October 2018 | Signature Research

Digital Leaders: Learn from Digitally Mature Companies to Grow Revenue and Profits

The more digitally mature your organization is, the higher your revenue growth and profit margins will be—regardless of industry

Get the full reportWe operate in a rapidly changing landscape where customers have taken the reins, predictive analytics are replacing historical reports, and every single interaction creates and consumes data—instantaneously. In short: It’s a digital world—we’re just living in it.

If businesses want to keep up, they’ll have to think of “digital” as more than just a catch-all buzzword that only applies to certain segments of their organizations, or as the latest technology update, or some pie-in-the-sky vision for the future. The future is here, now, and it looks and feels like Amazon, Google, and Apple. Just ask your customers.

Because when everything goes digital, everyone— especially the entrenched digital players—becomes a competitor. Catching up means becoming a little bit more like them: streamlining operations, getting to market faster, and better anticipating customer shifts.

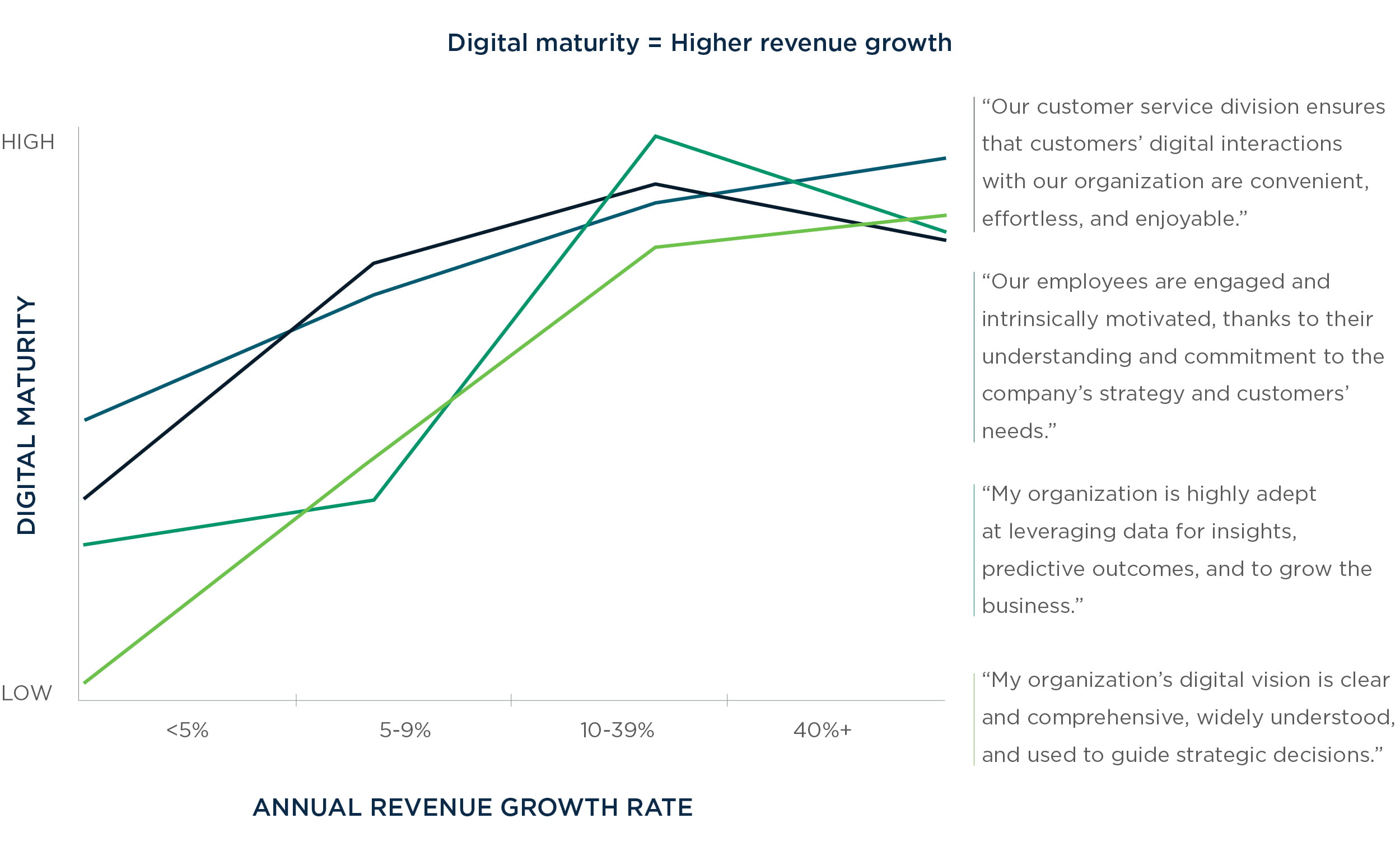

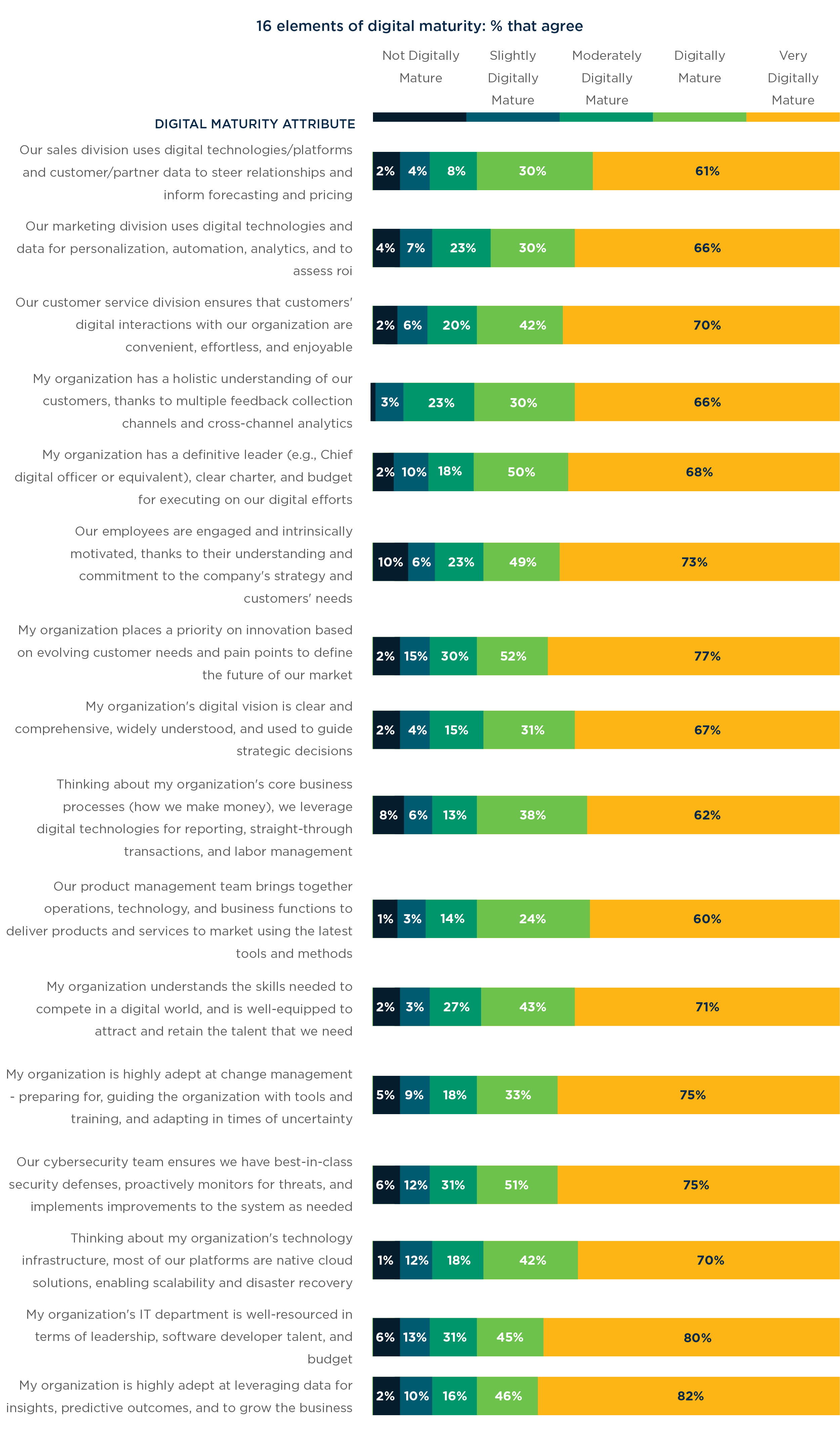

The more digitally mature your organization, the higher your revenue growth and profit margins—no matter what industry you’re in. A theory proven by surveying 407 business leaders on 16 elements of their organization’s digital maturity.

But, not all 16 characteristics of digital are made equal. When looking at the myriad of challenges posed by digital, the biggest challenge for most organizations is knowing which elements to focus on to drive revenue, as well as when (and how) they should implement those elements to best adapt their business to the digital world.

Chapter 1: Digital Maturity Assessment Survey Highlights

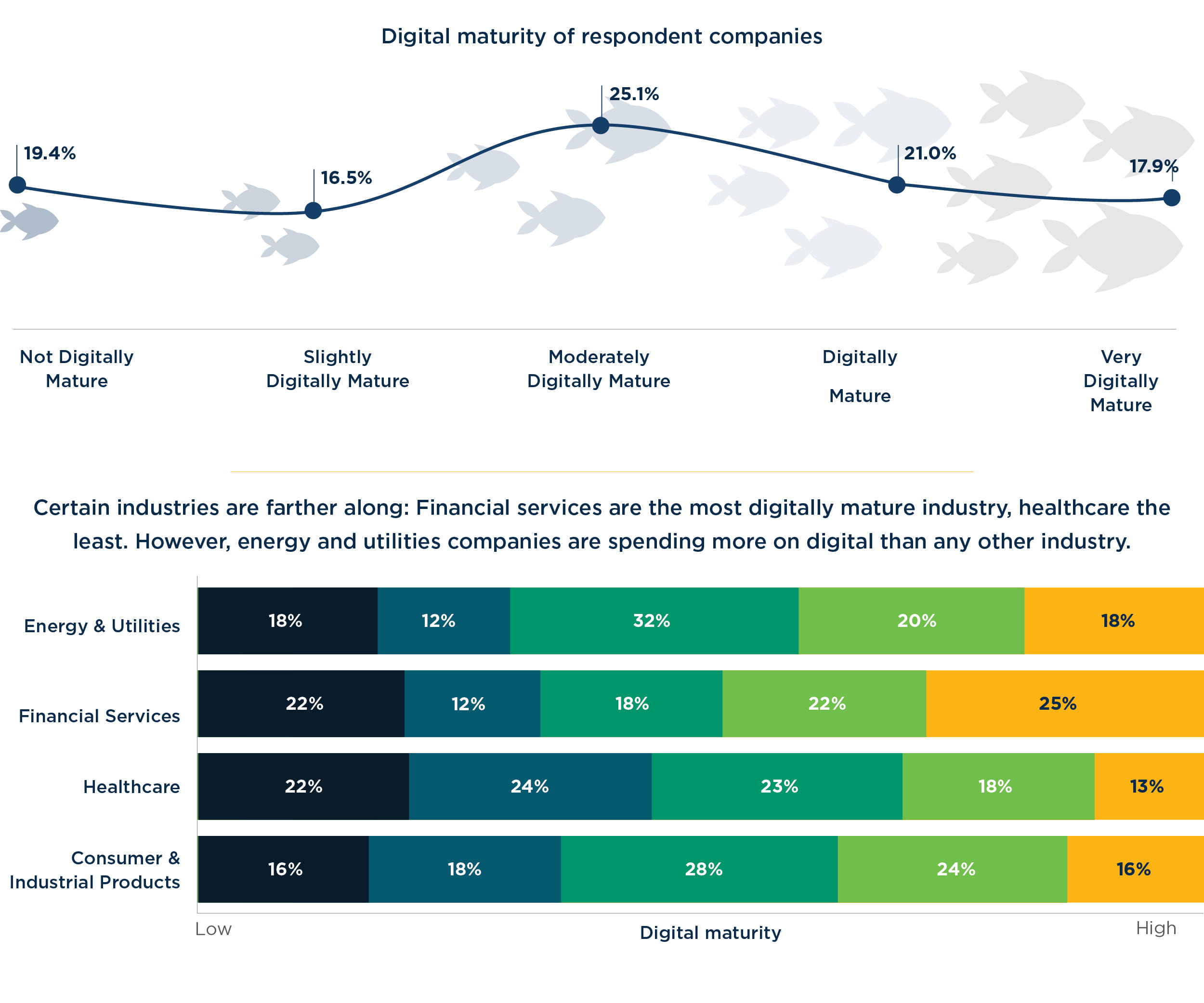

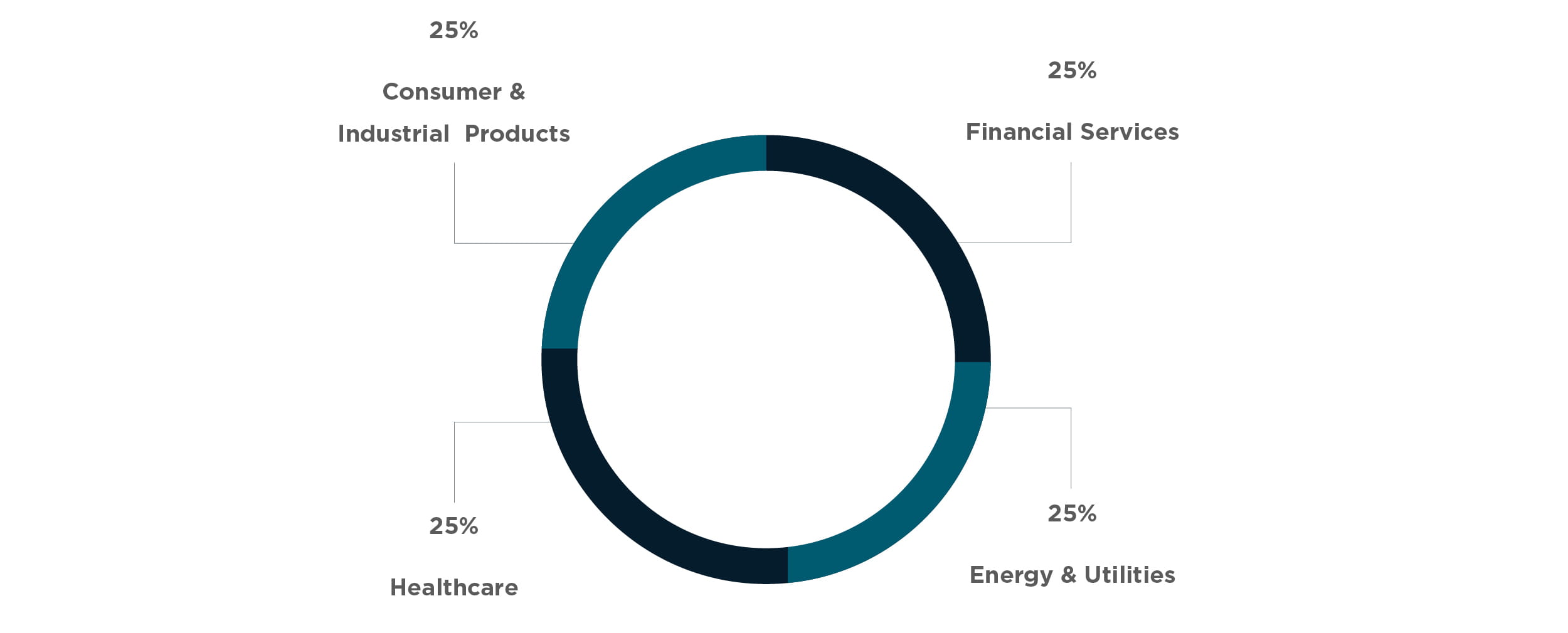

The following report is a summary of a survey taken by 407 executives across four major industries: healthcare, financial services, energy and utilities, and consumer and industrial products. The survey asked respondents, on a scale of 1 to 5, how strongly they agreed or disagreed with 16 statements about their organization. These 16 statements are the framework and primary characteristics of a digitally mature organization. (See more in Methodology) Additionally, we conducted phone interviews with 10 executives in various industries to learn more about their answers.

The top digital maturity assessment findings include:

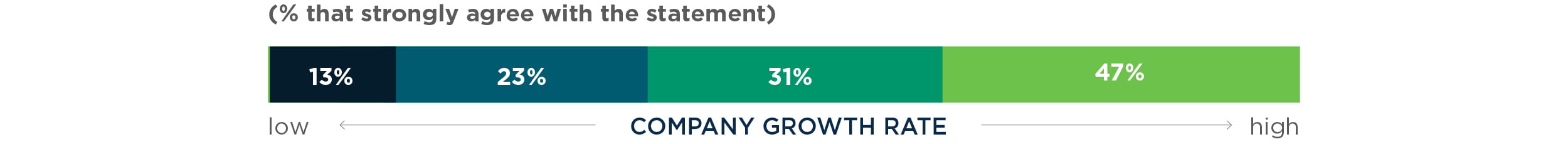

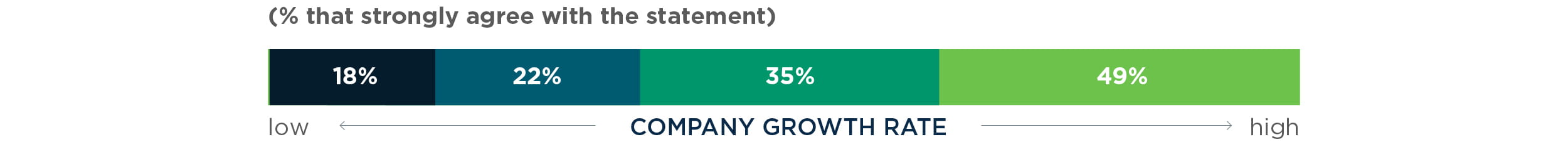

There is a distinct relationship between digital maturity and revenue growth. There is a relationship to net profit margin too, albeit less pronounced than the growth rate.

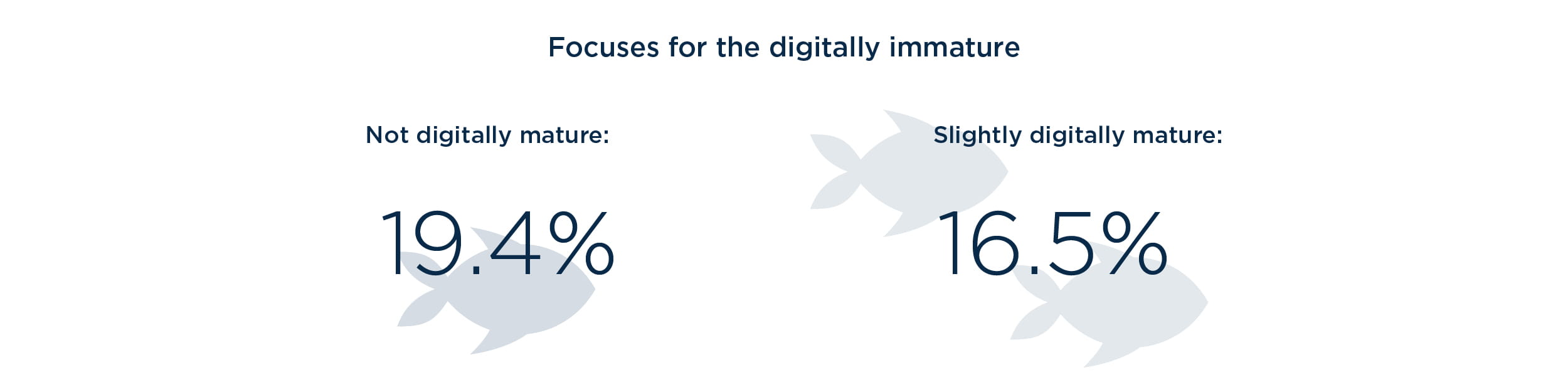

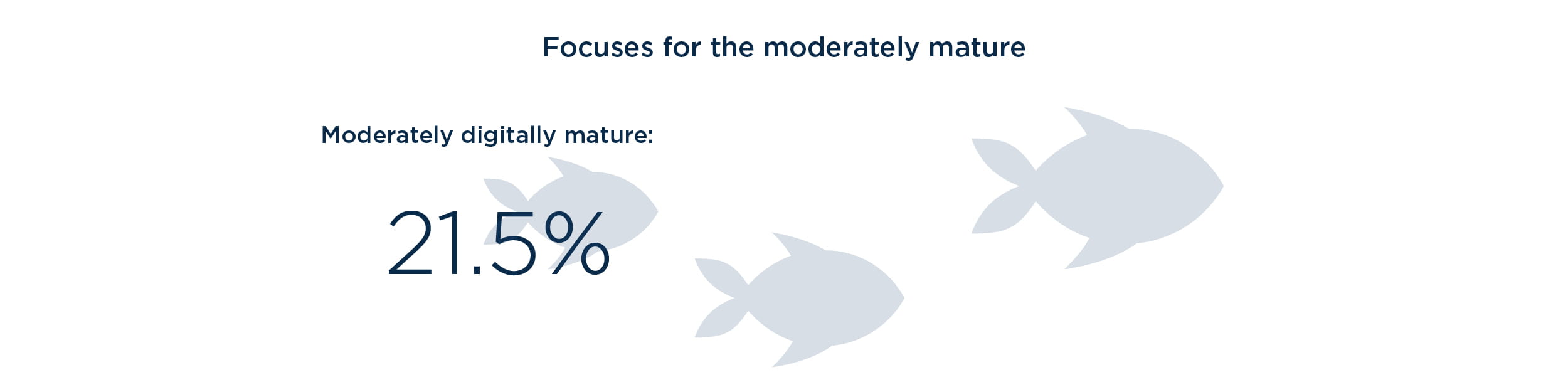

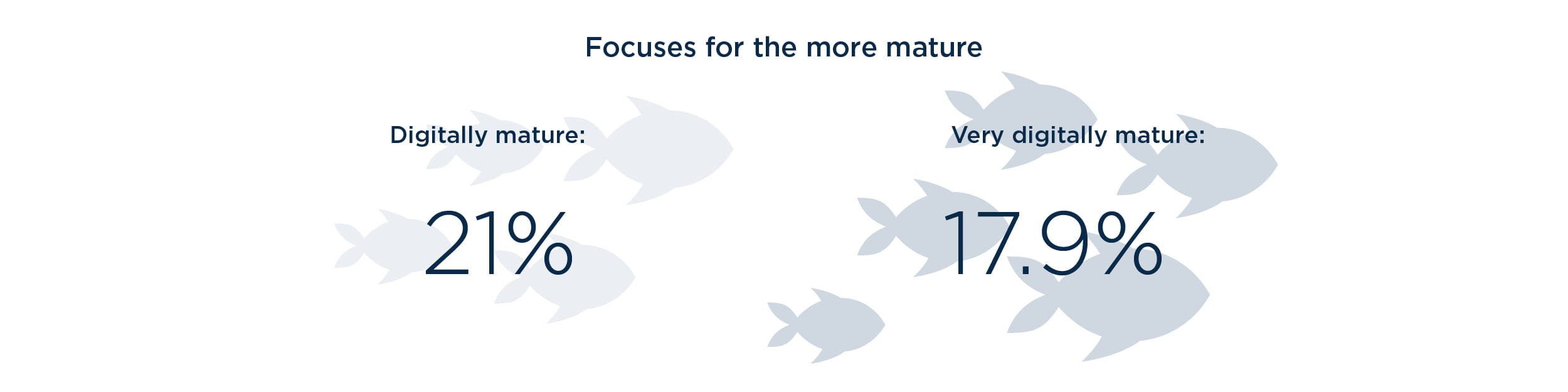

The digital maturity level of respondents varied greatly—most fall in the average, but at least 15% of respondents fall into each level of maturity, with the most mature being the smallest group. Also, certain actions tend to increase digital maturity more quickly at different phases of digital development.

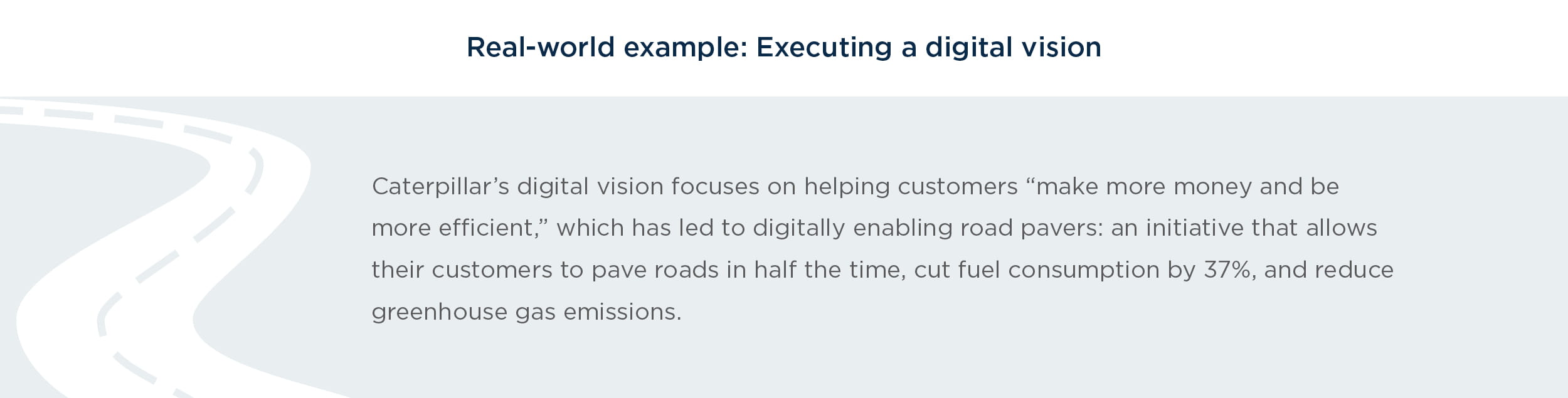

Chapter 2: A sound digital vision and leadership drive growth and profitability

While every business needs dedicated leadership, it’s especially important when undergoing digital transformation.

Why? Because the scope of change in the digital world means it can’t be accomplished piecemeal. Digital touches all aspects of a business—functionally, geographically, culturally—and needs a vision to match, one that gets everyone on the same page and shows how digital supports overall business strategy.

This isn’t just a practical business shift, it’s a mindset shift. Crafting a strong digital vision—that invites employees and customers to see themselves in it—requires not only infrastructure transformations, but cultural ones as well.

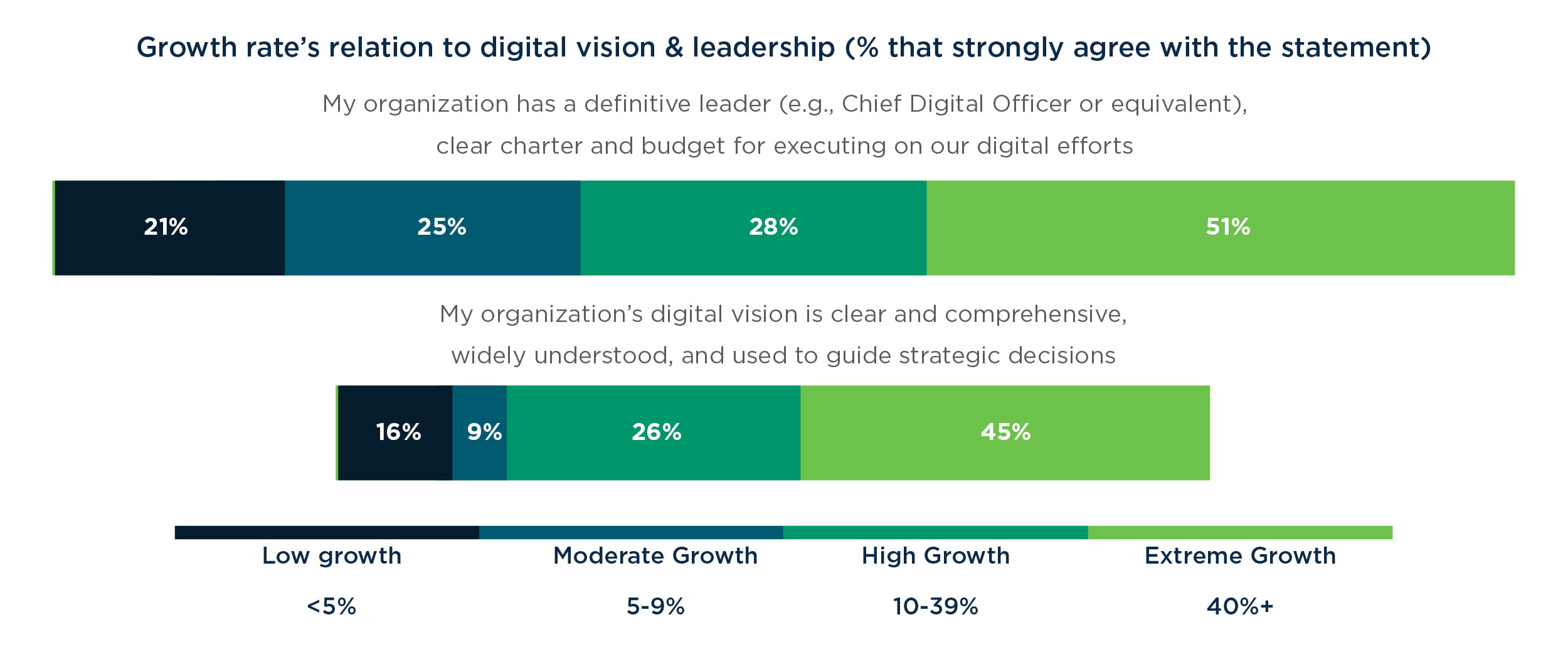

Of course, all this is easier said than done. When asked whether their organization’s digital vision is clear and comprehensive, widely understood, and used to guide strategic decisions, only one quarter (24%) of respondents strongly agree.

To craft a digital vision, an organization should execute three things simultaneously. First, realize this is a major shift and change for the organization, and requires communication early on and thoughtful rollout from front line to executives. Second, put the data to use. Pull in data sets and run them through statistical models to learn what correlations and opportunities exist in your business, and use it to inform your digital vision and strategy. Finally, use a cross-organizational group to identify what type of experience they want to deliver and the ideal operating model to get there. A digital vision should encompass not only technology, but how it will affect people and culture and change day-to-day business processes. By including different departmental groups in crafting the vision, you will increase buy-in and understand unique perspectives to create a vision that resonates organization-wide.

The level of difficulty means it’s even more important that a firm have strong leadership in place to establish, communicate, and execute on a digital vision.

A CEO of a utility company, for instance, has aligned his entire company with his vision of being the first end-to- end digital utility. This vision helps guide and support every business decision. So, when asked about budgetary challenges for such initiatives, a VP at the company says that because of the CEO’s vision, “Going to the board and getting funding has not been an issue. We have a board that is aligned with this vision.”

A vision like this, leader-led and value-driven, filters down to the rest of the organization. Getting teams to bring the vision to life is less challenging when employees can connect their daily contributions to the vision.

At these digitally mature companies, the financial performance speaks for itself—51% of organizations with extreme annual revenue growth rates (40% or higher) strongly agree that they have a definitive leader charged with executing on digital efforts. This drops to 28% and lower for organizations with lower rates of growth.

What makes a strong digital leader? Someone who…

1.) Challenges the current way of thinking.

The best digital leaders understand the breadth of digital; they know what’s at stake, who their competitors are, and that the focus should be on the outcomes (and, of course, the customer). They are ambitious, forward-looking, and think like a tech company. This means they create a more agile and adaptive working environment, one that encourages cross-function collaboration and allows digital talent to try new things, fail fast, and move on.

2.) Understands the role of firm culture and change.

For obvious reasons, digital change can be hard to visualize, especially among an older generation of employees. That’s why digital leaders need to make sure employees at every level of their organization have actionable steps that can be taken to ensure the transformation is successful. Employees need to understand the value (what’s in it for them) of these initiatives and remain engaged. This means thinking about change management not as a “last mile” step, but a “first mile” one. You can spend a fortune on the latest new technologies, but if your people don’t understand how this helps them, supports the vision, and how to properly use the tools, your ROI will soon disappear.

3.) Nurtures a team of digital achievers.

Good digital leaders know they can’t do it all themselves. They may be able to guide and develop a strategic vision but need help communicating it across the organization. They may have some technical knowledge, but that doesn’t mean it’s any less crucial that they hire trained technologists. This talent should be aligned across every business function and geography, opening up opportunities for cross-training and internal innovations. A global manufacturing firm, for example, built an internal Digital Center of Excellence several years ago. Now, says the head of its Big Data & Advanced Analytics team, “It’s become the ‘go-to’ for knowledge and best practices related to digital.”

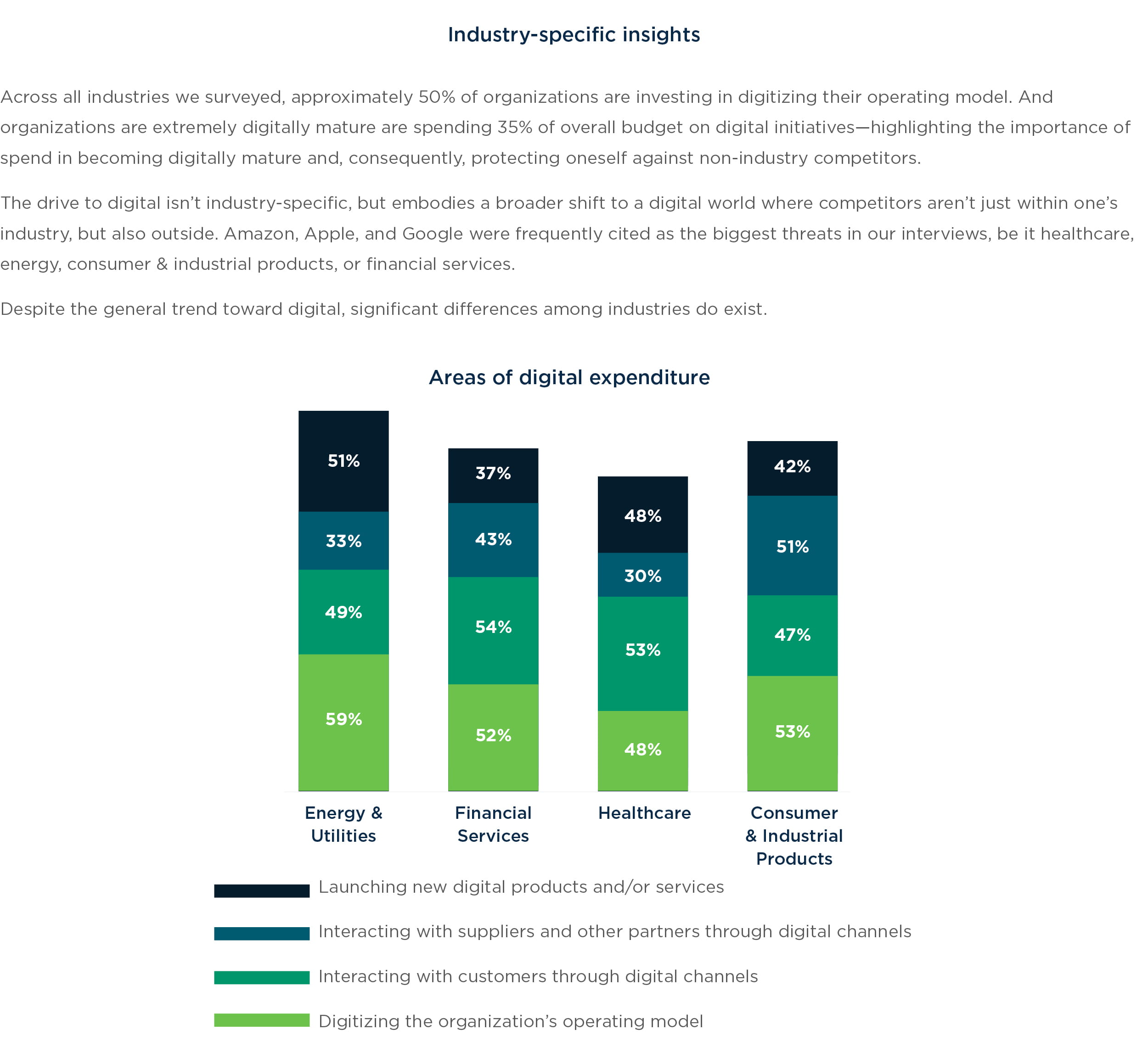

Chapter 3: Industry-specific digital maturity insights

Energy & Utilities

Scored highest in cybersecurity defenses

74% strongly agree that “our cybersecurity team ensures we have best-in-class security defenses, proactively monitors for threats and implements improvements to the system as needed.”

Energy and utility companies are spending the highest proportion of their overall budgets on digital (31%).

Energy and utility companies are mature in core IT functions, but are lacking in sales and marketing maturity.

Respondents who invested in digital technology for their core business operating model and not supplier experience had a 6.2% self-reported revenue growth.

Moving forward, energy and utility companies need to start looking at the disruption caused by the push toward renewables, which will shift energy from a unidirectional system to a bidirectional system where traditional consumers will get paid for the energy they contribute to the grid. “Picture you have a Tesla parked in your garage,” one VP in the industry says. “The wind isn’t blowing, and the grid needs more energy. Your Tesla starts giving energy back to the system and you get paid for it. THAT’S the future.”

Healthcare

Scored highest in innovation

74% Strongly agree that “My organization places a priority on innovation based on evolving customer needs and pain points to define the future of our market.”

Healthcare organizations are spending more than their peers on launching new digital products and/or services, with 48% reporting having done so in the last three years. In part, this stems from the lack of prior disruption in the healthcare space.

Healthcare respondents who focused on investing in the digital customer experience and not supplier experience in the past three years demonstrated a 2% revenue growth compared to those who invested in supplier experience.

Healthcare has indicated digital maturity across the board, but is lacking in a cohesive vision. Creating and communicating a digital vision is especially vital in healthcare organizations as they are trying to become more digitally mature.

Financial Services

Scored highest in digital vision

67% strongly agree that “My organization’s digital vision is clear and comprehensive, widely- understood, and used to guide strategic decisions”

One reason is that financial services firms are more likely to have a clear digital vision—and the talent pool requisite to make that vision a reality.

Other reasons for the industry’s relative success toward more digital maturity include a holistic understanding of customers (thanks to multiple feedback collection channels and cross-channel analytics), as well as the product itself. “The product itself is digital in nature,” one COO says. “Maybe having a digital product helps us get further along.”

Financial services respondents that invested in both customer and supplier digital experiences experienced a 5.9% self-reported revenue growth.

Consumer & Industrial Products

Scored highest in customer experience

When it comes to investing digitally to interact with suppliers and other partners, consumer and industrial products organizations top the rest, with 51% having made such investments in the last three years. Given the vast logistical challenges along any manufacturer’s supply chain—from suppliers, to partners, to field services— smooth digital interactions will become paramount in improving efficiencies and the bottom line.

Consumer and industrial products is ahead on the supplier side, but was behind on investment in core business processes compared to the other industries.

Chapter 4: A focus on experiences and data propels digital transformation

Speaking with executives, we found again and again that a customer-focused mindset ensures digital transformation isn’t simply “technology for technology’s sake”—but one that, instead, makes digital tangible, actionable, and, most importantly, profitable.

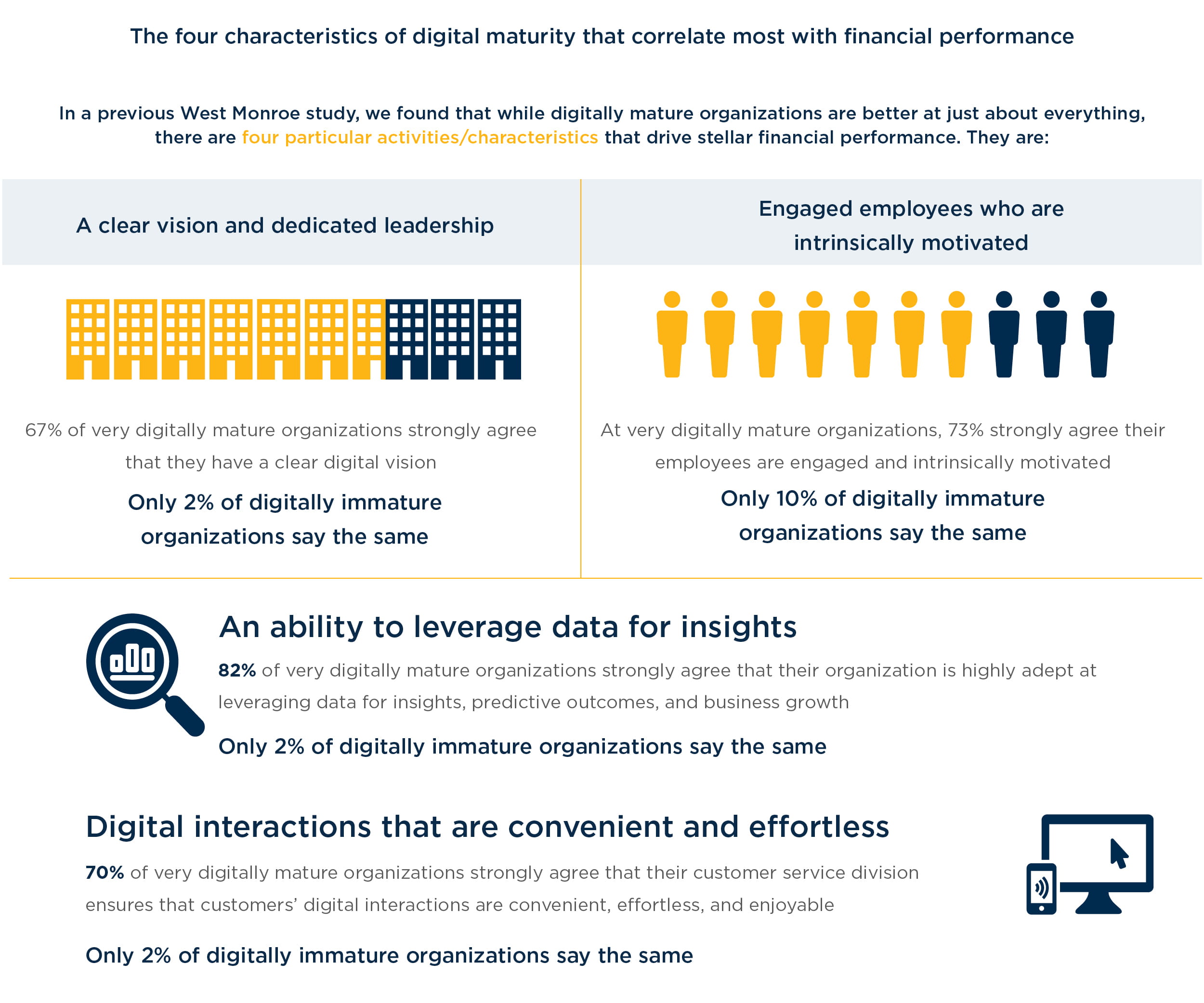

Remember the four elements of digital maturity most correlated with financial performance? Three of the four statements used to gather that data explicitly cite customers. It’s worth reiterating: Organizations’ revenue, growth rates and profitability tend to rise in tandem when executives agreed with the following:

My organization is highly adept at leveraging data for insights, and predictive outcomes to grow the business (and improve customer experience)

Why this matters: Data can offer insights that improve existing products and services while fueling continual innovation, increase engagement via smarter customer segmentation, and helps predict future needs and desires of customers.

Data analytics also supports and drives other areas of the business such as risk management and supply chain management. Underpinning everything is how data is used to support and drive better, smarter business decisions.

Our customer service division ensures that customers’ digital interactions with our organization are convenient, effortless and enjoyable

Why this matters: Because customers hold the reins and expect the same self-service capabilities that the likes of Amazon, Apple, and Google have to offer. Just think of banking, where you can deposit checks virtually and send money to anyone instantaneously. Or healthcare, where you can book appointments online, chat with doctors via an app, check your health records electronically, or request prescriptions without having to pick up the phone. Interactions with your customers should make their lives easier. By reducing customer effort, organizations can deliver more valuable interactions at lower costs. Net provider scores for low- effort companies are 65 points higher, repurchase rates increase, costs are lower with low-effort interactions costing 37% less, and employee retention rises. That leaves the question, how easy are you to do business with?

Our employees are engaged and intrinsically motivated, thanks to their understanding and commitment to the company’s strategy and customer’s needs

Why this matters: The ever-accelerating pace of technological change requires talent to be agile, iterative, and comfortable with learning on the fly. Digital transformations also bring about new roles, exacerbate generational differences, and give customers the power. To succeed, employees need to adopt a take-charge, growth-based mindset that always puts customers first and continuously incorporates their feedback. Digital tools allow employees quick access to customers’ needs and insights and give them greater ability to solve problems more effectively and independently.

What will motivate the new generation of the workforce is an agile, start-up feel where employees can make decisions and impact quickly. As a VP at a utility company says, “At the end of the day, unless everyone has the mindset that we look at how everything we do impacts the customers we will not be successful.”

Chapter 5: Your digital journey blueprint: What to focus on while working toward digital maturity

It’s crucial that organizations take stock of where they are in their digital journey. Only by understanding (and accepting) where you’re at, can you prioritize accordingly to get where you want to go.

What our survey found was that digitally immature companies should not try to implement all 16 characteristics to fast-track the maturity of their organization. Instead, they should focus on certain activities that will propel them to the next level faster than if they focused on others, or all of them.

Get your organization ready for a digital vision: Start with the end in mind and have a clear understanding of where you’re trying to go. Digital touches all parts of your organization, align on what digital means and what you want to see out of it. Your organization must be ready for the change from the people side and adjust processes accordingly before you bring in the technology.

Getting the right infrastructure in place to be able to collect and use data: You can’t use data to drive insights, improve customer experience, and grow the business if you can’t capture that data in the first place. Business leaders across industries recognize this can be a long journey. “We’ve spent the last two years getting all of our disparate systems into one technology stack that is consistent across the business, and it will take two more years to complete the marketing data platform,” a VP of marketing at an information company explains.

And although getting your technology and infrastructure where you want it to be can take years, you can experience incremental lift by working differently. There are techniques to use to allow you to move more quickly by breaking goals down into bite sized milestones: Advances in data management analytical tools is quickly reducing the time to value for getting the data your people need to become insights driven. Additionally, agile analytical techniques can help you rapidly and incrementally evolve the richness of the data you use to drive your business.

Improve existing products and services: Data can offer insight into what customers want in given products and services: from product usage to customer feedback via formal feedback. This information is highly valuable, and firms should use digital capabilities to consistently evolve products and services and expand value for customers.

Organizing around the customer: The rapid pace of change requires companies to heighten their business agility in order to approach digital maturity. As a result, organizational silos are being broken down, and teams are becoming more cross-functional and centered around customer journeys. Firms like Aetna, USAA, Barclaycard, ING, and Lloyds Bank are using a customer journey lens to provide context and direction for cross-functional teams. By organizing around the customer, from marketing, to customer support, to omni-channel environments, businesses are able to quickly adapt to meet shifting customer needs. A senior director at a major retailer points out that it isn’t just about new products and services, it’s also about new ways of delivering them: “There will be new channels and new ways of reaching customers that we haven’t dreamed of. Are we in a place where we can capitalize on those new channels without a lot of effort?”

Increase customer engagement: Data can be leveraged to improve and customize messaging for different customer segments, allowing firms to move beyond a traditional direct-marketing approach and engage with customers in an ongoing, mutually beneficial dialogue. “The depth and breadth of consumer data and the cleanliness of that data has been key to our understanding of what they buy, when they buy it, and what product they’ll buy next,” says the head of big data & analytics at a manufacturing firm. For example, our technologists at West Monroe became so ingrained with a client’s business model and data that they presented executives an opportunity leveraging machine learning that translated to an immediate $25 million revenue lift.

Ensuring the organization values data: Data is useless if there isn’t a company culture that underscores its significance and knows how to use it to improve customer experience. A senior director at a major retailer says, “There is certainly a huge need to understand how to make decisions based on data versus mere intuition. That links back to the culture—culture that focuses on data to drive decisions and insights.” The company should be able to trust and use the data to make better business decisions. Ensure that the data remains clean and accurate by having governance and processes in place. Take time to understand the variation of data needed from different sources, educate leaders and employees on how to read dashboards, and manipulate data and charts to glean the most useful information to make business decisions backed by data.

Predicting customer needs and desires: Use data to predict new customer needs and desires to ensure your organization’s place at the forefront of your industry. A digital strategy advisor at a utility company explains, “[Our customers] want answers right away and we have to figure out how we can deliver the answers before they know they have a question.”

Using artificial intelligence (AI), such as machine learning, organizations can proactively present sales opportunities during interactions with customers. For example, a bank integrated its CRM with an analytics tool to actively present offers based off product usage, history, and credit information. Using trend analysis and propensity models, at risk customers can be identified and proactively targeted as well as customers that are underutilized and should be targeted for cross-sell or up-sell.

Conclusion: A Necessary Digital Maturity Framework

To realize we now live in a digital world doesn’t take much: It’s at the grocery store when someone pulls out their phone to pay. It’s when you make a doctor’s appointment with a click of a button. It’s when your utility sends you a text message to let you know when it expects your power to turn back on.

And yet translating the realities of today’s digital lifestyle into effective business practices, especially for those unaccustomed to outside competition from tech companies, presents more of a challenge. When digital touches each and every aspect of a given organization, how do leaders develop and communicate a vision that’s executable across function, department, and geography? How does an organization learn to collect, value, and integrate the data they need to drive insights that improve customer experience? And from a cultural standpoint, how can businesses teach their employees to be agile, iterative, and innovative to adapt to the pace of technological change?

As established tech giants and innovative startups move to disrupt nearly every industry out there, it’s never been more important for organizations to answer these questions and others relating to their digital maturity, especially given that digital maturity is, by every measure, highly correlated with a business’s bottom line.

It’s our hope that this report, based on the insights of over 400 executives, can serve as a guidepost for your organization— wherever you may happen to be on your digital journey.

Methodology

In 2018, we conducted an online survey with 407 senior executives based in the United States to understand perspectives on digital maturity and the impact of employing digital initiatives across four key industries: manufacturing (specifically consumer & industrial products), energy and utilities, financial services, and healthcare. Respondents were divided among C-level executives (25%) and senior managers (75%) with decision-making influence on digital spend. Supplementary in-depth interviews were conducted with 10 senior executives in support of the quantitative research.

Survey respondents self-assessed themselves, on a 5-point scale from “strongly agree” to “strongly disagree” (and a “not applicable” option), on 16 different components of digital maturity. Responses were assigned points, with 1 point assigned for “strongly disagree” responses, up to 5 points assigned for “strongly agree” responses. Questions where respondents selected “not applicable” were excluded from their score. Points were then added up and divided by the total number of points possible for that participant (e.g. excluding any questions that were not applicable for them), then multiplied by 100 to arrive at a percentage score. Based on these percentages, we categorized each respondent into one of five levels of digital maturity: