December 2017 | Signature Research

Turning Point: The Fate of Standalone Dental

96% of health plan and dental plan respondents agree that convergence of medical and dental benefits will happen, but there's no consensus on how it will happen

Get the full reportThe business of selling dental insurance has been a profitable, growing enterprise for decades. With powerful provider networks, attractive premiums, and reliable brands, standalone dental payers have created a broad, loyal market customer base. At the end of 2015, approximately 212 million Americans – or 66 percent of the U.S. population – had dental benefits. A full 99 percent of the commercial portion of those plans were purchased from standalone dental insurers.

But now an array of market, regulatory, and technological forces are driving toward an inflection point in the purchase and delivery of dental benefits. The resulting disruption will likely put standalone dental plans’ market share – and margins – in the crosshairs of a legion of rivals, including new entrants, disruptive technology platforms, ancillary insurers, and behemoth medical payers that crave the reliable profitability of dental products.

And yet even as a reckoning approaches, many dental-plan executives risk being caught off guard by the speed and scope of the coming evolution. “For standalone dental, the idea of convergence is no longer speculative,” said Will Hinde, Managing Director of West Monroe’s Healthcare and Life Sciences practice, which works with dozens of dental and health plans across the country. “We’re about to enter a survival-of-the-fittest period in an industry that isn’t entirely ready for evolution.”

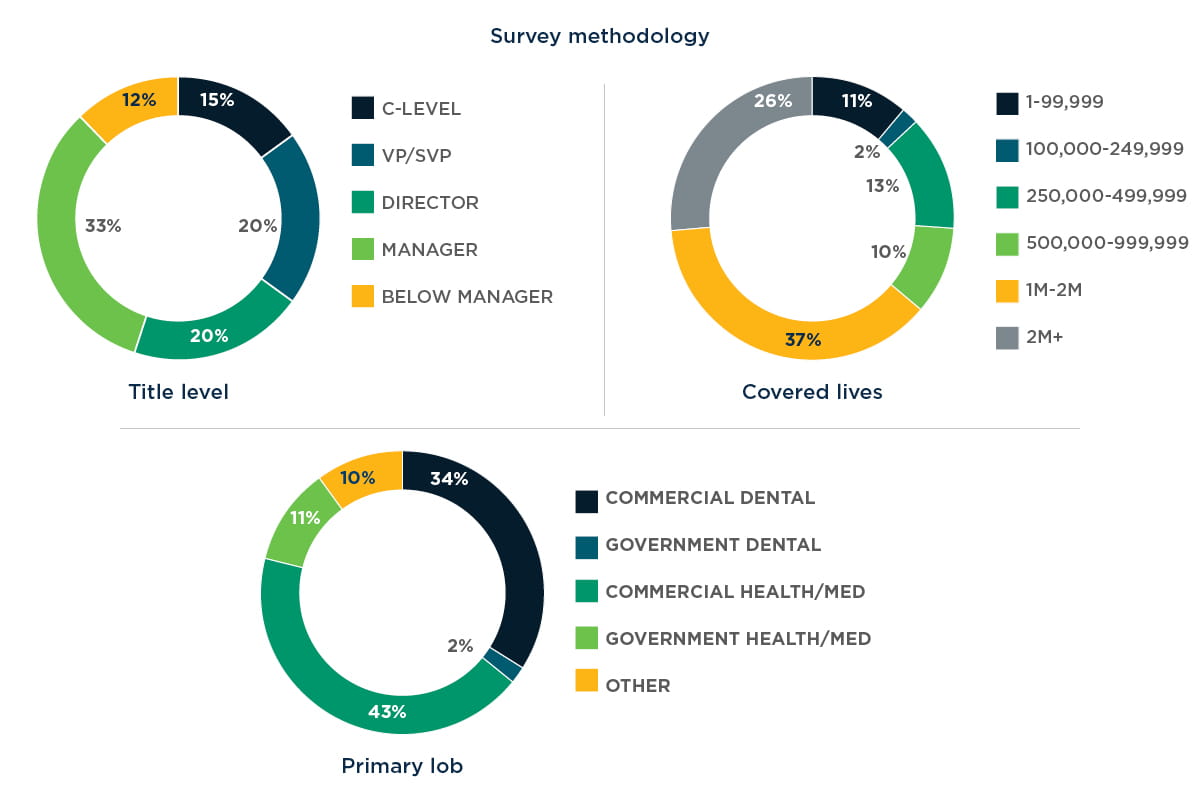

West Monroe surveyed 125 executives in dental and health plans across the country about their near- and long-term plans for dental benefits. The findings represent a chasm between reality and how the industry is preparing.

Survey Highlights

-

While respondents believe that the integration of medical and dental coverage is inevitable, there are many differing opinions on timelines and how the integration will occur.

-

39% of dental respondents have plans to partner with health insurers in the next five years, and 36% expect their benefits to be embedded with a health insurer in that time frame.

-

40% of respondents believe employer groups will continue to take a best-of-breed approach to insurance offerings. The CEO of a dental plan pointed out that most large employers have HR systems in place that make managing multiple carriers far less cumbersome. “They want good service for their people, so until medical can provide the same level of service, bundling won’t be attractive.”

-

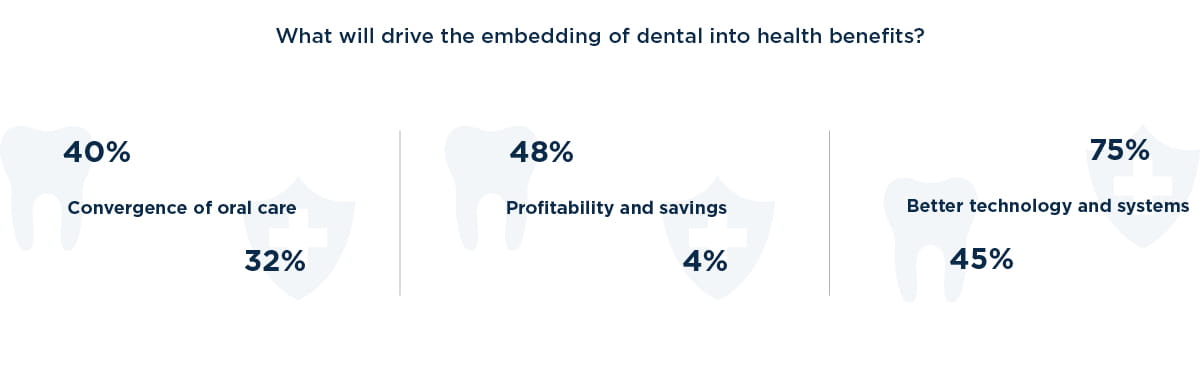

Respondents feel technology, regulatory factors, and the convergence of overall and oral health will be the primary drivers of convergence. The integration of oral health into overall health will propel a shift in consumer demand and drive savings for medical payers, according to one executive at a health plan. “Consumers are looking for simplicity,” he said. “And there are huge gains to be had on the medical side by properly managing oral health – it’s not like the mouth isn’t connected to the body.”

-

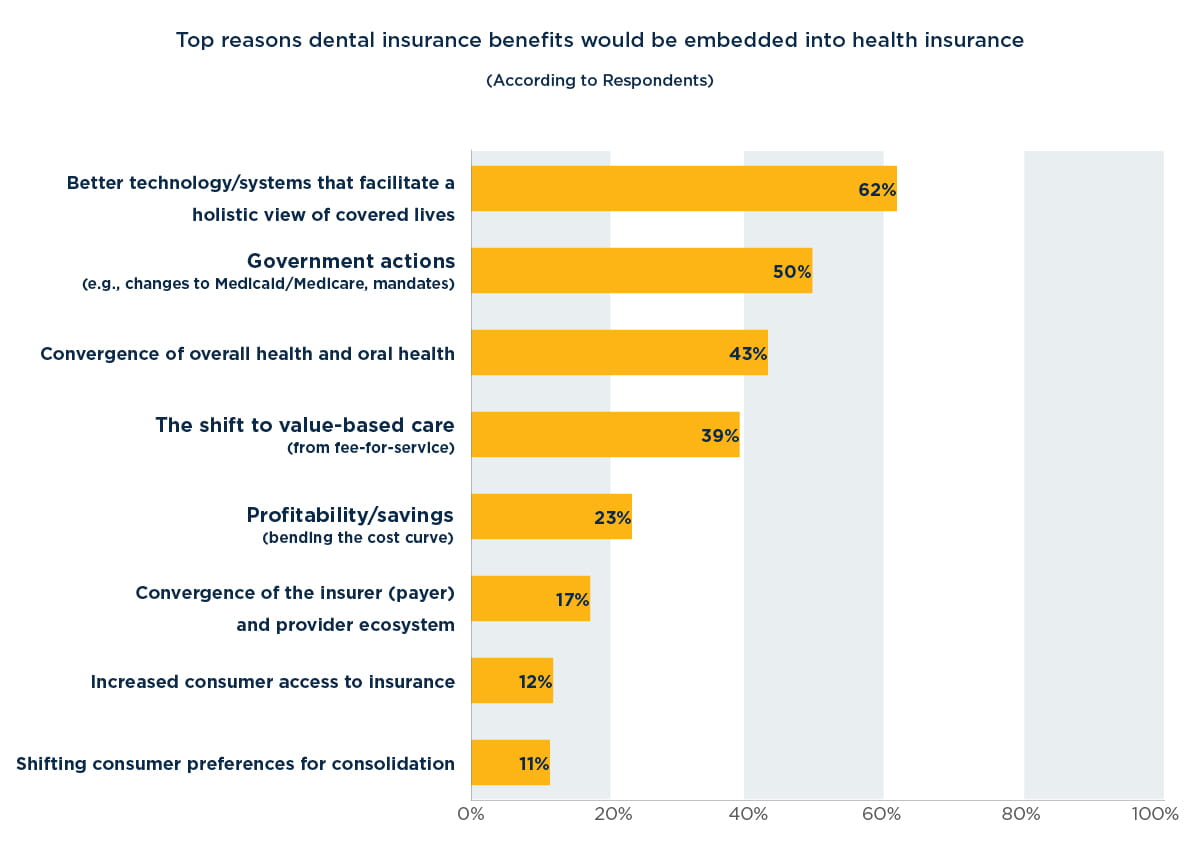

Convergence is more apt to speed up if certain events happen: 62% of respondents said better technology that facilitates a holistic view of covered lives is the top reason dental benefits would be closer to being embedded into health insurance. Respondents pointed to other events, including new government actions (50%) and the shift to value-based care (39%)

Chapter 1: For standalone dental plans, convergence is here

A full 96 percent of survey respondents believe that the embedding of dental benefits in medical plans is either already happening or will happen eventually. And the vast majority of both dental (82 percent) and medical (80 percent) respondents agree that medical plans have a clear or significant advantage over standalone dental insurers in a bundled scenario.

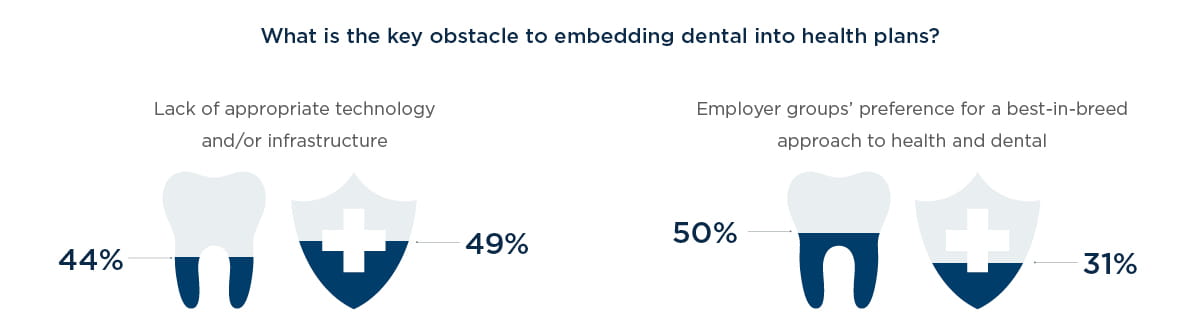

But 50 percent of dental respondents believe employers will continue to prefer a best-in-breed approach to bundling dental insurance with health insurance, and only 20 percent believe that bundling is gaining momentum. This perception likely stems in part from the fact that bundling has been on dental payers’ radar for many years, but has yet to materialize at scale. In interviews with survey respondents, several dental plan executives noted that medical payers have yet to prove they can offer integrated solutions that deliver significant benefits to employers or consumers.

One respondent reported seeing employers that had purchased bundled plans from medical players, usually offered with discounted premiums, return to standalone dental. “The discount runs out, and they haven’t seen the value,” he said. Convergence “is a risk” to the standalone dental plan market, he said. “But do I see a lot of movement in that direction? No.”

That may be true at the moment, but most indicators point toward a disruption that, once begun, could happen much faster than the market expects. We have seen it before. There was a time when auto, home, and life insurance were sold as standalone products. But then large players like State Farm used their large customer bases and efficient processes to cross-sell, consolidating market share across product lines and leaving many standalone home and life insurers facing a choice of selling or becoming obsolete. Similarly, smartphones offered the consumer an opportunity to hold a camera, personal organizer, gaming platform, navigational system and media player in a single device.

“Businesses that sold products offering those standalone functions faced a choice: adapt or die,” said Kristin Irving, senior director in West Monroe’s healthcare practice. “Those that adapted were able to survive and thrive. Those that did not suffered market-share loss, financial pain and, in some cases, obsolescence.”

In the coming years, standalone dental plans will confront a similar choice. The survey results contain clear evidence that convergence is afoot. Two-thirds of health-plan respondents say they already offer some type of dental benefits, primarily pediatric (51 percent) or a standalone product managed by the insurer or a subsidiary (50 percent). And 22 percent say they now offer adult benefits fully embedded into health insurance products. Among respondents from medical payers that do not offer dental products today, 100 percent say they plan to do so. And 98 percent plan to bundle dental with medical benefits.

Similarly, more than a third of dental respondents say their future plans include embedding benefits into a health insurer (36 percent), partnering with health insurers (39 percent) or adding ancillary multi-line products (43 percent) like vision, disability, and hearing.

Chapter 2: Competitive and regulatory pressures mount

As growing competitive and regulatory pressures— e.g., industry consolidation, the entry of startup disruptors, Affordable Care Act (ACA) profit caps—squeeze medical plans’ margins, health payers are aggressively pursuing diversification, with a focus on bolstering their product suites through the acquisition of more profitable products. Because dental plans typically produce higher margins, and because standalone dental falls outside the ACA’s mandatory medical-loss ratio, they are becoming increasingly attractive to health payers.

Until now, technology has been a barrier to combining medical and dental: On the dental side, patient record systems and claims platforms focus on the mouth and a dental-specific coding system. On the other side, health plan platforms don’t even include a tooth chart, demonstrating the difficulty of technology integration. “If the claims are still siloed, it’s hard to deliver measurable benefits,” a dental payer executive said in an interview.

But new technologies are starting to make it easier to bundle insurance products. Major technology vendors are investing in enhancements to their platforms to accommodate dental and other standalone insurance products, so they can operate on a single platform. Sixty- two percent of survey respondents say better technology or systems that facilitate a holistic member view will be a key driver in the move toward convergence, placing it higher than any other driving factor, including profitability/ savings (23 percent) and the shift to value-based care (39 percent). And as one respondent noted in an interview, “If somebody can deliver the technology to make bundling work [for medical carriers], it could change the game.”

Finally, consumers are exerting greater influence over their healthcare and demanding more customer-friendly features. Survey respondents understand this: Only 13 percent say they consider lack of consumer interest a barrier to convergence.

“As consumers get more sophisticated about managing their health, they’re going to value the ability to manage it through a single app,” said an executive at a health plan that offers dental benefits. “The new generation isn’t tied to the way things used to be.” In this environment, forward- thinking health insurers see oral coverage—and the ability to offer a single point of purchase and care management— as a unique opportunity to improve brand loyalty and add member touch points.

When convergence could happen is difficult to predict. The wheels of healthcare turn slowly, and medical plans are, for the time being, focused on other challenges. “If anybody tells you they can see beyond the next 24 months, they’re just making it up,” said the CEO of a dental plan.

Nevertheless, forward-thinking dental plans are already starting to anticipate the move toward bundling. “Standalone dental has to be proactive in understanding that we don’t necessarily control the market,” one dental plan executive said in an interview. “There are other forces driving buying decisions, and we can’t sit back and let our business be shaped by those forces.”

Taken as a whole, the survey results point toward a gap between market realities and leadership action in significant portions of the industry. Nearly half of dental insurance executives (47 percent) feel convergence is a threat to their business. However, 24 percent plan to proceed with “business as usual,” even while 60 percent of all respondents (both dental and health) think the percentage of standalone dental plans will significantly decrease in the next three to five years.

The results also point toward an opportunity: Insurers that embrace convergence early, capitalizing on the forces driving disruption, can quickly gain an advantage in brand loyalty, jumpstart growth, and emerge winners.

As Charles Darwin said of evolution, “It is not the strongest or the most intelligent who will survive but those who can best manage change.”

“Standalone dental has to be proactive in understanding that we don’t necessarily control the market. There are other forces driving buying decisions, and we can’t sit back and let our business be shaped by those forces.” – Dental plan executive

Conclusion: Seizing the moment - Next steps for dental plans

Even amid rising uncertainty about the independence of the dental-benefits business, standalone dental plans can and should take a number of strategic steps to put themselves in the strongest positions for managing the coming evolution. First, they must resolve internal issues: optimize processes, tackle the administrative inefficiencies long ignored, and get more insight into operations with new data management strategies.

At a minimum, internal issue resolution should include understanding cost accounting and paying down technical debt. But it also has a strategic component – plans must take a step back to ensure they understand their unique value propositions, and then focus their energies on being the best “fill in the blank” they can be. That “fill in the blank” could be (1) the highest auto-adjudication rate, (2) the quickest reimbursement, (3) the best customer- focused portals, or (4) the best call center metrics. The point is that remaining a standalone dental plan without a strong differentiator, and without the goal of becoming a destination for integration, is akin to burying your head in the sand.

Second, they should look hard at the options for diversification. Plans that haven’t already explored this path might look at becoming third-party administrators. Or they could explore offering ancillary products such as vision, hearing, life, and disability—something that 43 percent of our survey’s dental respondents say they intend to do.

A dental plan could also explore acquiring or merging with other companies—either dental plans for economies of scale, ancillary insurers for breadth of product offerings, or dental providers for vertical integration.

“Smart, aggressive dental payers are looking at all their options,” Hinde said. “And above all, they’re not waiting for the market to change before they take action.”

Finally, standalone dental plans should consider strategic partnerships. These could include alliances with providers or even competitors. Thirty-nine percent of dental plan respondents to our survey say they intend to explore synergistic opportunities with medical plans – an approach that, if executed skillfully, can benefit both sides through data sharing, client-base expansion, and by helping to curb previously insurmountable barriers in claims processing, dental channels, customer service, expertise, and network access.

“The survey is unequivocal: It’s absolutely essential that dental plans prepare themselves to become attractive partners and that they explore opportunities and partnerships,” Hinde said. “Standing still, or alone, is no longer an option for plans that want to thrive in the future.”