October 2018 | Point of View

Cost-to-serve analysis: Determine a customer’s actual value to your business

To determine a customer’s actual value to your business, you first must understand your cost of serving that customer

Cost-to-serve analysis: Determine a customer’s actual value to your business

Business leaders tend to believe they know what it costs to serve their customers. But few business leaders can answer questions such as: Do you price and align service levels accordingly? Can you isolate margins at the product level? How do the different regions you serve impact your bottom line? When pressed they might assert that they just inherently understand our business and customers. Or that they know what it costs overall and that’s enough. Or that they don’t have the time or energy to get into the weeds like that.

That is, they know what they’re selling, and they know they’re making money by selling it. But they can’t tell you with certainty whether or not their biggest customers cost more or less to serve than their smallest, how the cost of sales in one region differs from the others, or how they should set prices differently for the various customer types they serve.

This level of granularity represents a huge opportunity — and one that should concern not only the supply chain executives who oversee costs, but the marketing leaders who are accountable for customer profitability. By using a cost-to-serve analysis to value and segment customers by profitability rather than tenure or topline revenue, those leaders can drive growth and substantially improve their organizations’ bottom lines.

How to Determine Cost-to-Serve

An effective cost-to-serve analysis reveals the true cost of servicing individual customers. It does so by allocating otherwise fixed costs at the customer, product, geography, and channel levels, while utilizing advanced analytics to gain insights and visibility into the results.

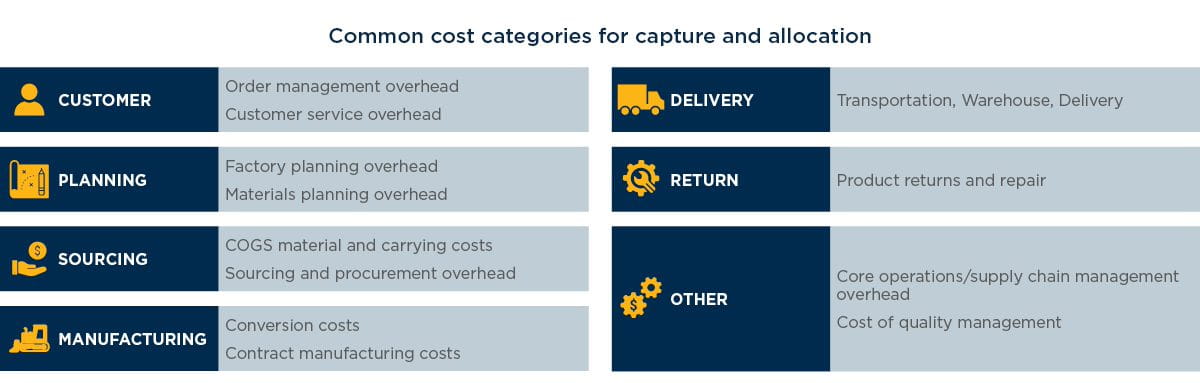

Some common cost categories for capture and allocation (using a manufacturer as an example) include:

Recently, West Monroe put this model into practice while working with a client who lacked visibility into their delivery costs. When we met with them, they were spreading large swaths of logistics costs equally across their customer base — without understanding what each individual client cost relative to their location, size, and frequency of deliveries, and other customized factors.

To gain visibility, we took a deep dive, assessing each and every customer according to the following variables:

What we found?

Their largest customer was being overburdened with freight cost, while smaller customers were essentially being subsidized and were riding for reduced fees.

This and other key findings led the client to shift their cost allocations and optimize freight costs, service levels, and pricing across the customer base. To ensure ongoing analysis and visibility — and to make sure the client could onboard new customers profitably — we implemented Rapid Insights. The client needed visibility into data across a variety of systems (multiple ERP instances, transportation, etc.) and didn’t have the time or resources for manual data manipulation and analysis. Using Rapid Insights, the client was able to ingest data from their disparate systems into a single repository without costly and lengthy system integrations. Once the data was integrated, the client was able to access customer-level detail on margins, exceptions, volume, and overall profitability.

The Value of Understanding Cost-to-Serve

A cost-to-serve analysis quantifies the value of negotiated service levels (e.g., the cost of managed fill rates or customer-specific inventory levels), shipment exceptions (e.g., expedites), customer service resource time, and/or other broad overhead costs across the organization’s entire customer set. This analysis enables re-segmentation of the organization’s customers based on newly understood margin insights — a re-segmentation that centers around a customer’s profitability, not just tenure and revenue volume.

The bottom line impact comes in one of two forms:

1. Cost savings from service reductions and more efficient internal resourcing

- Income Statement | Operating Expense – freight costs, COGS, SG&A, etc.

- Balance Sheet | Assets – working capital (inventory), PPE, etc.

2. Revenue growth resulting from pricing increases—either as an increase to single sale prices or in line-item surcharges, such as those often associated with rush shipments.

At the end of the day, you just won’t know your customer’s value to the business without understanding the cost-to-serve said customer. And if you don’t understand their value to your business, you’ll miss out on opportunities for innovation, operational efficiencies, segmentation, and pricing shifts that can improve profitability.

The cost-to-serve analysis itself might not be simple, but the decision to undergo that analysis surely is.

.jpg?cx=0.5&cy=0.5&cw=910&ch=947&hash=D82C31B87A38F6B94D04577BA76A2109)