August 2019 | Signature Research

Driving Down the Bank Efficiency Ratio: Despite Digital Adoption, Vast Improvements Remain

The efficiency ratio has always been the single most important metric for banks seeking to understand their productivity

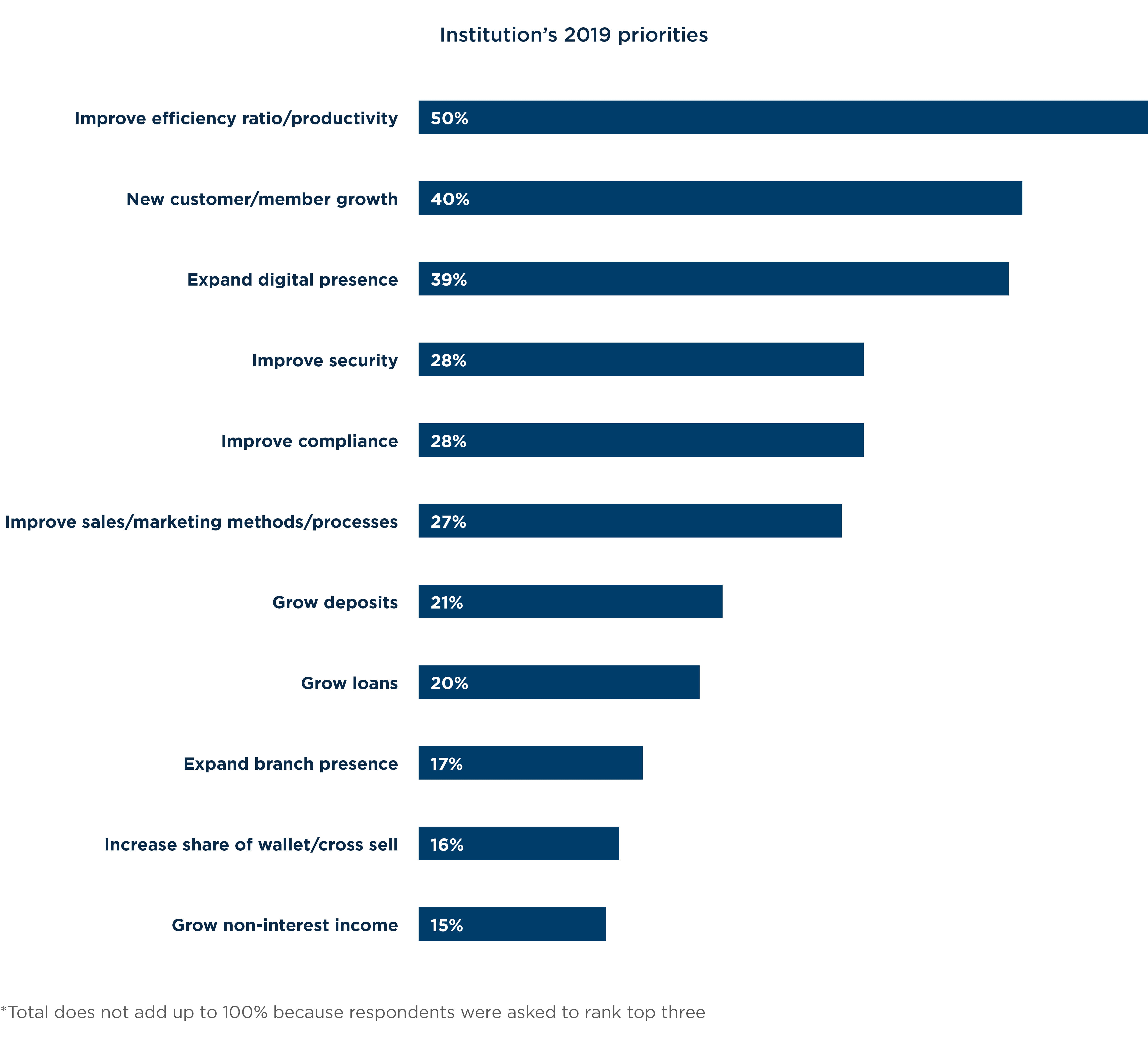

Get the full reportIn our survey of over 150 bank executives, we found that boosting productivity is the number one strategic priority at mid-market banks. In fact, more than half of our survey respondents selected boosting productivity ahead of new customer growth, expanding digital presence, and improving security. Digital technology emerged as the primary driver to boosting productivity. While consensus is clear, the results also revealed a stark perception gap in how successful efforts to boost productivity and lower efficiency ratio have been.

- Improving efficiency is a top priority in the mid-market. Ninety-eight percent of survey respondents indicated they are currently implementing strategies to improve efficiency. The time to boost productivity is now and digital technology is the way to do it: 61% indicated that leveraging digital technology is how they would get there.

- But, there’s a catch. Banks are making gains but not at the pace of an increasingly digital industry. Nearly 80% of our survey respondents perceive that they have been extremely or very successful in improving efficiency/productivity at their banks in the past year, but only 34% have a bank efficiency ratio at or below 50%. In fact, from 2015 to 2018, less than 20% of mid-market banks have shown a 5-point improvement in efficiency ratio. Less than 10% have made 10-point improvements.

- Technology isn’t being leveraged to its full extent. Not only are banks not making notable gains in reducing efficiency ratio, they’re indicating lackluster results with new technology. Ninety-one percent of respondents report high technology acceptance but only 43% indicated they are seeing results.

- The industry is making the right investments to make significant gains in productivity, but must focus on optimizing their technology investments before results will follow.

- Given that the mid-market’s priority around boosting productivity via technology dovetails with broader industry trends toward digital operating models, is it time to ask: Is the mid-market ready to rewrite the rules around the optimal bank efficiency ratio?

Introduction

The bank efficiency ratio has always been the single most important metric for banks seeking to understand their productivity. And more than a decade after the financial crisis of 2007–2008, it remains the key indicator of progress in their quest to become more efficient.

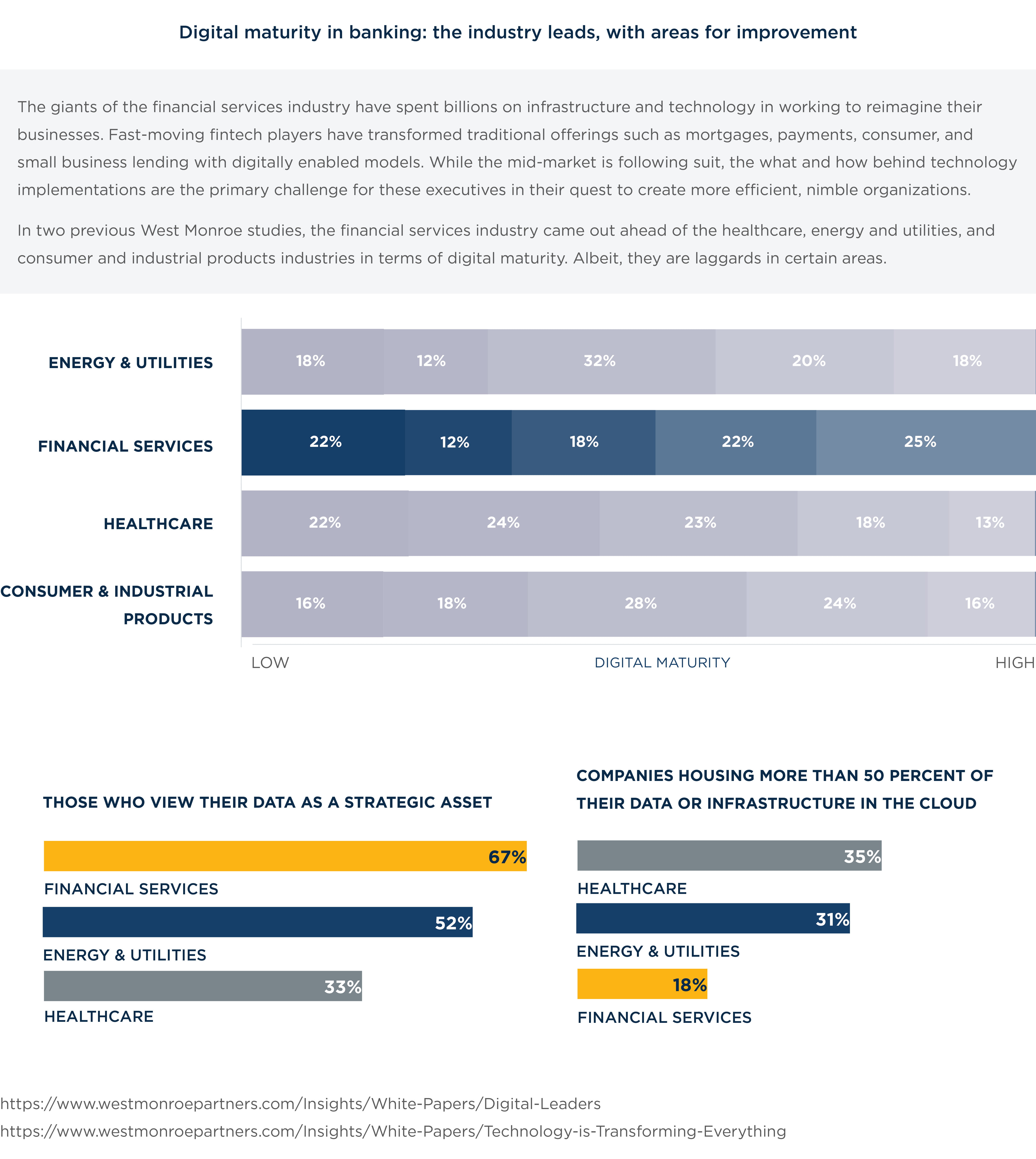

Indeed, in working with mid-market banks across the country every day, we see that the opportunities to improve operational efficiency and productivity have never been greater. Digital adoption by the financial services industry not only continues to grow, but even markedly outpaces other industries. The adoption of fintech solutions and shifts to digitized operating models have upended the traditional bank business and operating models and paved the way for more nimble, efficient organizations.

In addition, the time to focus on making productivity gains could not be more urgent. Three-quarters of CFOs and 59% of economists expect a recession by the end of 2020, meaning the question on the industry’s mind is: How can we prepare for the inevitable today?

We surveyed more than 150 director-level executives across U.S.-based mid-market banks—entities with $1 billion to $250 billion in managed assets—to gauge the priority they place on boosting productivity.

The results uncovered surprising insights about how banks perceive their efforts to increase productivity—what’s working, where they are falling short, and how effectively implemented technologies can accelerate productivity and change the way banks think about an optimal efficiency ratio. The mid-market is overwhelmingly aligned around the need to boost productivity by leveraging digital technology, but it has significant ground to make up in the quest to achieve optimal efficiency.

Chapter 1: What drove efficiency and productivity in the past and how that will change in the new digital era

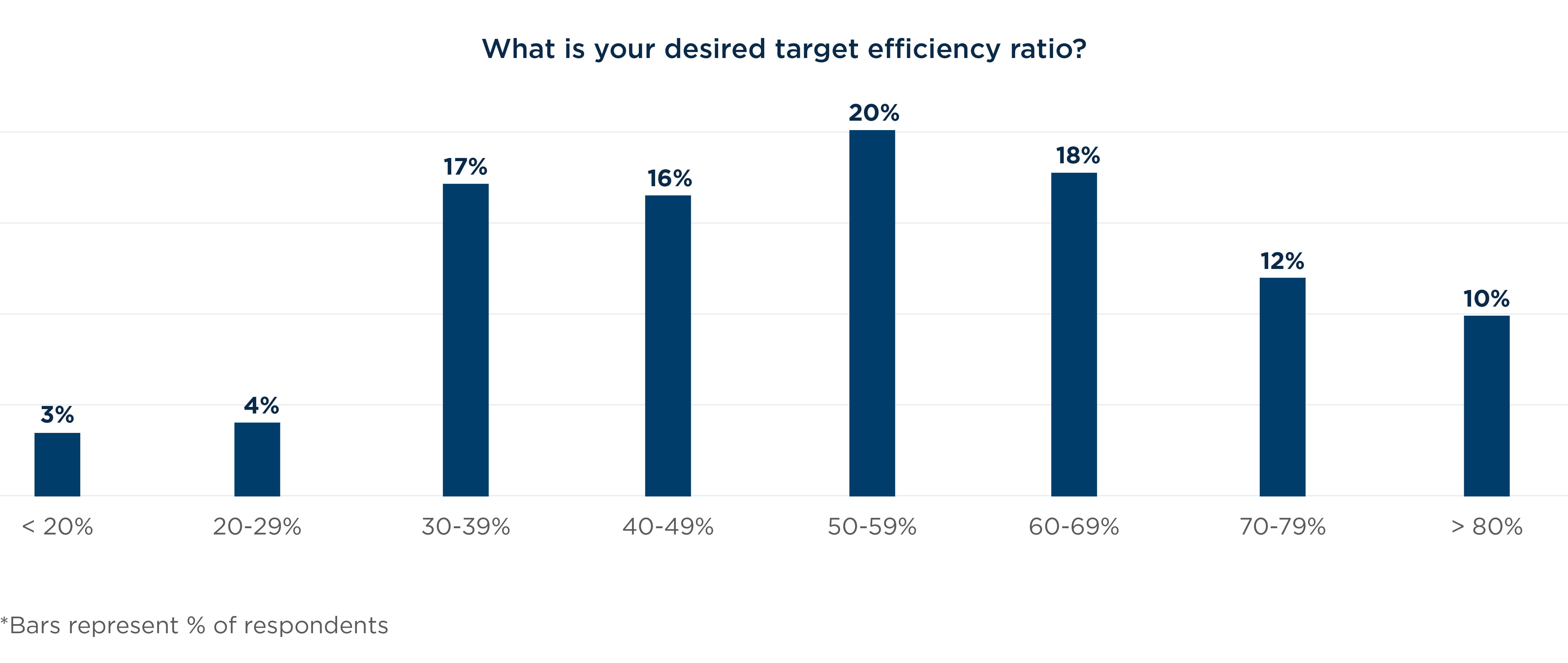

Over the last few decades, the banking industry entrenched best practices and performance indicators which are increasingly proving to be outdated and inefficient. As a result, an unwritten rule in the industry is that a bank efficiency ratio of 50% is the optimal, achievable standard. And banks are still striving for this 50% standard. Even within the top 100 banks, the median efficiency ratio hovers at 59%. In our survey, 68% of respondents in the mid-market reported a ratio above 50%.

We asked mid-market bank executives their top three strategic priorities, and improving productivity and efficiency ratio ranked No. 1 across respondents—ahead of new customer growth, expanding digital presence, and improving security. Why? Many pointed to the fact that continual improvement is table stakes—one CIO said, “It is a priority to always do better than the previous year.” Interestingly, both institutions that are prioritizing productivity—and those that are not—cited the customer experience as their reason. One CFO said, “Improving efficiency is a top priority of the institution to provide better services to customers,” and another board director said, “We want to be very productive when it comes to our clients and make sure all of their needs are always met.” But another bank operations director, who isn’t prioritizing productivity, said, “If you improve customer retention everything else falls into place.”

With the strong focus on boosting productivity and lowering efficiency ratio, it is worth revisiting why 50% became the “unwritten rule” for optimal bank efficiency and how the increased digitization of the industry is poised to rewrite the formula on efficiency ratio.

We asked mid-market bank executives their top three strategic priorities, and improving productivity and efficiency ratio ranked number one across respondents— ahead of new customer growth, expanding digital presence, and improving security.

The 50% “standard” for bank efficiency came to be in the context of traditional high-cost, legacy business models and operations, with the mid-market’s traditional heavy branch orientation at the center. With many physical locations, banks were able to signal their growth and assemble larger customer bases— and significant overhead. Brick-and-mortar buildings increased operating costs with leased land, monthly rents, and building management fees, as well as high numbers of employees, but without generating more revenue. The industry-wide orientation toward large numbers of physical branches, and the workforces that power them, meant that efficiency ratios could only get so low.

Further, leading up to and during the financial crisis of 2007–2008, changing rules and a volatile regulatory environment left banks scrambling to ensure compliance. To combat increasing regulatory requests, most banks increased staff levels, amassing armies of experts to run interference, avoid fines, and meet legal requirements. Staff increases also came to call centers with enhanced customer service operations necessitating higher staff levels, thus driving up overhead.

Despite the systemic cracks induced by the financial crisis and the tectonic shifts of the fintech era, the unwritten rule around 50% bank efficiency ratio still stands. However, current market dynamics and increasing adoption of digitally enabled business strategies have the potential to significantly alter these traditional high-cost pools.

Current market dynamics and increasing adoption of digitally enabled business strategies have the potential to significantly alter these traditional high-cost pools. ”

Chapter 2: Technology is paving the way for significant gains in productivity and efficiency

In addition to overwhelming consensus around the focus on boosting productivity, our survey also shows widespread agreement on how to get there—the adoption of new, digital technology. To achieve greater productivity, one director at a mid-market bank said, “We are ready to stop focusing on cost and invest more in technology.”

From our data, the mid-market should be well on its way to experiencing massive productivity gains from new technologies as respondents overwhelmingly indicated they would leverage technology to drive down their efficiency ratio. Sixty-one percent reported that automation technologies were the most implemented efficiency strategy at their institution and 94% shared that cloud computing/SaaS technology was the most effective way their institutions are increasing their efficiency. Even more telling, 91% of survey respondents indicated a wide acceptance of technology in boosting productivity.

Advanced technologies coupled with an understanding of the way traditional and digital workforces can augment each other have set the stage for huge productivity gains, cost control, and ultimately, profitable growth within the mid-market. In fact, when we consider this alignment around productivity via technology, we might argue

that these results reveal an opportunity to not only drive toward the industry standard of 50%, but to dust off the old formula and apply new thinking to what is possible when boosting productivity to drive down efficiency ratio.

Yet, the actual results of the mid-market’s productivity efforts tell a different story.

Chapter 3: Despite alignment on technology’s ability to boost productivity, a clear perception gap exists

While our survey results indicated overwhelming consensus around the priority placed on boosting productivity and leveraging digital technology to drive these gains, they also indicated that the mid-market has significant ground to make up to achieve optimal efficiency.

Nearly 80% of our survey respondents think that they have been extremely or very successful in improving efficiency/ productivity at their banks in the past year, but only 34% have an efficiency ratio at or below the industry standard. In fact, many of the banks reported efficiency ratios in the 60-70% range. When we looked into the rate of progress within the mid-market, the results were even more telling. From

2015–2018 less than 20% of mid-market banks have shown a five-point improvement in efficiency ratio. Less than 10% have made 10-point improvements. Improvements are being made, but not at the pace demanded by today’s market.

Further, in 2018 alone, banks spent upward of $40 billion investing in new technology services. All of this spending is fueling the acceptance of technology investments as a driver of productivity. Yet, of the 91% of respondents who indicated a high level of technology acceptance, 43% reported they are not being used to the fullest potential at their institutions.

What accounts for these struggling efficiency ratios, despite the perception that respondents are successfully hitting their targets and even improving? If the vast majority of banks are leveraging digital technology to boost productivity gains, but are reporting underwhelming results, these survey results point to an immediate opportunity to up the ante. Banks prioritizing productivity should first understand how to optimize their investments in digital technology to unlock their efficiency ratio and set new standards in the industry.

Chapter 4: Optimizing technology investments to boost productivity

There is a high degree of variation among mid-market banks in terms of size, products, and business models. And it is true that mid-market banks have struggled in the past with driving scale and efficiency with smaller bases of customers. However, modern digital technologies now make it possible to drive more revenue from higher-touch, lower-volume interactions with customers.

Embrace technology, but understand limits

It is not enough to just invest in new technology to improve a bank efficiency ratio. Without a considered, strategic approach to how technology will be implemented and utilized by the people working with and alongside it, those technology investments will always fall flat.

Technology by itself is not a silver bullet. In our experience, when new technology is not fully aligned with an organization’s goals, strategy, people and even available skillsets, results will always lag. Indeed, one chief technology officer noted that operating efficiencies can only be gained first “through business realignment.” For the mid-market specifically, many banks are limited by their core systems and a finite group of vendors when attempting to meet their customers’ digital expectations.

Meanwhile, new technologies like cloud, automation, and enhanced CRMs provide viable paths to achieving new efficiencies while still providing a high-touch, relationship- based environment for bank clients. To fully realize the benefits of technology to productivity and improving efficiency ratio, banks should:

-

Define the customer journey and understand their needs. Leveraging technology to tackle some of the “basics” of the business doesn’t mean a lost opportunity to build deeper relationships with your clients. Dazzle them with quick and consistent “basics” via automation, and free up time to expand relationships and deliver a stellar experience.

-

Clearly assess your needs as an organization. Whipsawing from core vendors to bleeding-edge technology isn’t necessary. Tools like digital CRMs, cloud, and RPA are proven and provide a gateway to increased technology adoption while allowing you to reap benefits for your organization’s productivity immediately. Start where you know you can make an impact.

-

Align new technology to your strategy. Ensure technologies are delivering on discrete objectives: Is it helping you make better decisions, faster? Is it freeing up your employees from manual, administrative tasks?

Featured Content

Become cloud-ready: Prepare for the inevitable on your financial institution's terms

Read MoreEnable automation through better business process

In our own experience, banks often move to introduce new technology absent of a broader strategy. In fact, only 34% of surveyed executives responded that when they implement a new technology to improve efficiency, they always redesign the business process first. The vast majority acknowledged that they only sometimes or usually take this crucial step. In our experience, process improvement must be done through the lens of both client experience and technology together, rather than as siloed entities.

We have found this to be one of the most critical factors in realizing value in technology investments.

Developing a clear strategy and identifying all of the processes that will support it is a critical and often missed first step when adopting new technology. When it comes to automation in particular, while many banks know they want to automate, they often struggle to prioritize what to automate. And it isn’t as simple as the longest processes. Technologies like automation are tools, not strategies in and of themselves. For banks seeking to make productivity gains via automation, they should:

- Assess processes by evaluating them based on both their business value and complexity. A low-complexity process with high business value is a great candidate for automation.

- Pilot automation by mapping both current and future-state in an automation environment. Start small, but think big. Pilot with a small user group to perfect the process.

- Bring the pilot to scale after it’s been tested by rolling out to impacted teams and start to measure results of a newly automated process.

- Integrate automation fully by updating documentation and ensuring consistent utilization.

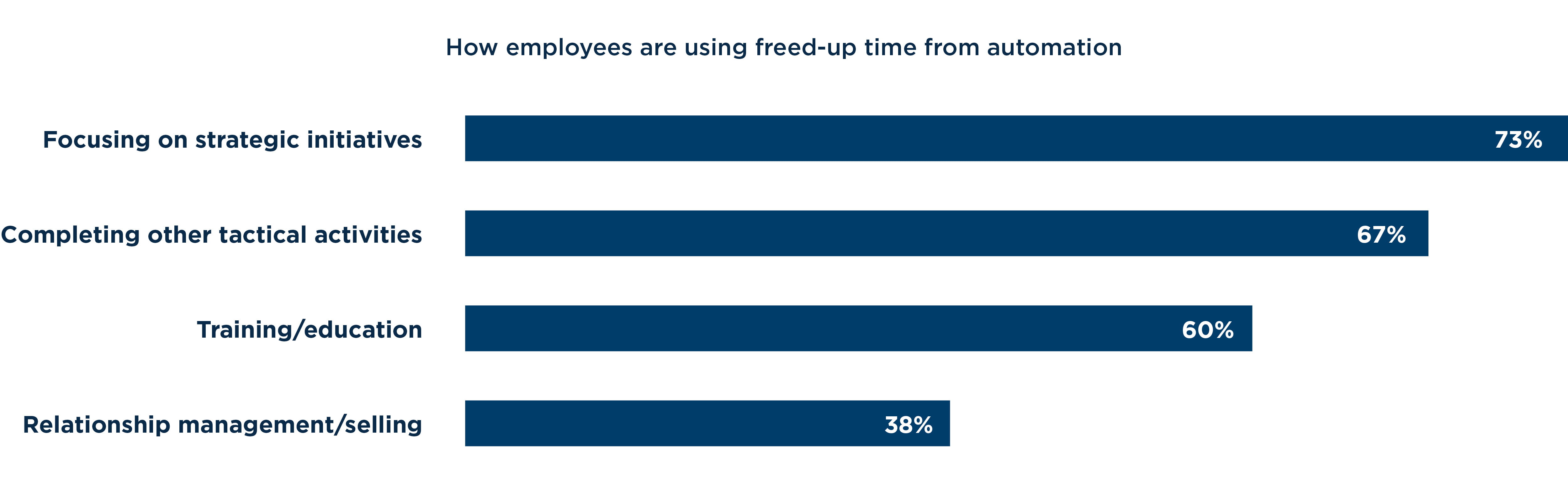

Change the way people work

A bank’s employees, its human capital, are a vitally important part of the equation. Digital transformation can turn well-defined roles upside down. Take automation, for example. Roles once focused on high-touch, high-accuracy clerk-type work now both shrink and shift to analysis and exception-handling activities. For employees staying in the role, this changes not only required skill sets, but how success should be defined and evaluated.

It is unreasonable to expect that technology like automation can replace a traditional workforce one- for-one, but organizations that reap the benefits from technology do so by embracing a blended, digital workforce and changing the ways their employees work. Banks seeking to embrace a blended, digital workforce should:

- Perform a skills assessment. As processes are automated, look at impacted roles and redefine success. Does that employee have the right skills to be successful? How do roles need to be redefined to allow new technology like automation to augment jobs, not just replace them?

- Recognize that hard decisions may be required. Implementing new processes and technology doesn’t magically achieve business goals. This requires you to rethink staffing levels, areas of focus, or even whether your current employee base can successfully execute in a digital world.

- Support your employees through the transition with effective change management. Don’t just assume employees will “get it” and adapt for themselves. Communicating goals and benefits is crucial to buy-in. In some cases, extensive training around new ways of working, new processes, and the tools that enable them are critical to achieving your digital strategy.

Conclusion

Despite consensus around the strategic priority of boosting productivity and wide acceptance of new technology, mid-market banks still have ground to make up in the quest for optimal efficiency. Our survey results revealed an important contradiction: an industry aligned around leveraging digital technology to boost productivity, but one that is still failing to meet analog standards of optimal efficiency ratio.

Our survey results revealed an important contradiction: an industry aligned around leveraging digital technology to boost productivity, but one that is still failing to meet analog standards of optimal efficiency ratio. ”

Mid-market banks prioritizing productivity via technology are making the right investments, but we caution that technology alone is not a silver bullet. By optimizing technology investments, the mid-market can unlock hampered efforts to lower efficiency ratios and boost productivity. In fact, our results revealed an alignment of the mid-market around digital-enabled productivity so strong, we posit that an industry where digital technologies enable more end-to-end online transactions and fewer branch locations, and where automated processes speed up and streamline operations—the mid-market could rewrite the formula around the optimal, achievable efficiency ratio.

Methodology

In April–May 2019, West Monroe commissioned research by Sources Medical American Banker in an online survey to directors, VPs, CEOs and board members at mid-market banks with between $1 billion and $250 billion of assets under management. We received 163 responses, nearly half from banks between $10 billion and $30 billion.