Data Science for Revenue Forecasting and Value Creation in Private Equity

In volatile markets, projecting a company’s ability to deliver on the investment thesis becomes ever more complicated. Revenue and growth potential are key – but they can be hard to forecast with confidence. That’s where we come in. We combine large-scale engineering, statistics, and machine learning to analyze customers, products, services, and channels.

That allows us to predict:

- Customer behavior

- Growth from new customers

- Repeat rate from individual customers

- Spending level by customer

- Lifetime value by customer segment

Results you can expect

- Uncover millions of dollars in cross-selling or growth opportunities

- Increase customer profitability–and determine which customers to exit

- Develop more accurate valuations and revenue models

- Increase multiples at exit

Build value rapidly and confidently with Intellio®

West Monroe’s Data Science for Private Equity offering is powered by our Intellio® suite of assets. We help you see value where others cannot. Intellio® Predict evaluates targets and portfolio companies—analyzing their revenue streams and forecasting potential revenue growth. The result? Concrete models for expected growth and gross margin. We call this data-powered investing. Intellio® Predict was purpose-built for private equity value creation and includes industry-specific models for software, financial services, retail and manufacturing.

Learn more about West Monroe’s Intellio® suite of assets that deliver results, faster.

What We Offer

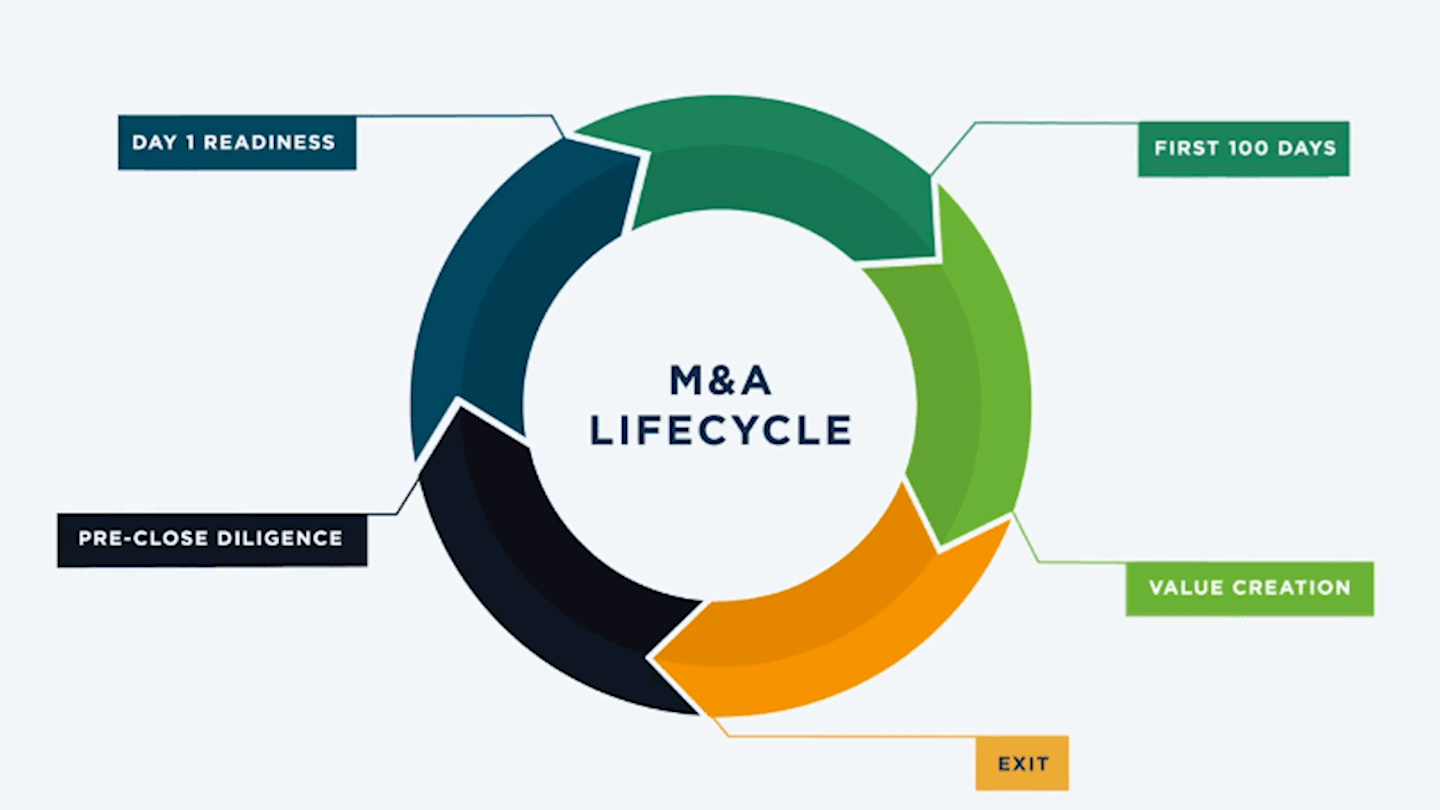

We use data science and advanced analytics to transform raw customer data into actionable insight and business value across the private equity transaction lifecycle—from due diligence to post-close value creation to successful exit.

Understand your target’s revenue growth potential

We put data science capabilities to work during due diligence to de-risk investments, instilling confidence around the ability to achieve short-term numbers. We also validate maturity and growth potential to inform accurate valuations and negotiations.

Boost growth and value potential

Following investment, we can quantify upside between best and worst customers, SKUs, and channel segments. We also benchmark white space opportunities using our rich proprietary knowledge base – derived from analyzing more than 143 billion data points.

This insight guides the right operational improvements for maximizing value:

- Remedy areas of revenue leakage, such as unprofitable customers

- Pursue areas of greatest revenue growth potential, such as cross-selling or new revenue streams

- Reverse-engineer customer segments to focus on the best customers and products to maximize growth

Prepare for (and negotiate) a successful exit

As you prime your portfolio company for sale, we help you identify the optimal time and plan for exit, as well as untapped upside that can attract prospective buyers and maximize value creation.

$160B

transaction level revenue data analyzed

25

years of data science research

$33B

in closed private equity investments across software, financial services, consumer and industrial products, retail, and other sectors

Using Intellio® to create value across the M&A lifecycle

Interested in easier, better M&A? Private equity firms that buy, build, and sell platforms can use West Monroe’s Intellio® suite to drive more value.