December 2016 | Point of View

AMI for the water industry: Applying lessons from electric industry deployment

Many loyalty reward strategies were built for the pre-digital marketplace — Now those loyalty and engagement efforts have become highly inefficient, hindering success.

Consider these facts as we ponder the future of the water industry:

- Water covers 70 percent of the Earth’s surface, but only about 1 percent of it is available for human consumption.

- According to the United Nations, global water usage has been growing at twice the rate of population growth in the last century.

- People can live without electricity. We cannot live without water.

- The U.S. water industry has an 80/20 structure: 80 percent served by public entities and 20 percent served by private entities.

- 89 percent of Americans served by a public water system are served by a public or cooperative entity. The largest private water company in the U.S. is American Water, which serves 15 million customers in 1,600 communities in the U.S. and Canada. It is followed by United Water, which serves 7 million customers and is owned by the French firm Suez Environment.

- According to the U.S. Geologic Survey, 1.7 trillion gallons of water are lost per year in the U.S. alone, at a national cost of $2.6 billion per year. The EPA has supported this statistic and added that in the United States an average of 700 water main breaks occur every day and, globally, up to 60 percent worldwide water is lost to leaky pipes.

- Water utilities will spend over $2 billion on smart meter and infrastructure upgrades through 2020.

- The percentage of water meters read remotely is expected to increase to 26 percent by 2016, up from 8 percent in 2009.

Introduction

It should come as no surprise that concerns about the water industry’s future have kept the topic of advanced metering infrastructure (AMI) on the table among water-sector policymakers and utilities. Water scarcity, aging water infrastructure, water quality and accompanying regulations, water distribution, and the impact of inefficient water usage all combine to create huge challenges for water utilities in the decades to come. The cost of repairing and expanding the potable water infrastructure in the United States alone will cost more than $1 trillion in the next 25 years.

These challenges parallel in many ways the challenges that the electric industry has faced, and has begun to address through the deployment of smart meters, AMI, and related smart grid technologies. Over the last decade, we have all become more familiar with a full scope of AMI network applications across the electric utility sector, and the ever-prevalent use of advanced meter reading, remote connect/ disconnect, voltage monitoring, transformer monitoring, distributed automation, substation automation, etc. And yet while the needs of the water industry closely track those of the electric industry, deployment of AMI for water utilities has been much slower to materialize.

This provides an advantage to the water utility industry to benefit from the electric industry’s experience with AMI. There is little history with smart water solutions on which to base business decisions, and that can make water utilities— which are traditionally conservative, budget constrained, and risk averse—particularly hesitant to adopt something new. Rather, until forced to make a change, water utilities generally will seek to focus solely on delivering water supply to their customers via the existing infrastructure. There are several problems with that scenario, however:

- The increasing scarcity and rising costs of water supply that are projected over the next 30 years

- Existing water infrastructure is typically older than electric or gas utility infrastructure and is in desperate need of being updated

- Water utilities cannot afford to continue to take huge revenue losses when a solution is within their reach

- Increasingly water customers will demand more detailed information about their water usage and resulting water bills; which is a demand that cannot be met based on the way water utilities function today

All of these factors point water utilities in the direction of a “smart water grid,” but what would that look like? Certainly, it is the case that all utilities are unique and one model for an AMI system would not need the needs of all water utilities. However, when examining the full scope of AMI/ smart water grid deployment, the architecture itself would look very similar to the “smart electric system” we are now familiar with, as it would include the following six key components:

- Advanced meters capable of interval usage reads

- Measurement and sensing devices that collect data on water flow, pressure, quality, potential leaks, etc.

- Real-time communication channels for two-way communications between smart devices and the utility back office

- Data management software to process and aggregate collected data;

- Real-time data analytics and modeling software and;

- Automation and control tools to enable water utilities to conduct network management tasks remotely and automatically.

Similar to their counterparts in the electric utility industry, there will be variations in the ways in which water utilities choose to pursue AMI based on their unique business needs. However, to achieve a true “Smart Grid for Water,” water utilities would very likely need to integrate AMI, CIS, SCADA, asset management/work order management, GIS, and analytic engines.

In any combination it appears to be clear that water utilities have an opportunity to improve their overall performance through advanced technologies broadly captured under the banner of AMI. System performance in the field, coupled with utility programs to enable consumption and efficiency that utilize customer data, create a powerful combination that has the potential to transform the water utility industry much in the same way that it has transformed the electric industry.

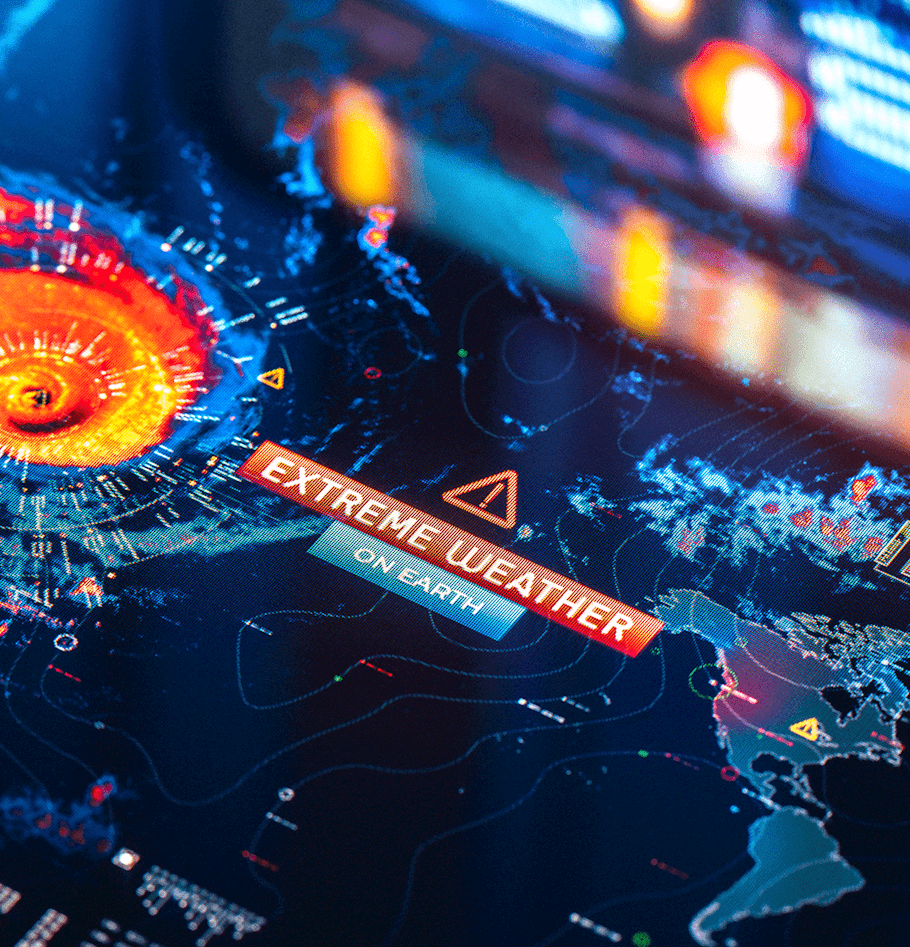

Chapter 1: Let’s examine these drivers in great detail

Revenue loss—Not surprisingly, revenue loss is typically the primary driver that would lead AMR or AMI from traditional manual meter reading. Revenue loss that results from a variety of reasons—theft, unaccounted usage, leakage— typically increases as the water infrastructure ages and accuracy of usage tracking declines. Other revenue losses are occurring due to a decline in customer demand. Regardless of this decline, capital costs that are necessary to keep water service going have increased. Raising prices to cover capital investments only cause lower demand. A utility may respond by raising prices to offset revenue declines and maintain sufficient profits to make these necessary investments.

However, higher prices are further depressing demand, and it is increasingly difficult for water utilities to keep up with revenue and profit forecasts. The end result is that water service providers are facing new challenges in forecasting and preparing for future water demand, staying fiscally solvent while providing fair prices, incorporating conservation and efficiency, and communicating clearly to customers about rates and service. This drives interest in new technologies such as AMI that can support conservation measures, measurement and operational efficiency.

Aging infrastructure

Like the energy infrastructure of the United States, the water infrastructure dates back to the 1940s or earlier and has only been upgraded on as “as needed”basis. The result is that the water system in the U.S. today is running on aging and crumbling infrastructure, including millions of miles of buried pipes of various types, including metal, plastic and wood.

Water scarcity and conservation

Droughts throughout the American west, southwest, and southeast have been well- publicized. Smart water metering solutions can enable water conservation through more accurate metering and billing, and provide the basis for new rate structures built around dynamic pricing that can enable the creation of energy efficiency and demand response programs.

Enhanced water management capabilities

Water utilities that upgrade to AMI should immediately see many improvements around their water management capabilities that cannot be achieved through traditional infrastructure or AMR. The improvements found through AMI can include: enhanced tracking of water consumption and flow patterns; ability to track and predict changes in trends and demands; ability to shift water consumption to different time periods; identify anomalies in distribution or customer usage.

Leaks, pressure management, and water quality

According to a recent survey conducted by Sensus, collectively water utilities lose an estimated $9.6 billion on an annual basis because of leaked water.

Without an AMI system in place, water utilities today typically have little insight as to where water leakage is occurring across their system, and thus oftentimes leaks occur without detection and lead to unexplained water losses. Many utilities have struggled to locate and measure leaks on their distribution network, let alone implement leak-reducing solutions. Leakage management is conducted on an “ad hoc” basis, responding to visible and obvious leaks and repairing infrastructure as needed. Smart water networks, which include components such as flow sensors, can identify leaks early. This reduces the amount of water that is wasted and saves utilities money that would otherwise be spent purchasing and treating additional water supplies. Further, backflow notifications and integrated pressure monitoring are also “smart functions” that can track minimum pressure requirements that are created to prevent infrastructure damage.

Need for greater bill accuracy

Budgets remain tight for towns and cities across the United States, many of which have the role of providing water service to residents in their areas. Both AMR and AMI technologies enhance the capability to more accurately track water usage and bill for it accurately. If we think of the meter as a utility’s cash register, then the accuracy of usage measurement that can be achieved through AMR/ AMI would naturally be very attractive to water providers.

Customer service

Like their electric utility counterparts, water utilities are seeking to improve customer services. Oftentimes, the pressure to improve customer service comes from regulatory agencies, which include customer service and/or customer satisfaction as a key performance indicator in regulatory reviews.

And just like electric customers, water customers are now accustomed to receiving instant information. If their water bill appears too high to them, they want to be able to call their water supplier and obtain instant information as to what caused the spike. Customer service benefits and expectations that customers increasingly will demand from their water utility include: enhanced billing accuracy; efficient resolution of bill inquiries with real-time data; timely notification of customer premise leaks; customer information (Web) portals; and innovative payment options such as pre-payment. The traditional systems being used by water utilities simply cannot provide this level of granularity and real-time insight as to usage patterns.

Leveraging the benefits of an ami system already in place

There is a common phrase among AMI circles that “all the heavy lifting has already been completed for water utilities.” Most AMI deployment activity over the last decade has been focused on deploying two-way fixed network solutions to support electric and/or gas operations. Most electric AMI providers will find that their system can directly support water meters in addition to electric meters as individual endpoints served by the same communications infrastructure. Moreover, for those electric and gas utilities that also serve water customers, since the AMI network is already in place it may not be such an overwhelming leap to install smart meters to track water consumption as a part of the overall AMI project rollout. The opportunity to use existing water towers, microwave towers, power plant stacks, etc., also can be leveraged to decrease deployment costs. Further, some have posited that the Zigbee protocol, which has reached global status as a wireless communications protocol, can easily do for water what it has already done for electric and gas to create a standards-based platform to connect interoperable devices.

Chapter 2: How is AMI deployment for water utilities similar/different when compared to AMI deployment in the electric industry, and what lessons can be applied?

There are arguably more similarities than differences when comparing AMI deployment between the water and electric industries. However, the differences, though fewer in number, are fairly significant and may create larger barriers toward AMI deployment in the water industry than were found in the electric industry. Let’s explore the similarities first.

Similarities

1. Similar business objectives drive the push toward AMI. The reasons why a water utility would explore AMI track very closely with the reasons electric utilities have identified:

- Improve and protect revenue

- Reduce customer service calls

- Reduce distribution losses

- Reduce overall account management costs

- Reduce operational costs

2. The need to change the regulatory model. The regulatory model between electric and water utilities in similar in the sense that private utility rates are regulated by a utility commission, and public entities are regulated by a board or city council. More importantly, however, the success of AMI deployment for both water and electric depends in large part on the need to make changes to the existing regulatory model: 1) to address the lack of political will to increase rates; 2)to allow for more alternative pricing models (i.e., dynamic pricing) that reflect the true cost of consumption. As in both the electric and water industries, existing pricing models were created to address supply but not necessarily consumption behavior. Most water tariffs still in place today are based on volumetric pricing, sometimes using block tariffs in which rates increase as more water is used. However, due to the billing cycle that remains common among water utilities—i.e., customers receive a water bill either quarterly, twice a year, or once a year—there has been little awareness among customers regarding how their water usage patterns have affected their water costs.

These rates that provide no insight into how changes in consumption patterns correlate with spikes in pricing and do little to incentivize customers to make changes. Thus if AMI systems are to be installed in the water industry, they will need to be correlated with time-of-use or other dynamic pricing programs to truly be successful. Thus, a key pre-requisite for many water utilities it to socialize changes in ratemaking tariffs to incorporate new pricing signals that will encourage conservation.

Further, the decoupling of utilities’ fixed-cost recovery from the volume of water sold is something that water regulators should consider, as it has been applied in the electric industry, to enable efficiency and demand response programs. The primary objectives of decoupling is to eliminate a utility’s economic disincentive to encourage conservation. Decoupling mechanisms help those utilities remain steady by guaranteeing an agreed-to amount of revenue regardless of how much water is used or conserved. By assuring that utility revenues will not decline as a result of efficiency measures, decoupling removes the incentive to promote higher quantity sales and the disincentive to invest in both demand- side and supply-side conservation. In 2008, California became the first state to implement water decoupling mechanisms in light of state- mandated conservation. There have been mixed reviews about California’s decoupling.

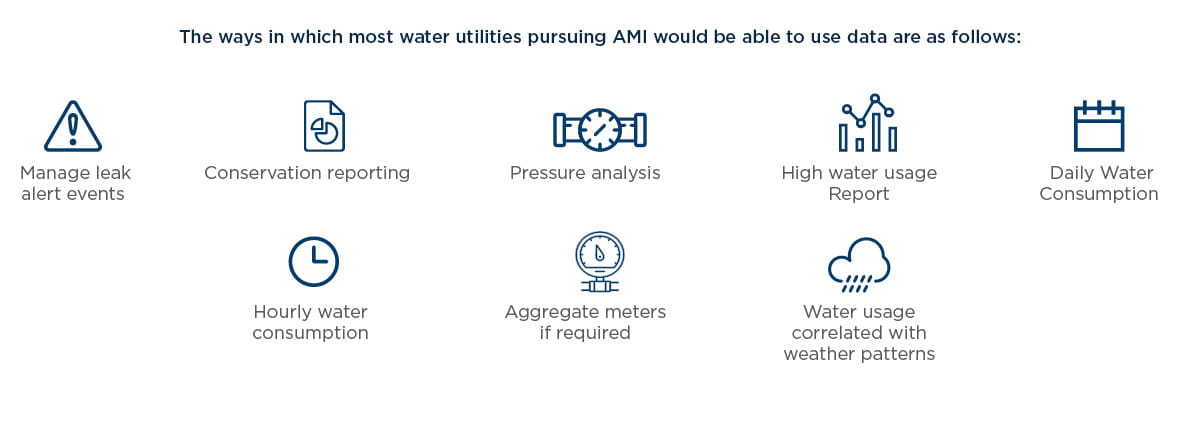

3. The role that data analytics plays. The role that data analytics plays. Data analytics will play a huge role in the future success for both AMI electric and AMI water deployments. AMI applications enable utilities to take basic measurement data and turn that data into actionable information to improve operations, customer service, preventive and predictive maintenance, and regulatory compliance. This is true for both electric and water utilities. For the water utility specifically, the transition can be quite significant.

For example, hourly interval reads of water usage data could replace four or 12 annual reads per customer. While some water utilities might decide to pursue AMI without the inclusion of a meter data management system (MDMS) and rely solely on moving data to an existing CIS, they might soon find that this approach becomes inadequate to both handle the huge influx of new data and to support consumption-reduction programs that they would use the AMI infrastructure to leverage. Further, water utilities that use an AMI network in parallel with an MDMS are not only able to detect leaks more easily but also have the means to immediately notify customers of the leakage.

4. Many of the same vendors are serving both markets. There is an obvious commonality among the vendors that are active in both the electric and water markets. Many of the vendors that are active or emerging in the water utility market have their roots in AMI for the electric industry and are familiar names in the energy and utilities industry.

- ABB—distribution networks, network optimization and asset management

- Aclara StarNetwork system (ESCO)—fixed network AMI, leak detection, data software

- Echelon—smart meters, data concentrators, system software

- Elster—metering and distribution

- GE—advanced remote monitoring, asset protection and control, back office systems

- IBM—work and asset management

- Itron’s Water SaveSource AMI program— metering and modules, AMI fixed network, MDMS, data analysis

- Landis+Gyr (Ecologic Analytics used for both electric and water data)—meters, communications, software, network management

- Oracle—customer care and billing, CRM, network management, MDMS, work and asset management

- Schneider Electric /Telvent—data analytics, leakage management, pressure management

- Sensus—AMR, AMI, meter reading and utility software, remote monitoring

Differences

1. The lack of federal directives. AMI in the electric sector was given a boost by Congress with the passage of the Energy Policy Act of 2005 (EPAct). EPAct amended the Public Utility Regulatory Policies Act (PURPA), and state PUCs and unregulated utilities were directed to take a fresh look at a number of issues, including a wide variety of time-based rate structures, and alternative rate forms, and net metering. The 2005 revisions to PURPA also require PUCs and unregulated utilities to consider whether it is appropriate to create an AMI. If it was deemed appropriate, the PUCs may also set an advanced metering standard for utilities.

Appropriateness was defined to mean whether the costs and the benefits to both the customer and the utility balance each other out.

The EPAct was essential to driving the electric smart grid in the U.S. A similar approach may be needed to drive AMI deployment in the water sector. No comparable federal directive has been created to date for the water industry. Without such a federal directive, water utilities have had little incentive to pursue AMI and, in fact, concerns about return on investment have left many water utilities in a state of “analysis paralysis.”

2. The lack of funding. Lack of funding for water utilities, many of which are public entities facing budget constraints, is a huge barrier for AMI deployment in the water sector. In fact,

the biggest concern among water utilities, and the primary impediment to AMI deployment, is insufficient funding for their capital infrastructure projects. It will take an estimated $1.7 trillion to repair and expand the US potable water infrastructure in the next 40 years, according to the American Water Works Association. Because of the constraints of insufficient public and private financing for infrastructure improvements, utilities have been forced to seek creative sources of savings to fund capital expenditures. In other words, because it’s too cost prohibitive to completely overhaul water pipes, pumps and reservoirs that are often 50 to 100 years old, more utilities are investing in smart meters as a way of gaining more intelligence about what they have. Water utilities, at least at this point, have not had the benefit of federal stimulus funding to support AMI/smart network deployment.

The ARRA stimulus funding of 2009 provided about ARRA stimulus program provided $7-$10 billion to the electric industry. It is true that the ARRA federal funding of 2009 included some limited funding for water initiatives, but as noted above, cost of repairing and expanding the water infrastructure in the United States alone will cost more than $1 trillion in the next 25 years. With no additional federal government incentives to support the development of innovative water technology solutions, the growth the water smart grid and AMI deployment for water utilities may continue to track far behind electric AMI deployment. In order to support the advancement of water AMI, taxes breaks or other incentives for utilities/municipalities, technology providers and consumers will likely be necessary.

3. The lack of standards. At this time, the water industry lacks a standard communications protocol similar to the electric industry’s use of MultiSpeak, which would create challenges as multiple applications would be added and expected to communicate with the AMI communications platform. Further, NIST has not created interoperability standards and protocols for advanced water technologies as it has for the electric industry. An exception to the argument that there is a lack of standards for the water industry is the Zigbee protocol, which as previously noted is thought by many to be an obvious platform from which to begin the integration of interoperable devices on a standard communication platform.

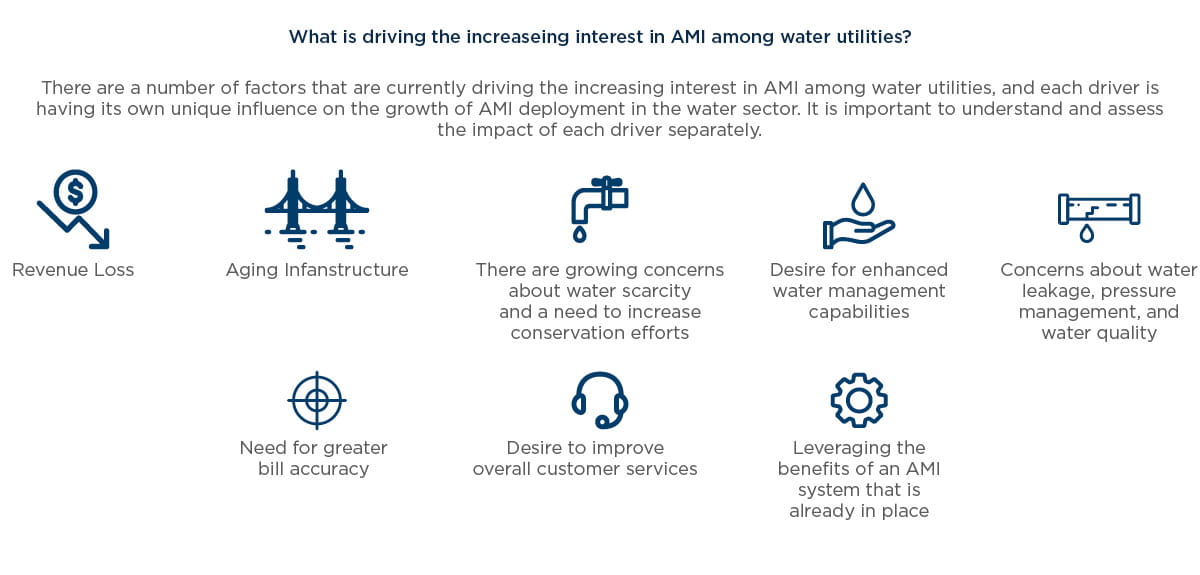

Chapter 3: How can water utilities create a strategic AMI business case?

If there is one issue that will delay the deployment of AMI within the water sector, it is the fact that many utilities still doubt that a strong business case for the “water smart grid” can be made.

While the drivers for AMI in the water sector will continue, many water utility decision-makers may continue to be hesitant to pursue AMI due to concerns about the high upfront costs that are associated with replacing their existing meter- reading system. In the absence of regulatory directives, broad political support, or federal/state funding incentives, many water utilities have little inclination to pursue AMI.

Despite the fact that independent studies have repeatedly indicated that AMI can bring significant savings to water utilities in capital expenditures, O&M, labor and vehicle efficiency, and quality monitoring, a common conclusion is that the return on investment for water AMI is just too difficult to quantify. This conclusion is based on beliefs that 1) benefits are not significant enough to justify the investment; 2) the cost of smart waters meters is still too high; and 3) the cost of the AMI network, which is necessary to truly achieve the benefits of the water smart grid, is too high.

While there are some commonalities associated with building the business case for water AMI, utilities will face challenges that are associated with their unique and current situation. For instance, some water utilities have not taken any steps toward upgrading their infrastructure and continue to rely on manual meter reading; some have AMR technology in place which enables drive-by meter reading and are stopping there; and others have AMR in place but are looking to upgrade to AMI, which would enable the full suite of two-way communications, data analysis, and consumption programs.

What we see today across the water industry is a fragmented marketplace, with four long-term meter reading alternatives in place for water utilities:

- Maintain existing system (manual meter reading)

- All AMR (drive-by meter reading)

- Hybrid system (AMR plus some AMI)

- All AMI

The vast majority of water customers today are being served via AMR with walk-by/drive-by technologies. These AMR scenarios are limited to one-way communications (i.e., a utility being able to “pull” information from a meter but not being able to “push” information to customers) and produce one output: a customer bill. AMI is a much broader application that enables in-depth data analysis and support conservation initiatives, which can include services and uses that water utilities may not be traditionally used to, including but not limited to: remotely identifying location and extent of water main breaks; remotely controlling water loss during breaks; remotely restoring service after an outage; monitoring compliance with water restrictions & conservation programs; and increasing theft detection.

The price difference between AMI technology and traditional, drive-by AMR technology has decreased significantly, but there is still a wide enough gap to create a barrier for some water utilities. The challenge is that the vast majority of water utilities have taken the step toward AMR deployment, which creates a barrier toward creating a business case for AMI. In other words, those utilities that have AMR systems in place may find it more difficult to justify a move to AMI because inherent benefits such as meter reading efficiency have already been achieved from the AMR deployment. The business case to upgrade to a two-way AMI fixed network simply for monthly billing is hard to justify. In that case, utilities with AMR that want to upgrade to AMI will likely have to explore enhanced operational efficiencies to justify an AMI investment. Water utilities may find that the real value of an AMI system will be the reduction in operational costs on a monthly basis, and on that basis the deployment of water network management solutions may actually outpace the deployment of smart meters themselves.

In building the business case for AMI, water utilities would be wise to consider the following system improvements and ensure they have been sufficiently vetted to provide a reliable estimate for the associate benefit:

- Fewer O&M related truck rolls

- Reduced maintenance costs on utility trucks as they aren’t used as frequently

- Reduced waste of purchased and/or produced water

- Reduced leakage detection costs

- Fewer pipe bursts

- Backflow detection

- Remote controlled service lines / shut-off valves

- Lower energy costs due to adjustment in water pressure settings

- Faster theft or other loss detection Lower risk to public safety from flooded intersections or lack of service to hydrants

Of course, water utilities will also need to include costs in their business case. While the smart metering costs are straightforward, there are less obvious costs that will to be balanced against the anticipated benefits. Many of these costs are similar to ones electric utilities face when implementing AMI, including:

- Modifying or replacing the existing CIS

- Expanding or obtaining new software to view and analyze the influx of data that will now be obtained from smart meters

- Additional hardware to process and store data

- Additional messaging software to handle increased communications between AMI applications.

One way that water utilities can explore the both the costs and benefits of AMI is through the use of pilot programs. Similar to the electric utility industry, engaging technology providers in a concentrated effort across a percentage of their total customer base can help water utilities to establish benefits, gather cost data, and evaluate the value of full deployment, which can then be rolled into the broader business case.

Chapter 4: Which water utilities have pursued AMI thus far, and what are the benefits that have been achieved?

City of Albuquerque, New Mexico: The Albuquerque Bernalillo County Water Utility Authority (Water Authority) which, working with Utility Partners of America (UPA), has been upgrading homes and businesses to a smart water management infrastructure. This has been a particularly important initiative in New Mexico. The state of New Mexico has the lowest water-to-land ratio of all 50 states, and water conservation is of the utmost importance year-round. The Water Authority, which covers approximately 350 square miles and serves a population of 670,000, manages about 200,000 residential water meter connections and 850 commercial customers in the metro area. Reports indicate that significant improvements have been achieved in the following areas: better leak detection, improved field response, reallocation of crew resources, and enhanced fine collection.

Cleveland water: One of the largest water providers in the U.S., Cleveland Water recently received the 15 millionth water communication module from Itron. Cleveland Water is over halfway through its deployment of Itron’s smart meter solution toward the goal of outfitting all 425,000 water communications modules with the new technology. The smart metering solution has enabled Cleveland Water to provide customers with increased access to monthly bills based on actual consumption rather than estimates, and have eliminated the need for utility workers to manually obtain meter readings.

City of Detroit, Michigan: The city of Detroit jumped from manual reading to AMI, but skipped AMR along the way. The decision to jump to AMI was based on the realization of many more sophisticated technologies and customer offerings that could be achieved through AMI but not with the drive-by approach that would be limited by AMR.

City of Dubuque, Iowa: Began with an objective to create a new baseline for water consumption, educate residents about water conservation, and reduce overall usage. A pilot program was created to test the hypothesis that customers who are provided more information, analysis and insights around their water usage—along with the enabling technology to support consumption changes—would be able to conserve water more efficiently than other residents who were not provided such information. The customers in the pilot conserved an estimated total of 89,090 gallons of water over a nine-week period with an average savings of 6.6 percent per household. The results of this pilot have justified the city of Dubuque’s decision to expand the pilot and move forward with consideration of full AMI deployment for its water customers.

City of Madison, WI: The city of Madison had relied on three meter readers up until 2011. Now they are making an upgrade installing more than 66,000 Itron datalogging communication modules and a fixed-network collection system. Like the city of Detroit, the city of Madison considered upgrading to an AMR system but determined that it should invest in the more advanced AMI fixed- network solution, which will enable it to move from a six-month billing cycle to a more cost- effective one-month cycle.

Memphis Light, Gas and Water (MLGW): In 2013, MLGW selected the EnergyAxis Advanced Metering Infrastructure and EIServer Meter Data Management systems from Elster Solutions for the first phase of their smart meter deployment. The first phase encompasses approximately 60,000 electric, gas and water endpoints and is expected to be completed by the end of 2014. MLGW is the largest three-service public utility in the United States. They serve electric, gas and water customers with more than one million utility service points.

City of New York, NY: The New York Department of Environmental Protection selected and formally contracted with ESCO’s Aclara RF Systems to provide its city-wide AMI solution for the city’s entire water service territory. The STAR network system is operating across the city’s five boroughs, and thus includes approximately 875,000 metered endpoints serving nearly eight million customers. The city is using the STAR meter modules to collect interval data for current billing needs and to support other programs that are designed to allow the city and its customers to better management water consumption, identify leaks and equipment problems, and effectively control other related operating costs.