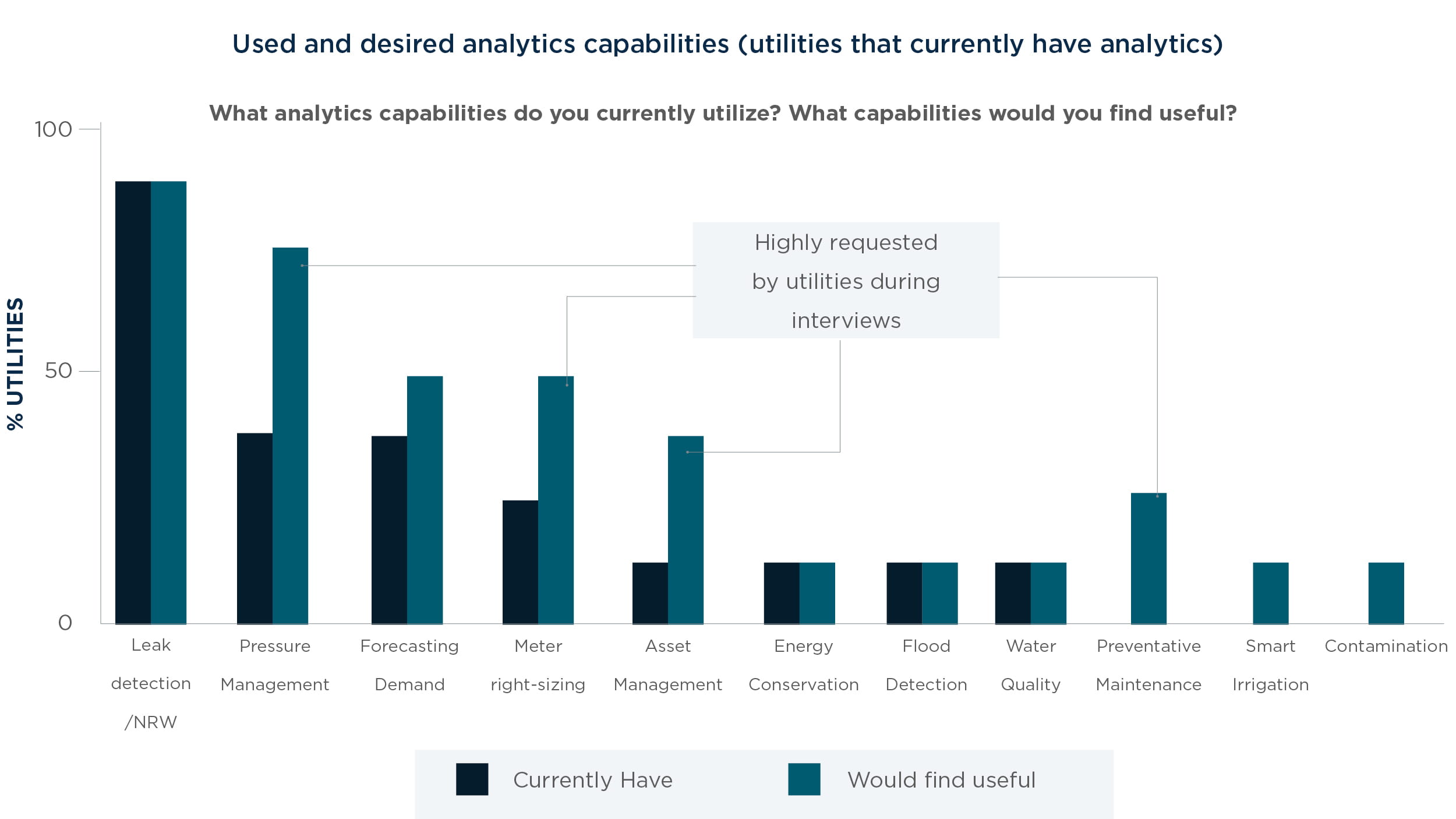

What features are important to the utility? A third key consideration is the specific capabilities a water utility wants its investment to provide. For utilities with current analytics capabilities, leak detection is by far the most utilized function (Figure 6). The research also showed strong desire for several analytic functions not currently available in many commercial solutions. Examples of non-off-the-shelf capabilities include meter health/right-sizing, pressure management, asset management, and preventive maintenance.

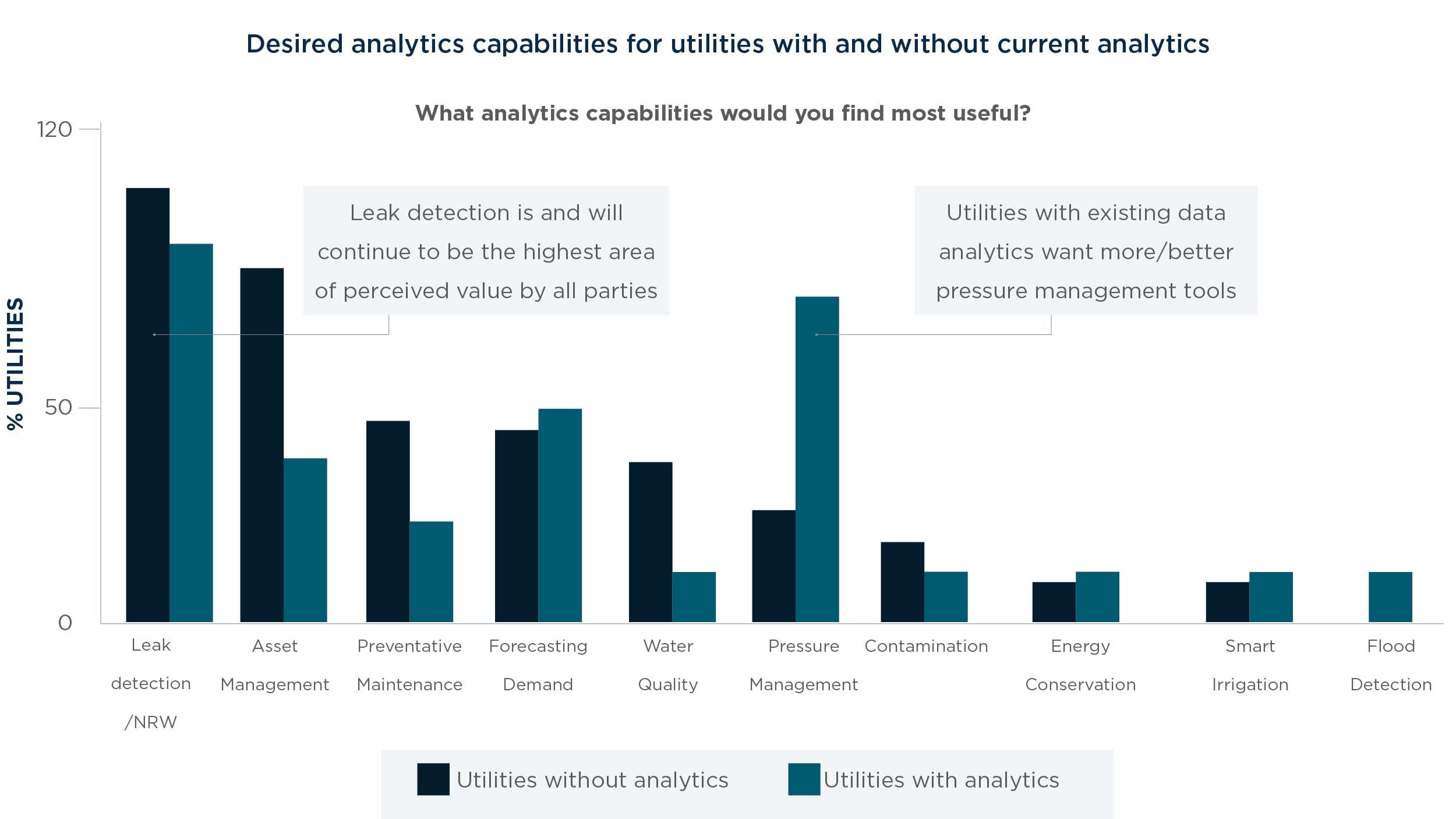

Each of these analytics capabilities is possible with a robust data architecture and advanced algorithm development, yet many of these capabilities are not readily available in off-the- shelf products. One goal of this research was to identify gaps for the industry and vendor marketplace to consider. All utilities in the study considered leak detection to be the most useful analytics capability (Figure 7). Many also consider asset management and better pressure management tools to be highly desirable.

Chapter 2: Other relevant perspectives

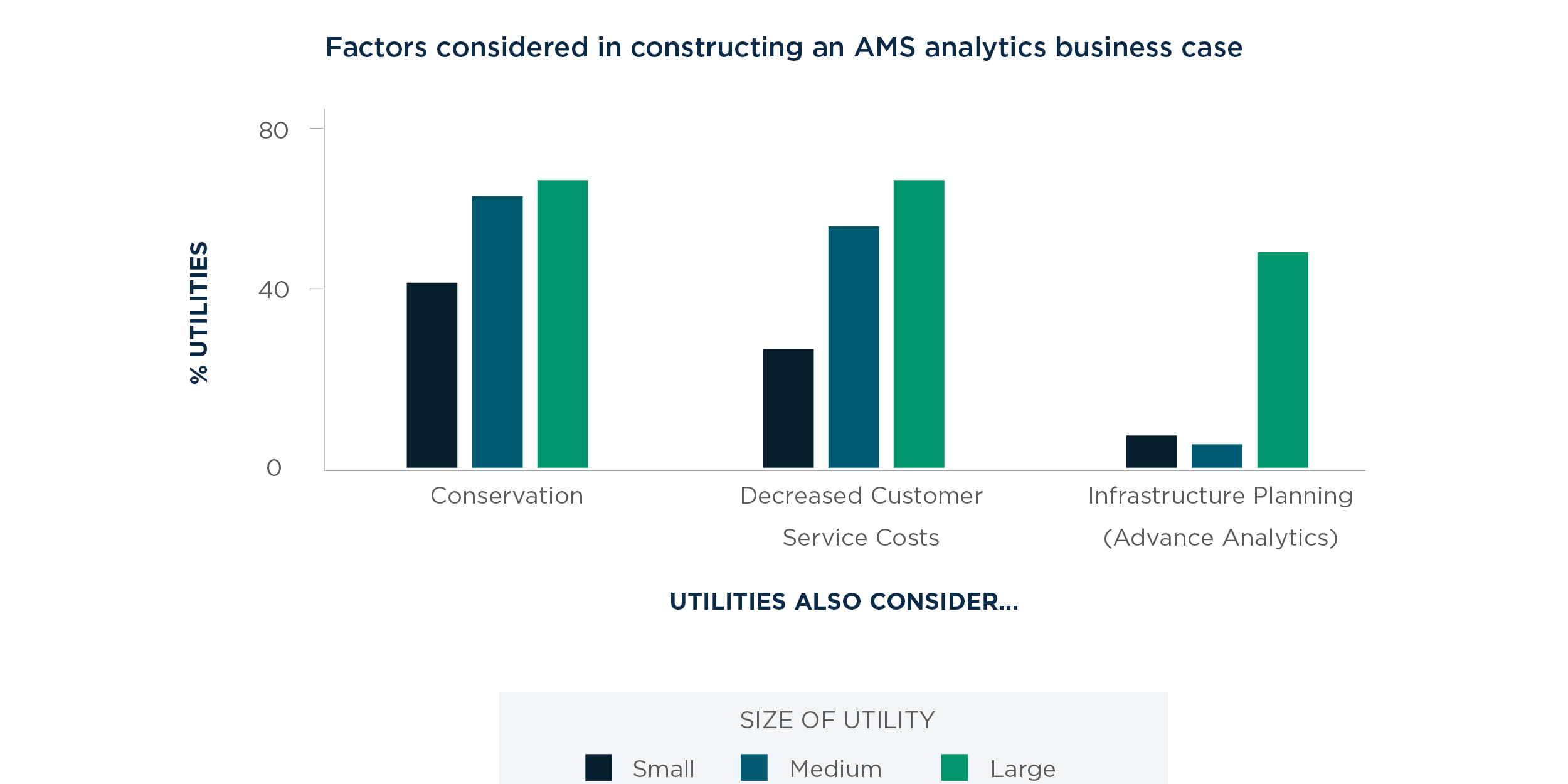

The study raised several other interesting perspectives that are relevant to water utility leaders formulating their strategies and building their business cases for AMS and analytics. Large utilities are much more likely to consider infrastructure planning and to a lesser degree, customer service costs, than their smaller peers (Figure 8) when developing an AMS/analytics business case.

Addressing barriers to adoption

Water utility leaders have a responsibility to not only deliver a return on investment but also to ensure that any investment is placed in areas that best serve the community.

The research revealed four main barriers to AMS adoption that water utility leaders should address when considering why the utility should invest in AMS and before developing the business case detail. Those barriers include:

1. Cost

Two-thirds (67 percent) of utilities cited cost as a barrier to AMS implementation. The upfront cost of implementing AMS can be particularly daunting for small and mid-sized water utilities. In the study, several utilities expressed interest in AMS but felt that without external funding, such as grants, it would not be feasible.

2. Ambiguous accounting of benefits

More than half of utilities (58 percent) said that difficulty quantifying AMS benefits has hindered adoption. In fact, after adoption, several utilities continued to manually analyze data to identify potential leaks—a function that even the most basic AMS software can automate.

3. Lack of integration with existing system architecture, including billing software and existing meters

This is often a prerequisite for AMS adoption. Several utilities interviewed said they have initiated multiple AMS pilot studies but have not moved forward because they felt their legacy CIS systems would collapse under the weight of increased data. More than half (51 percent) of utilities consider billing management capabilities when choosing an AMS vendor.

4. Organization structure/ responsibility/capabilities

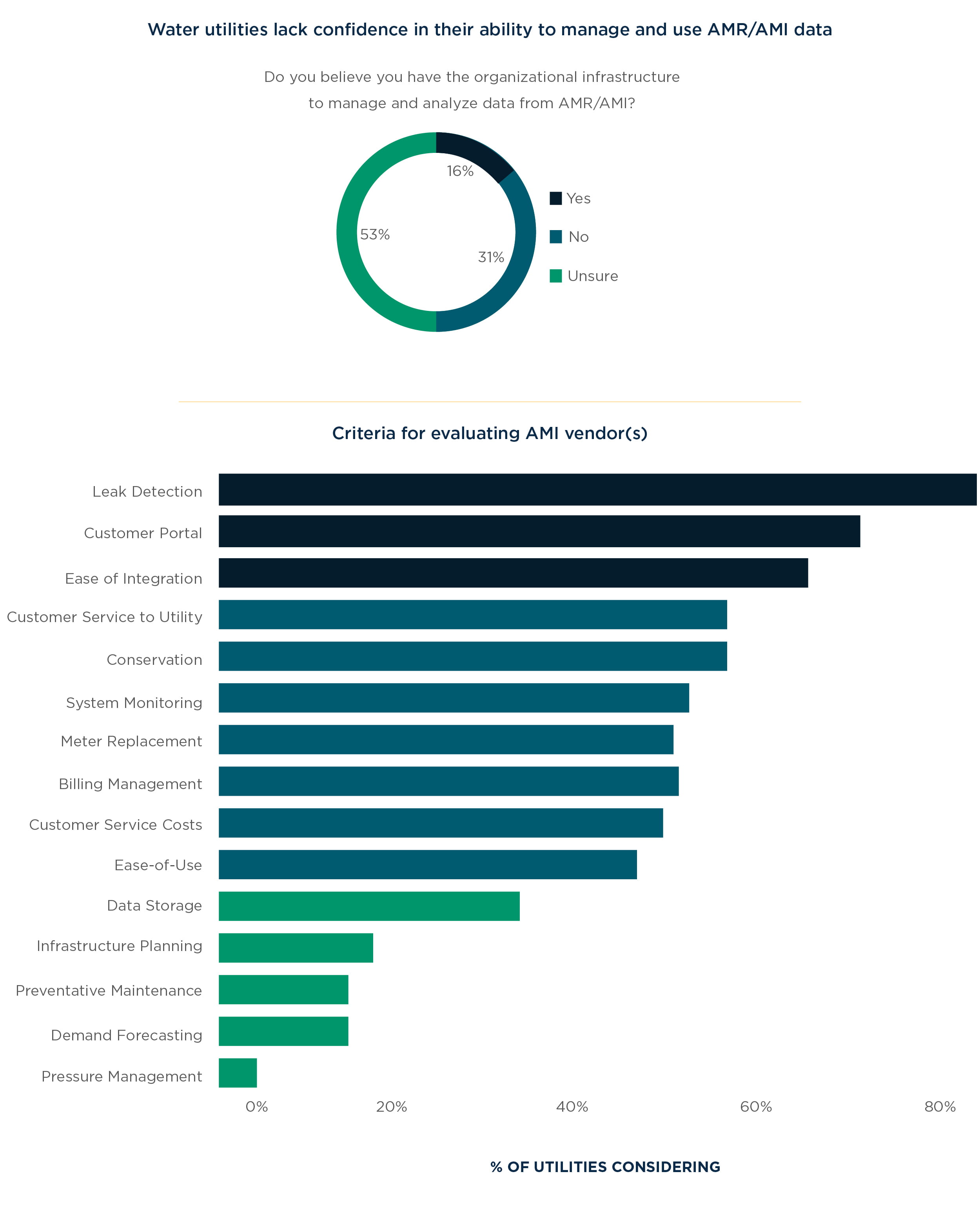

Nearly a third (31 percent) of utilities said they don’t have the organizational infrastructure to manage and analyze AMI/AMR data (Figure 9). Moreover, many utilities expressed dissatisfaction with utilization of AMS functionalities due to unclear organizational responsibility. Communication and collaboration across divisions such as customer service, operations, engineering, and IT is critical for realizing AMS benefits; yet organizational change management is often neglected.

Other lesser-cited barriers included lack of expertise (25 percent) or time (17 percent), unclear end-user benefits (17 percent), and perceived security risks (8 percent).

Desired analytics capabilities

This study examined the availability of products compared to utility needs. The survey found that utilities consider many factors when choosing AMS vendor(s) (Figure 10). “Essentials,” those factors cited by at least two-thirds of utilities surveyed, include leak detection, customer portal, and ease of integration.

Chapter 3: Analysis of available AMS/advanced analytics solutions

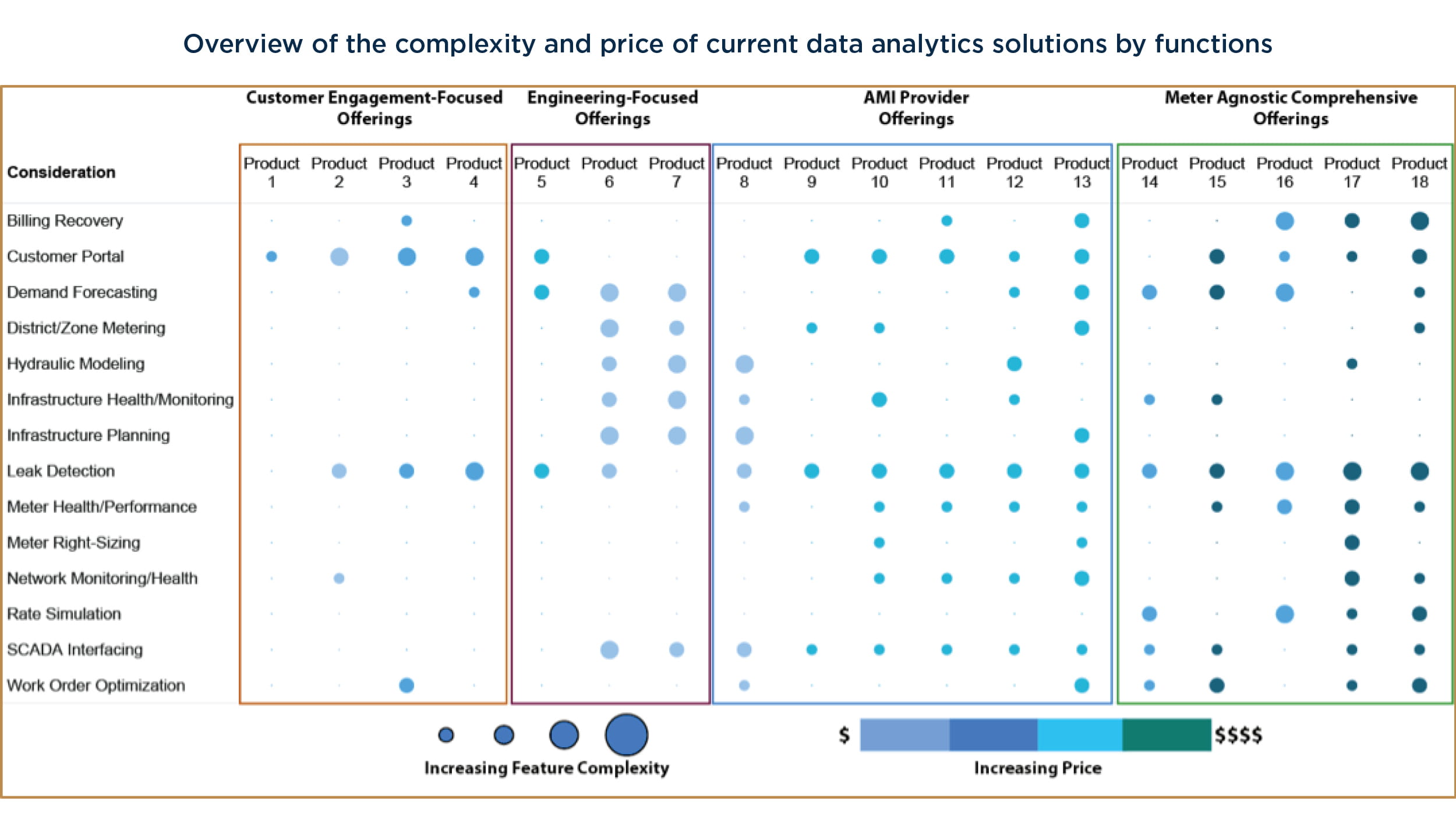

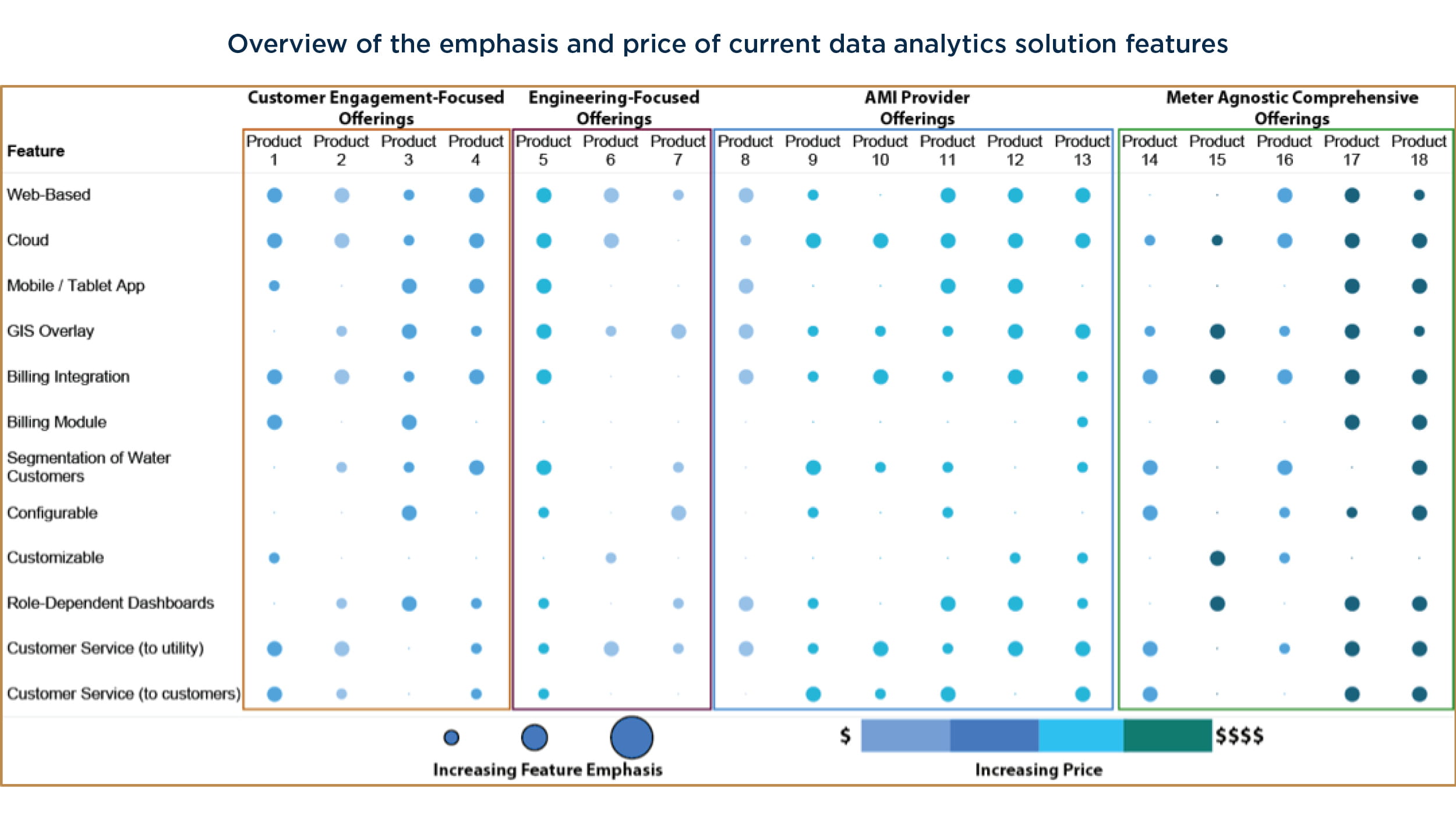

The second part of our research included analysis of existing market solutions. The research team compiled an initial list of solutions and conducted preliminary research to identify the key functionality available in these solutions. From this research, the team identified 18 vendors for in- depth analysis, segmented into four categories:

- Customer engagement-focused offerings (4 products)

- Engineering-focused offerings (3 products)

- AMS provider solutions (6 products)

- Meter-agnostic comprehensive offerings (5 products)

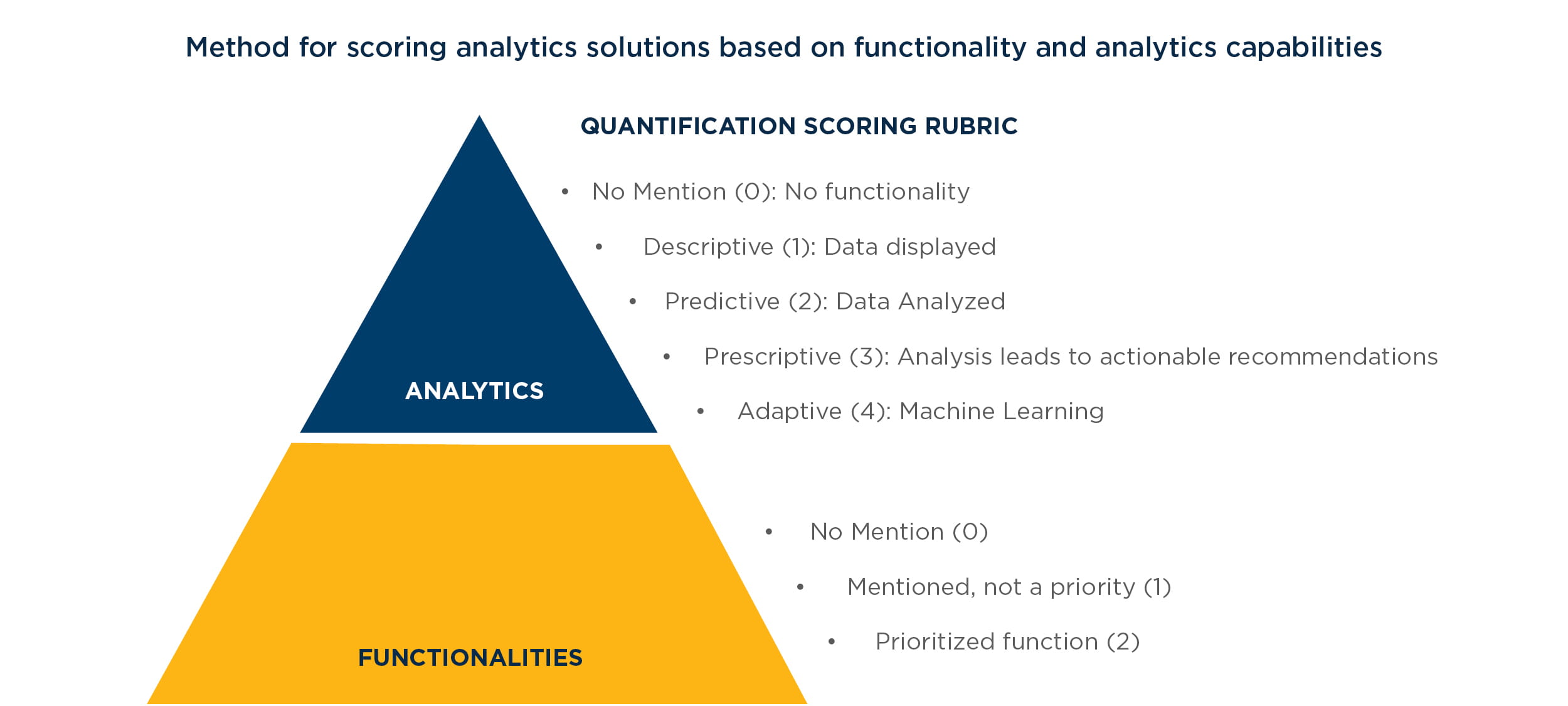

We examined the features and functions of these solutions. For solution functions, the analysis incorporated price and complexity. For solution features (e.g., web based, cloud, etc.), the analysis incorporated the degree to which a vendor has increased emphasis on the feature, as well as price. The research team applied a scoring rubric that applied points for prioritized functionality (as indicated by survey participants) and sophistication of analytics capabilities (Figure 11).

Advanced analytics market findings

The analysis provides utility leaders with tools to enable them to answer the question of what AMS solutions are available with what features/functions. Figures 12 and 13 show functions and features currently available in each of the 18 products studied (listed across the top of each table). The data plots represent the presence of functions and features in each product, as well as relative price (circle color), complexity (circle size, Figure 12) and vendor emphasis (circle size, Figure 13).

The analysis found that web-based and cloud capabilities are nearly ubiquitous across solutions. Integration with billing systems—a priority of most utilities interviewed—is prevalent in all but the engineering-focused platforms. Following are other key observations about the data contained in Figures 12 and 13:

Customer engagement-focused offerings. These solutions are built around customer portals, and their features and functions reflect two key themes: behavioral science to drive conservation goals and a high degree of granularity in segmenting customers (e.g., by demographics, usage, billing history). To the first point, these offerings allow utilities and customers to compare water usage to other households with similar traits, assigning each customer a score for a given period of time. By providing easy-to-understand statistics on water usage and working to reset what customers view as appropriate and normal usage, these offerings help utilities achieve substantial conservation goals upon implementation and customer adoption. To the second point, these offerings use pattern recognition to identify similar segments of customers, allowing utilities to conduct in- depth analysis of customer behaviors and target messages and programs to certain segments.

Engineering-focused offerings. Several providers offer solutions for improving utility operations and efficiency. These solutions are deeply rooted in analytics—specifically hydraulic modeling—and many are on the forefront of using modeling for predictive purposes. Engineering-focused solutions also incorporate data from multiple sources, such as meter-read data, SCADA, pressure data, GIS, and hydraulic models to better predict event outcomes and provide actionable insight. These offerings tend to be complex and less mature than their more established meter data-centric analytic solutions. In addition, they are often more purpose-built making them better suited for niche utility needs.

AMS provider offerings. AMS providers offer analytics platforms that include significant breadth of functions and features. These offerings are often sold as modules, providing utilities the opportunity to build semi-customized solutions. They include leak detection, network health reporting, basic customer portals, and integration of SCADA data with meter-derived data. These analytics functions often generate reports and alerts, which require user input and assessment to act. Several AMS providers have completed recent acquisitions and/or formed partnerships that may produce greater functionality across their broad offerings.

Meter-agnostic comprehensive offerings. This fourth category of solutions are agnostic to the meter and AMI vendors. These solutions can be particularly attractive to utilities that leverage multiple vendors and don’t want to be locked into proprietary solutions. Like AMS provider offerings, these solutions typically can be purchased as modules. Most have user-specific dashboards and complex analytic functions; including advanced pattern recognition algorithms that provide insight into customer-side leaks, billing issues, demand forecasting, and individual meter functionality.

Chapter 4: Pillars of success

From analysis of the 70 water utilities in our study, we have identified six key “pillars of success” that provide best practices and lessons learned for executives considering AMS and data analytics.

1. Construct a rigorous business case

A robust business case is essential to successful implementation of both AMS and the corresponding analytics platform. Many utilities have been slow to adopt AMS and analytics due to cost and lack of clarity around the benefits. A “see what happens” approach, where a utility simply invests in a smattering of technologies and assesses results only after implementation, is sure to disappoint.

Interviews with utilities found a spectrum of approaches for creating a business case. Some utilities used a hardware-centric approach, focusing mainly on their needs to replace aging meters and drive down metering costs. Typically, they considered the benefits of more data only as an afterthought. Other utilities incorporated basic analytics functions into their cost/benefit analyses and approached purchasing decisions and system design with these capabilities in mind.

A few utilities integrated all aspects of their strategic plans into their decisions to implement AMS and analytics. These industry leaders, often working with experienced advisors, considered potential impacts not only on metering costs, but also on water losses, customer engagement, revenue stability, and conservation goals. Furthermore, they sought to quantify potential impacts and measure subsequent progress.

By investing resources up front to build out comprehensive business cases, they were able to critically evaluate capabilities for driving value. Ultimately, this led to greater satisfaction with and success of their AMS/analytics initiatives.

2. Break down silos within the utility

AMS and analytics have the potential to touch every aspect of a utility’s operations. Failing to involve all affected divisions from day one can lead to suboptimal utilization. Interviews revealed utilities that involved most of their divisions in business case construction, system design, and continuous system improvement experienced better outcomes and were significantly more satisfied with their investment.

For example, a mid-sized West Coast public utility engaged its engineering, customer service, and IT divisions to build out an industry-leading analytics solution comprised of products from multiple vendors. This solution has successfully reduced water losses, allowed the utility to meet conservation goals, and increased customer satisfaction. Many utilities are aware of this need, as illustrated by the high percentage of survey respondents who recognize potential value in billing, operations, and maintenance (Figure 2). Awareness is only a start, though. Utilities must strive to manage stakeholder participation constantly during design, implementation, troubleshooting, and platform improvement.

3. Understand the full breadth of available solutions

During interviews, the research team described advanced analytics capabilities to utility executives. One of the most common responses was, “I had no idea that was even on the market.” In fact, a recurring theme in these discussions was the absence of a comprehensive picture of currently available analytics solutions.

Interviewees often dismissed functionality such as predictive meter health or rate class simulators as “too advanced” or “years away” when in fact they are part of several existing solutions on the market.

While there are several offerings with many key features and functions, there are nuances and complexities to each analytic feature of each offering. Understanding those is vital to finding the best fit and end-user experience for a utility and its customers. For example, a mid- sized Southeastern public utility purchased a meter data management system. Once satisfied with this investment, it purchased a customer portal offering from the same vendor, only to be disappointed with portal’s lack of integration and poor user experience. Given that the current market provides tremendous breadth and depth of products, utilities should be certain they are selecting both the right product and the right functionalities within the product.

4. Assess the utility’s internal capabilities objectively

As a utility transitions from quarterly or monthly meter reads to AMS-enabled hourly or even sub-hourly reads, the amount of data increases by orders of magnitude. At the same time, it generates similar increases in data from SCADA networks, GIS updates, and customer outreach programs, among other sources. As the research showed, only 23 percent of utilities felt they have the organizational infrastructure to manage this tremendous increase in data.

Nevertheless, many utilities said they overestimated their internal capabilities before, during, and after implementing AMS/analytics. One investor-owned, East Coast utility said its decision to manage analytics for customer usage data without the support of a commercial solution led to several missed opportunities for using metering data to detect customer-side leaks.

Attempting to “go at it alone” can be detrimental for an unprepared utility. Those that successfully managed the day-to-day influx of AMS data and subsequent operation of data analytics platforms often created entirely new positions or even divisions and continued to work closely with vendors to refine their operations.

5. Be prepared to work with multiple vendors

From the high-level view of the analytics solution marketplace presented earlier (Figures 12 and 13), it is apparent not all vendors offer all functionality. To create a robust data analytics platform, a utility should be prepared to work with multiple vendors. While AMS vendors, for example, provide broad analytics functions and features, some other products may provide more depth in a particular area—improving the ease of extracting insights. In this research, one-third of utilities studied said they looked beyond their AMS vendor for one or more analytics platforms. This will require a utility to balance the complexity of integrating multiple vendors’ solutions with the benefits gained from selecting the best solution for each required function. To simplify this, several vendors have formed new partnerships and agreements for providing accessible integration and standardized data formats.

6. Engage customers from the start

Ultimately, investments in AMS/analytics benefit a utility’s residential, commercial, and/or industrial customers. It is important, therefore, that the utility conveys these advantages to customers throughout design, implementation, and operation. In many communities, public interest groups have formed over concerns about data privacy and security, as most citizens are not fully informed of the inner workings of utility data management. Furthermore, since these platforms represent significant investments, it is important to communicate their net benefits. Finally, to fully realize benefits, a utility will need to maximize engagement with leak-detection programs and customer portals.

This research project noted a strong correlation between resources invested in customer outreach and level of satisfaction and ultimately success of a project. Water utility leaders should strive to provide transparency into key decisions and utilize extensive customer engagement campaigns to enable the customer to take advantage of the new technologies as they are implemented.

In one case, a mid-sized Western utility accomplished these goals through multiple information sessions, a full-scale print/digital ad campaign supported by its vendors, and strong presence at events throughout the community. Thus, it was highly successful in driving adoption of its advanced customer portal offering and quickly realized its conservation goals. Conversely, several of the utilities interviewed said they poured resources into customer- centric solutions but only minimally focused on customer outreach. These utilities expressed disappointment in their investments.

Conclusion

While the immediate benefits of AMS are recognizable and accomplished with relatively basic data analytics, utilities will need more advanced capabilities for analyzing meter- read data to generate additional value. AMS vendors provide analytics solutions that can fulfill basic requirements for many utilities, but they are often specific to that vendor’s equipment. There are vendor-agnostic solutions that can support multiple vendors, but they do require integration and customization. Due to the complexity of this marketplace, many utilities feel their AMS data is underutilized. Many of the utilities consulted for this research project expressed frustration that they are not fully utilizing the information they gather today.

Choosing the right software solution depends on numerous variables unique to each utility. Maximizing the benefits of AMS and analytics requires careful planning and should consider the following six pillars for a successful implementation.

- Constructing a sound and comprehensive business case

- Involving every business division in the design and implementation process

- Understanding and carefully evaluating the full range of solutions available in the marketplace

- Evaluating internal capabilities critically and assessing preparedness to move forward objectively

- Being prepared to work with multiple vendors to ensure that features and functions match the utility’s unique needs

- Engaging customers at every step of the process

Our changing climate, aging utility infrastructure, and water shortages are continuing to alter customers expectations. In this environment, analytics that enable a data-driven organization will become more than a “nice to have.” They will be required.

Research background

There are a number factors driving the need for digital technology which include aging infrastructure, EPA regulations, water conservation requirements, shifting customer expectations, revenue protection, to increased interest in using data to drive decision making. These increased expectations have resulted in a surge in number of utilities considering or adopting AMS. While water utilities have varying reasons for taking this step, one theme is consistent: Water utilities are looking for ways to realize tangible benefits from their investments. But to maximize returns, water utilities must have insightful data and analytical features available that support enhanced utility management.

Water utilities typically achieve operational benefits by automating the meter-reading process, decrease operational costs due to fewer truck rolls, increase employee safety, and optimize meter-to- cash operations staff. In many cases, utilities also increase customer engagement and satisfaction by implementing online portals and programs that allow customers to view their water usage in near real-time, set up water-usage or leak alerts, pay their bills or change their rate program, and obtain information to help them reduce water usage.

An AMS deployment has the potential to completely transform the utility’s operations and customer service by eliminating manual processes and providing new data that can improve decisions by the utility and customer.

A traditional utility’s billing operation generates one data point per account per month, for a total of 12 data points per year. By introducing an AMS, the utility’s billing operation will generate 24 readings per account per day. In addition, each reading may include several data points — location, volume, time. When adding other functions such as leak detection or pressure monitoring, the data points can increase dramatically.

Most utilities accustomed to 12 readings per account per year now face the challenge of what to do with all this new information. Typically, utilities that are unprepared to capture, store, segment, analyze, and transform the data into information rarely realize the full benefits of their AMS. They struggle with data storage, business intelligence, customer engagement, data management, operational use, and many other matters. Therefore, water utility executives who are positioning their organizations to implement AMS must address the key enablers to utility transformation associated with AMS, which include data management and analytics.

Between 2013 and 2020, water utilities are expected to spend upward of $2 billion on smart metering infrastructure1. Moreover, the marketplace for management and analytics solutions for water utilities with AMS programs is evolving quickly, with a variety of vendors involved and a complex array of solutions from which to choose. Every utility, however, must understand that realizing the benefits of AMS requires an appropriate investment in data storage, data management, business process redesign, and analytics software. In many cases, the right answer might involve solutions from multiple vendors—creating a complex decision-making process. Without robust architecture and analytics, meter-reading and utility data points can quickly go from potential sources of value to burdensome, intimidating, and underutilized.

Research methodology

The research team studied more than 70 water utilities across North America, explicitly to understand adoption of AMI systems within the broader context of AMS as well as the factors that led to or deterred from adoption of AMS and data analytics platforms. The methodology included:

- Outreach for participation in a survey

- Follow-up interviews with more than 40 survey participants who indicated a willingness to provide additional information or to complete the survey via interview

- Secondary research to gather similar information about utilities that did not participate in the survey/interview process and/ or to validate or supplement survey/interview data

Survey participants represented a variety of roles within water utilities, including finance, operations, billing, metering, IT, analytics, planning, engineering, and other functions. Geographically, the utilities studied represent all major segments of the contiguous United States (Figure 14). In addition, the utilities studied represent a mix of investor-owned, municipal, and co-operative organizations, as well as diversity in the number of customer connections they maintain (Figure 15).

Using the survey and interview data, the research team applied additional steps to quantify utilities’ consideration of AMS/analytics features:

- In addition to segmenting utilities as large, medium, or small, the research team segmented utilities into two other areas: 1) precipitation levels (wet or dry) and 2) primary consideration for adopting AMI and/or analytics (see box at right).

- First, the team identified 15 advantageous features that utilities consider when deciding to implement AMS and analytics.

- Based on primary and secondary research, the team assessed which of the features each utility in the study considered and then identified each utility’s primary consideration.

Then, researchers correlated annual rainfall, utility size, and primary consideration for adopting AMS and analytics to each of the 15 features. Analyzing that data provided insight into considerations of most importance, as well as tendencies of utilities based on rainfall.