Aug. 14, 2018 | InBrief

Measuring RPA success: Evaluating the impact of automation beyond ROI

Measuring RPA success: Evaluating the impact of automation beyond ROI

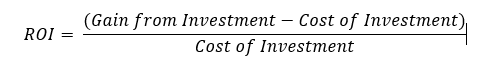

Perhaps it is the implied simplicity, or its general acceptance in the industry, but ROI (return on investment) is the ubiquitous approach to evaluating success of an investment. To establish a consistent understanding of ROI, let’s define it as follows:

As for automation, the prevailing measure of “Gain from Investment” is cost reduction. While FTE arbitrage is seemingly the easiest gain to derive, and gaining the most traction in headlines about RPA, our point of view is that there are more meaningful interpretation of ROI when it comes to automation and RPA.

Establish a Baseline

When evaluating automation, think of the robotic process as a digital employee. How do we evaluate our human employees? Baseline metrics and comparison to others. We’ve all undoubtedly undergone a performance review at least once during our career. Common employee evaluation techniques include speed, accuracy, and monetary contribution to the company.

A Holistic View of RPA Benefits

Intrinsically, there are two categories of RPA benefits at a company: primary and secondary. Primary benefits include those that are directly related to the implementation of RPA. Examples include improved efficiency, increased accuracy, and headcount reduction. Secondary benefits are those benefits made possible indirectly by RPA implementation. These benefits, while harder to quantify, can lead to tremendous gains to the company, both in top line revenue growth and bottom line cost savings.

Primary Benefits

- Increased Efficiency: Perhaps the most frequently referenced (and most easily grasped) benefit of automation, increased efficiency is realized through higher workload capacity and increased speed, both resulting in increased throughput rate. In a bank, this might mean that a loan closing and booking team can address more loans each day, improving the customer experience and reducing the need to hire as volume increases.

- Increased Accuracy: Any process that requires manual data entry or data transformation introduces the opportunity for error. While humans experience fatigue and distraction, an automated process can run 24-7-365 and utilizes computer memory and programmable rules to ensure consistency and accuracy. In a bank, data entry and transcription errors can result in increased re-work, decisioning based on inaccurate data, and negative financial impacts and fines.

- FTE Reduction: Headcount reduction may be the most difficult benefit to discuss, but is also widely misunderstood. Workload redistribution and reduced future hiring needs are more realistic options. An organization that embraces automation can address increased capacity related to growth without adding headcount.

Secondary Benefits

- Asset Redeployment: Workload Redistributions allow an organization to move headcount from one area to another to address organizational needs. If automation produces increased capacity and the workload doesn’t match the excess labor supply can be reallocated to new areas. . For example, consider how a bank would redistribute work in the front, middle, and back office if they suddenly had more “free” time to work with. Keep in mind that resources and capital refer not only to human capital, but also technology resources like computers and bandwidth.

- Improved Customer Experience: All the primary benefits mentioned above relate to cost savings, but viewed from another angle, these primary benefits enhance the customer experience which can lead to increased revenues as well For example, as employees’ capacity increases (through speed, efficiency, redistributed workload), more time can be allocated to customer-facing functions and activities (like improved customer service, increased sales efforts, customer retention activities). There are also benefits from increased speed-to-market through faster loan decisioning and approval, or improved competitive positioning through lower costs (reflected in reduced lending costs and interest rate margins) due to resource needs and efficiency improvements.

- Faster Scalability: In today’s banking environment, top management should consider the question, “how do you make your bank immediately scalable without increasing headcount?” As financial institutions growth through acquisition and organically (new locations or branches), this question becomes top-of-mind. While physical hiring requires times, an automated workforce is distributed as a software resource. With automation you gain a pre-trained digital workforce. Scalability is instantaneous as jobs can be added by purchasing software licenses and applying them to an existing automation protocol. Literally load an automation workflow to a robot and press “Go”..

- Increased Job Satisfaction: Job satisfaction surveys regularly reveal that the most engaged employees feel they are doing meaningful work that can be easily mapped to company success metrics. What can banks do to increase employee engagement and job satisfaction? Start by taking automatable functions away and allow these employees to be more customer-centric. Banks should consider who will do this work in the future if they are not automated.

While cost reduction is often touted as the most significant gain for banks implementing RPA, it's important to look beyond ROI and dig deeper into RPA's capabilities to truly grasp the potential benefits that come with implementing this tool.

.jpg?cx=0.5&cy=0.5&cw=910&ch=947&hash=A4606672548264CB35551B59CE1C1AC2)