August 2018 | Point of View

Rethinking loyalty: Inefficiency is hindering your ability to create loyal customers

Rethinking loyalty: Inefficiency is hindering your ability to create loyal customers

Many loyalty reward strategies were built for the pre-digital marketplace — Now those loyalty and engagement efforts have become highly inefficient, hindering success.

Many of today’s consumer loyalty programs have grown organically over time. Originally built for the traditional, pre-digital consumer marketplace, they are now overcomplicated, too transactional, and too homogeneous—they no longer serve their intended purpose of inspiring true customer loyalty. The research is telling: U.S. households actively engage with fewer than half of the loyalty programs in which they are enrolled.

Through our work developing loyalty and engagement strategy and associated co-brand or private label card programs, it is apparent that loyalty and engagement efforts have become highly inefficient. Rewards programs are increasingly spread too thin across varied and opposing market demands and have struggled to maintain efficient design that both maximizes resources and yields an engaging experience for their consumers.

Loyalty and engagement tactics and strategies must now meet the demands of “smarter,” digital customers who expect seamless, real-time experiences, while retaining their more traditional brick-and-mortar customers through differentiated loyalty offerings. In their current state, many loyalty programs are trying to do too much with too little and as a result are no longer winning the hearts and minds of customers by making efficient use of their available resources.

Rather than continuing to tweak existing offerings, organizations pursuing loyalty and engagement tactics need to consider new and more efficient strategies for winning the hearts, minds, and wallets of their customers.

In a changing marketplace, companies must find new ways to earn customer loyalty

Customer loyalty has never been more important than it is today, but it has also never been harder to achieve. Once-straightforward tactics such as providing coupons, discounts, or basic points systems to drive purchases or card usage are no longer enough to move the needle. Companies today are challenged to keep pace with a more varied rewards landscape that goes beyond discounts to include experiential rewards, membership perks like expedited shipping, and even differentiated digital and brick-and-mortar rewards programs. Today, companies must find ways to engage and earn the loyalty of increasingly fickle customers who:

Expect more. Today’s consumers want it all: frictionless interactions, real-time response, personalized experiences, and the ability to shop when and how they want—not to mention simple and valuable reward offerings. Some will even pay a premium for special treatment.

Know more. They shop armed with ratings, reviews, and recommendations from hundreds or even thousands of people in the palms of their hands, accessed via social media and other digital channels.

Are “better” and more persistent shoppers. They know that they can always find a lower price, a discount, more points, or added card benefits if they look in the right places.

Are increasingly digital-first. They shop online for everything from groceries to apparel to furniture, and are increasingly comfortable with bots and artificial intelligence interfaces, such as Amazon’s Alexa and customer service chatbots.

Compounding these evolving customer demands, an array of other factors—from emerging, non-traditional competitors to burgeoning volumes of data and sophisticated new tools for mining, are driving complexity into the loyalty equation.

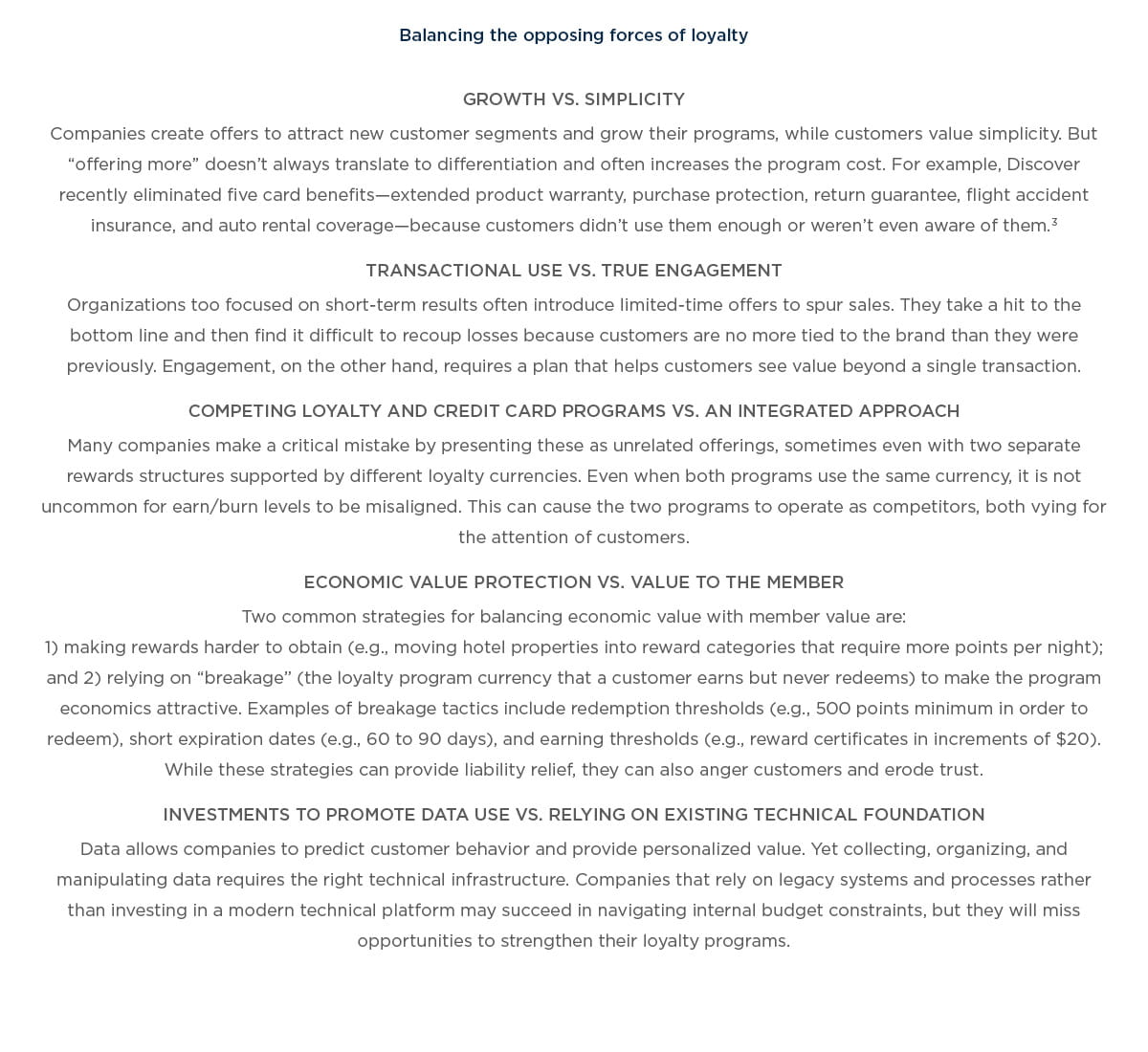

Increasing complexity has created unintended forces that drive inefficiency

To address the complexity of the new consumer marketplace, companies are adding more loyalty- based tactics to their portfolio in an effort to match the competition and customer expectations. But in this case, complexity breeds complexity, and once- simple strategies are being pulled apart by a set of four opposing forces that put at risk the desired intent— creating a loyal customer base:

1. Customer expectations

Points and rewards have become baseline expectations for customers. They increasingly want more points for their purchases, lower costs for rewards, and more differentiated experiences.

2. Loyalty program operations

Organizational pressure on loyalty programs is building, working to stretch value per point and cost per point at the same time. Companies must understand how best to structure and support their loyalty efforts internally, working to harmonize loyalty mechanics with standard business processes.

3. Program cost and liability

Program liability is growing due to increasing numbers of customers who join programs and hold their rewards for extended periods of time. As rewards become more difficult to redeem, redemption cycles get slower and program costs increase.

4. Card program market dynamics

The issuer/merchant co-brand relationship can be lucrative for both parties, but it requires careful balance of partnership and financial terms, integration with other aspects of a company’s loyalty program, and a complimentary rewards structure to maximize impact.

While each force is a necessary consideration to drive loyalty, we find they can operate at odds with one another if not properly balanced. When this happens, a loyalty program becomes inefficient and struggles to meet the needs of the merchant or financial institution, its partners, and—most of all—customers.

Inefficient program design leads to indifferent customers

Market research reinforces our observation that many loyalty programs are not as efficient as they could and should be. The average U.S. household is enrolled in 29 loyalty programs but is active in just 12 of them.1 Further, being a loyalty program member doesn’t mean that the customer isn’t shopping around—half of a brand’s highest- spending customers also shop with competitors.2

These statistics should concern merchants and financial institutions. If not corrected, inefficiency can create indifferent customers, increase costs, produce unnecessary investments, increase susceptibility to competitor moves, strain partner relationships, and ultimately diminish returns.

Loyalty programs must be simple, unique, and adaptable

In our view, an efficient loyalty program built for a new age and new customer expectations has eight key characteristics.

It is differentiated and unique to the business. Successful programs include offerings that are unique and exclusive. For an airline, that could be providing a sports car to transport top-end loyalty members between flights. For a sports team, that could mean offering sideline passes or lunch with a player. It also strikes the right balance of offerings: If some unique benefits are particularly expensive, such as free shipping, or scarce, such as automatic first-class upgrades, companies often offer those only to higher-tier customer segments.

It is simple. An efficient program offers a simple menu of options, making it less costly to market and administer. This will also make the program easier for customers to understand and, therefore, more convenient to use. For example, card program benefits should be consistent with loyalty rewards, serving as an accelerator but not an additional set of earn/burn options to be managed by the merchant or analyzed by consumers in search of the best way to engage.

It is consistent across channels. An efficient program is designed to deliver familiar and reliable messages and functionality, whether a customer is interacting on site, online, or via a mobile device.

It is well-integrated with a credit card program. An efficient program has an integrated card offering that accelerates the impact of the loyalty strategy. Offering an integrated loyalty-plus-card program gives those who are most loyal additional and accelerated ways to earn and will likely convert more customers into cardholders— customers who carry the credit card generally spend significantly more than non-cardholders.

It delivers the experience customers expect. An efficient program provides the level of personalization and instant gratification that today’s customers crave. It leverages customer data to personalize the experience—for example, delivering real-time, location-based offers and displaying points in the account (via website/app) immediately after they are earned.

It applies a longer-term approach to building customer relationships. An efficient program has a sustainable plan that is not highly focused on short- term or one-time events, such as special promo offers that primarily generate immediate activity rather than long-term engagement. It is grounded in a philosophy of innovation and is always evolving—just like customer expectations.

It emphasizes overall perceived value to the customer rather than solely monetary value. An efficient program presents the customer with a holistic view of the value received. For example, an airline’s highest-tier flyers receive a more comprehensive set of benefits—such as first boarding group, greater discounts on lounge membership, complimentary upgrades when seats are available, waived fees, higher mileage accrual—than lower-tier flyers. Some of these benefits don’t necessarily have significant monetary value, but together they enhance the overall travel experience. In this way, the company can manage costs more effectively while continuing to emphasize value to the member.

It runs on modern technical infrastructure that can support growth. An efficient program is not limited by legacy processes and systems. Rather, it runs on a modern technical platform that enables use of data to deliver a differentiated experience, allowing programs to be as proactive or reactive as the consumer desires. Additionally, it takes advantage of process automation capabilities to reduce costs and improve quality.

A program with these characteristics can cater to the wants and needs of target customer segments and provide each customer with a personalized experience. As a result, customers are more likely to perceive and realize value in the relationship—not only monetarily but also emotionally and experientially—and to build a connection with the brand. And, just as importantly, it can be managed efficiently and effectively by the company in a way that maximizes the value of the resources being directed towards driving customer loyalty.

Where to go next depends on where your loyalty program is now

In the battle for customer loyalty, rewards program design must be modernized to meet the demands of the new marketplace while maximizing company resources. But where do you start? Before continuing to tweak your current program, companies should first understand how efficient your efforts are today and the impact—positive or negative—that each opposing force of loyalty has on your business.

Identify your key drivers of inefficiency

Start by identifying and evaluating drivers of efficiency in four key areas—customer expectations, card program market dynamics, program operations, and program cost and liability. Next, determine the maturity level of each. Gathering this insight usually requires a combination of tactics: customer interviews; competitive research and benchmarking; and analysis of current program structures, delivery organizations, underlying operations, contracts, costs, and liabilities.

Prioritize and map out a path to efficiency

Once you gain clarity on your program’s key drivers of inefficiency, develop a prioritized plan to address them. Depending on the breadth and depth of inefficiency, this could entail a few tactical adjustments or a more holistic series of initiatives. Modernizing a loyalty program and reconciling the opposing forces of loyalty can seem daunting. Start by focusing on the most critical inefficiency drivers and consider possible paths forward:

As you undertake these efforts, keep one important guiding principle in mind: the initiatives must work together to help create an integrated, more efficient program. A series of “improvements” that are not all driving toward the same vision may only result in a different set of inefficiencies.

Building loyalty is about more than rewards

Customer expectations are at an all-time high. Companies that don’t keep pace with the digital powerhouses will struggle to earn loyalty and, ultimately, find it difficult to thrive. Building loyalty isn’t just about points and rewards. It’s about providing utility by being more deliberate in the experiences your brand creates. From loyalty operations to managing experiential value and card programs, most companies have opportunities to improve their offerings, reinvent the concept of customer loyalty, and drive greater business value by improving the efficiency of their current loyalty efforts.