July 2020 | Report

2020 Energy & Utilities Outlook: Mid-Year Update

West Monroe has identified six key issues utilities will need to confront as they enter the new decade

Mid-year update

When we published the 2020 Energy & Utilities Outlook in January, we couldn’t have predicted the impact coronavirus would inflict on our country and, in particular, the utility industry. Since then, our Energy & Utilities professionals have helped utility executives swiftly adapt their organizations to this new reality. The major imperatives of the industry—evolving the business model, accommodating and integrating customer preferences, and running an efficient operation—are all still extremely relevant.

1. Capitalize on the Rise of Distributed Energy Resources (DERS)

As customers increasingly embrace DERs, utilities and regulators are rethinking the role of the distribution utility.

2. Combat the Growing Cyber Threat

With cybersecurity threats on the rise, utilities must have a robust action plan in place to identify, isolate, and mitigate threats while limiting the operational impact to the business.

3. Conquer the Grid Modernization Challenge

Driven by public expectations and competitive pressures, utilities are exploring new business models, sources of revenue, and rate paradigms.

4. Enable Transportation Electrification

Electric passenger vehicles across the U.S. are forecast to reach 11% penetration by 2025 and 40% by 2040.

5. Deliver a Better Customer Experience

Utilities focused on modernizing technology are empowering employees to deliver a better customer experience.

6. Compete for Talent

To succeed in a competitive environment, utilities must create a culture that attracts and retains top talent.

Introduction

The start of the new decade marks a turning point for the utility industry. While change has been constant for utilities in recent years, the pace is accelerating. The challenge to deliver safe, affordable, and reliable power while meeting public policy and regulatory goals for adopting new and innovative technologies is daunting. There is a growing urgency to embrace distributed energy resources (DERs), transportation electrification (TE), and grid modernization. Questions remain, however, about the role of utilities, customers, and third parties in meeting these challenges.

Utilities must also meet evolving customer expectations, update aging infrastructure, react to public policy and regulatory directives, and embrace disruptive technologies, all while keeping electricity prices affordable. The pressure on utilities to phase out antiquated field-area networks, including those that still rely on analog communications alone, can cost billions of dollars, with major implications for future operations.

This vortex of pressure and change is exciting and intense for utility officials and regulators. It’s decision time, and the choices made now will determine which utilities capitalize on the new opportunities and which become slow- growth commodity businesses. To excel in this environment, utilities require quality talent with new skills. That means winning the war for talent. Meanwhile, cyber threats and grid vulnerability are being recognized as very real threats requiring significant investment to protect our infrastructure from a national security concern.

To help the industry identify challenges and seize opportunities, we are sharing our observations and point of view in this 2020 Energy & Utilities Industry Outlook.

Chapter 1: Capitalize on the rise of distributed energy resources

Mid-year update

Due to the economic slowdown and restrictions in fieldwork and supply chain disruptions, solar and storage are seeing a contraction in 2020. There is a 1.2-gigawatt forecast decrease in residential storage in the U.S. and a 20% forecast reduction in the global energy storage market. We expect an overall reduction in commercial sales of DERs as consumers have less disposable income due to layoffs and furloughs, and DER investments take a backseat to business continuity.

However, some utilities are positioning themselves to take a more active role in DER ownership and installation in certain locations due to changing residential and commercial load profiles during and even beyond COVID. Specifically, residential demand is up 20-30% on weekdays with a gentler ramp-up in the mornings and a later midday peak. Demand in the commercial and industrial segment, on the other hand, is down by 15-19%. While feeders in residential areas may be less stressed from two-way power flows, particularly from rooftop solar, the overall increase in demand presents a challenge for feeders that were already at capacity. Leading up to the summer season, we suggest utilities work to mitigate outage risk on these feeders. Specifically, as many utilities we work with are doing, utilities should be:

- Analyzing which infrastructure assets (e.g., feeders) are most at-risk

- Conducting studies to compare emergency upgrades to non-wires alternatives (NWA)

- Preparing and executing an implementation plan for infrastructure upgrades and soliciting NWA in support of the at-risk infrastructure where the economic pencil-out.

Several utilities across the country have already set up NWA programs allowing them to gain capabilities in administering these types of programs.

The challenge

The proliferation of DERs across North America continues to accelerate. It’s paramount for utilities to plan for an even greater penetration and concentration of DERs

over the next few years. Utilities and regulators working together can lay the groundwork for utilities, customers, and other stakeholders to capitalize on DERs for a better, cleaner energy future. Alignment of utility and customer- owned DERs to the grid is of utmost importance to ensure reliable operations and maintain consistent capacity and voltage across distribution networks.

Allowing DERs to proliferate without proper utility and regulatory planning can compromise safety and grid reliability. The mix of solar resources, wind, vehicle charging stations, battery storage, and smart thermostats complicates grid operations, but also has the potential to provide greater flexibility for meeting demand. Utilities must prepare for scenarios such as mass electric vehicle (EV) charging during coincidental peak times, insufficient hosting capacity for DER installations, and overgeneration of rooftop solar during times of low demand.

Equally important is the impact of these grid-edge technologies on the utility business model and how they recover costs. Customers can change load demand by consuming their own electric generation and/or selling electricity back to the grid or directly to neighboring customers. As with any transformative business model shift, there will be winners and losers.

Trends

A survey of ours published in early 2019 showed how quickly DERs are connecting to the grid.

Fifteen percent of customers surveyed said they have renewable energy resources powering their homes, up fivefold from a survey conducted in 2015. The penetration is broad as well: 92% of utilities have DERs on their system, up from 80% in 2015. More than 40% of utilities see DERs as an opportunity, up from 31% previously.

The proliferation of DERs is driven in part by declining costs, regulatory directive, public policy, more robust and competitive market of DER providers, and in some cases legislation. Solar costs have dropped by 70% since 2010, fueling annual generation capacity growth of more than 50% on average, according to figures cited by the Solar Energy Industries Association (SEIA). In 2018, nearly 60% of installed solar capacity was utility-scale.

Numerous state and local governments are committing to clean energy. Four states, Washington, D.C., Puerto Rico, and more than 100 U.S. cities have committed to 100% carbon-free or renewable energy goals. Six cities have already hit their targets, generating all of the energy used community-wide from clean, non-polluting and renewable sources, according to the Sierra Club. Additionally, EV programs are quickly being established across the country with special tariffs and rebates to support adoption.

Several states have also enacted into law requirements and provisions for decarbonizing the economy across all sectors for reducing carbon emissions.

Taking action

As customers increasingly embrace DERs, utilities and regulators are rethinking the role of the distribution utility, transitioning to more of a modern, digital-age services platform than a provider of electric service. Platforms such as Lyft and Airbnb create marketplaces, enabling distributed customers and suppliers to interact with confidence and efficiency on whatever devices they choose. Given that electricity is a fungible product that can be produced by a proliferating number of suppliers, there is fertile ground for enabling a platform-based utility business model.

Customers are already adopting DERs at a rate faster than utilities and regulators are upgrading grid system controls and operations and the regulatory paradigm. In some cases, DERs are sufficiently spread across the grid so that the impacts are not yet noticeable or are focused on just a handful of circuits. This suggests that while visibility of DERs is important, system-wide upgrades may not be needed.

Utilities have a unique opportunity to stay ahead of the curve and engage in DER roadmap strategies with an eye to developing organizational consensus on DER action priorities on a three-, five-, and seven-year horizon.

Many response strategies to prepare for DER can take three to five years to fully design and pilot, and five to seven years to make fully operational. Without full certainty on actual DER penetration levels for solar, EV charging, and batteries, some utilities may be playing catch-up if long term technical and operational readiness plans are not in motion.

Chapter 2: Combat the growing cyber threat

Mid-year update

The pandemic is magnifying cyber threats as a result of more people working remotely using video and teleconferencing capabilities. By one estimate, phishing emails have quadrupled since the crisis began. Given the increased risk of a cyberattack, utilities must respond quickly to adapt. Specifically, utility cyber plans should address threats from mass remote work (at utilities and their vendors), increased remote control of critical assets, and an increased volume of threats.

The cybersecurity playbook should account for this fuller aperture of situations. It must be operationalized throughout the organization via communications, training, and employee accountability. Outside of a robust cybersecurity program, but related, utilities should invest in infrastructure to prevent employees from choosing to use personal devices in a bid to remain productive if performance of company assets or software lags.

The challenge

U.S. CEOs rank cybersecurity threats as their top business concern. There were ample intrusions in the past year that reminded utility officials of the turmoil that can erupt if an employee clicks on a malicious link or treats a password with insufficient caution. Attacks like the one that crippled Baltimore Water’s ability to bill its customers grabbed headlines, but the frequency of cyber assaults tells an even more harrowing story.

A recent survey found that more than half of utilities (56%) report “at least one shutdown or operational data loss per year,” and a quarter say they have been impacted by “mega-attacks with expertise developed by nation- state actors.” Meanwhile, only 42% characterize their cyber readiness as high, and only 31% rate their readiness to respond to a breach as high.

As new technologies, operations, and data platforms expose utilities to new vulnerabilities, cybersecurity becomes a more critical component of grid operations and, thus, modernization.

Cyberattacks often occur without warning, leaving no time to prepare. The impacts of a cyberattack can also be felt across a wider geographical area, making it much more difficult to adequately respond in a timely manner. Scrambling to organize resources and an appropriately skilled and trained response team to troubleshoot such an unexpected disaster is a logistical nightmare.

Trends

The 2019 Worldwide Threat Assessment of the U.S. Intelligence Community report warns that cyberthreats to the grid include the cyber capabilities of rival nations, and nonstate actors as a potential risk to national security. The report explicitly calls out the threat these actors pose “to disrupt our critical infrastructure.”

Utilities are increasing employee awareness across their organization of grid vulnerabilities and appropriate precautions and response by providing training and engaging employees more thoroughly on such threats. However, both external and internal factors complicate these efforts. New security initiatives are frequently deprioritized due to insufficient funds, while gaps and redundancies between operating companies often cause inefficiencies. These include a lack of centralized reporting, disparities between IT and OT capabilities, an overlap of investment on tools that perform the same function, and a lack of tool licensing that leaves some groups with little ability to efficiently comply with policy.

Hiring and retaining high-quality cybersecurity talent remains a major challenge. Professionals with the appropriate expertise are in demand across the industry and, as a result, are scarce. Most utilities worldwide report insufficient staffing to meet their OT cybersecurity objectives. (See also “Competing for Talent,” below.)

Organizations also tend to be narrowly focused on data protection at the expense of business resiliency and continuity. Given the proliferation of threats and vulnerabilities, insufficient cyber protection and resiliency can be costly, leading to business disruption, lost revenue, operational shutdowns, and reputational damage.

Taking action

As identified in our 2019 Energy & Utilities Industry Outlook, combating cyber threats requires a culture of security awareness and sensitivity throughout the utility. The best cybersecurity programs are founded on the understanding that it’s not a matter of deploying a few engineers to shore up weaknesses, but more a question of getting everyone in the organization to work together to address threats.

Well-prepared utilities promote resiliency; they right-size and optimize security investments to address business objectives on an evolving threat environment. When utilities invest in infrastructure to enhance resiliency and integrate tools to protect the grid, they also build in rapid response and recovery plans as a core part of the infrastructure project. A utility’s cybersecurity strategy must evolve to ensure cyber resilience while enabling business strategies, supporting strategic cybersecurity transformation, and addressing the evolution of cybersecurity threats and regulatory challenges.

Leading utilities reinforce resiliency by operating critical cybersecurity systems with clearly defined processes to respond when the inevitable attacks occur.

A robust response plan involves several important steps. First, a utility needs to map its network architecture to clearly identify dependencies between and among networks, zero-in on potential intrusion paths, and determine the best disconnection points to mitigate a breach. Next, utilities must take the critical step of defining the data and functionality needed to continue operating after a breach. After that, utilities focus in developing mitigation plans and procedures. This entails creating processes to limit the impact to operations, remain in regulatory compliance, and continue monitoring operations. Cybersecurity threats are only expected to increase in the future, which requires that utilities have a robust action plan in place to identify, isolate, and mitigate while limiting the operational impact to the business.

Chapter 3: Conquer the grid modernization challenge

Mid-year update

Grid modernization actions (defined as legislative and regulatory actions addressing grid modernization) increased to their highest level in any quarter since tracking began by the North Carolina Clean Energy Technology Center. Energy storage is getting more widespread attention from lawmakers and regulators requesting studies and establishing resource targets. Nevada and Virginia adopted goals for 1,000 MW by 2030 and 3,100 MW by 2035, respectively. Overall, spend on grid modernization in 2020 is expected to be $141 billion, an increase of nearly 17% over the 2019 figure.

PBR is picking up steam across more regulatory jurisdictions. Hawaii completed phase one of a regulatory proceeding wherein goals and outcomes were established. Michigan, Nevada, Colorado, and Washington, D.C., are investigating implementing PBR. Minnesota, Maryland, and Rhode Island all have committed to establishing and monitoring performance-based metrics. Oregon and Arizona regulators have stated they will consider PBR.

Even in states that are moving incrementally toward PBR and in those that have decoupled utility sales from revenues, COVID-19 will muddy the waters related to revenue recovery as the rates in these states still assume a base level of sales based on the utility’s test year. Several factors will determine whether a utility is financially impacted or not:

- Magnitude of reduced sales

- Magnitude of arrears

- Lower fuel and purchased power costs

- Cash balances on hand

- Ability to recover lost revenue approved by regulators

To the extent that these factors merge to negatively impact utility revenue and weaken balance sheets (and especially in areas hit with summer storms), utilities might well be forced to trim O&M expenditure to achieve the return on equity garneted by regulators.

The challenge

Grid modernization is now an imperative, driven by public expectations, competitive pressures, and the need to update and replace aging infrastructure. On the regulatory front, states across the country are exploring new business models, sources of revenue, and rate paradigms that align financial incentives with climate policy goals, customer interests, and the changing energy market landscape.

The drive to modernize poses novel challenges. Despite the momentum, regulators with an eye on energy affordability,—particularly in Massachusetts, Virginia, New Mexico, and North Carolina—are increasingly scrutinizing the costs and business cases in support of a comprehensive grid modernization strategy.

Trends

Several states, including New York, California, and Hawaii, are implementing performance-based rate mechanisms to reward utility programs and efforts that eliminate or postpone traditional utility infrastructure investments, support distributed resources, and improve the customer experience. Still, regulatory uncertainty is high, and utilities are anxious about how changes in investment strategies and revenue recovery will impact their ability to cover costs while still meeting obligations to serve and be the electricity provider of last resort.

While 31% of utilities want to operate predominantly under performance-based regulation 10 years from now (compared to 4% doing so today), only 14% expect this to happen.

Utilities are rising to the challenge. Over the next five years, electric, natural gas, and water utilities are projected to spend upward of $500 billion on infrastructure improvements in the U.S. These investments include new and upgraded transmission and distribution (T&D) infrastructure, and upgraded systems for both IT (CIS, GIS and others) and OT (ADMS, OMS). This investment also includes support for the proliferation of DERs and advanced metering infrastructure (AMI).

In some cases, utilities face regulatory mandates for specific innovations. For instance, electric utilities in New York, California, and three New England states must consider non-wire alternatives (NWA) such as distributed generation, energy storage, and demand response before investing in new T&D infrastructure. In other cases, utilities are encouraged to invest in NWA grid- edge technologies. According to a recent report from a consortium of energy nonprofits, there are roughly 100 non-wire alternative projects in planning stages across the U.S. Spending on alternatives worldwide is expected to increase tenfold in the next decade.

As for field-area network upgrades, many utilities are weighing the benefits and costs of opting for LTE versus 5G technology. While the latter is more expensive, in many cases the costs can be justified by the improved capabilities in connecting and controlling machines, objects, and devices over a broad geographic area.

Taking action

Utilities need a robust planning process to satisfy regulators and make prudent infrastructure investment. Useful suggestions for this include:

- Knowing peak demand, shoulder, and off-peak requirements and their respective variability

- Knowing load profiles of DERs interconnected to the grid

- Knowing the unique features of load areas and demand growth and supply options available

The resulting problem statement from knowing these parameters provides the basis for identifying investment needs and solution sets to meet the demand and supply imbalance.

To address public and regulatory concerns, it is important to engage stakeholders—including potential critics—to build a broad consensus around need and available options before an investment strategy or project is agreed upon. The resulting public conversations can be messy, particularly with renewable energy or other initiatives of importance to public interest groups and government agencies. Before engaging the wider community, utilities should reach some internal consensus on the solution set of potential options. This should consider an assessment of the economic and policy goals of the utility and regulators, and the needs of the engineers and grid operators, who typically are more risk-averse in favor of reliability and resiliency.

Finally, utilities need to ensure that stakeholders share the same vision of success. The answers to most questions about cost savings and efficiency improvements are likely to be inexact, yet utilities can minimize conflict and criticism by working both internally and externally to establish clear criteria, enabling them to gauge success, and adapt when plans start to go awry.

Chapter 4: Enable transportation electrification

Mid-year update

Global sales of EVs were down 6% in Q1 2020 compared to the same quarter in the previous year and are expected to drop 43% by yearend as a result of COVID, less disposable income, and low gasoline prices which impacts the economics of EV ownership.

While infrastructure buildout necessary for EVs might suffer a temporary setback through yearend 2020, the decrease in the rate of penetration presents a unique opportunity for utilities. They can use the time to improve and refine EV demand forecasting and construct the necessary charging infrastructure to support EVs as sales recover.

The challenge

The EV market is poised for aggressive growth in the next decade. We believe that transportation electrification and the harnessing of flexible EV charging loads pose a transformative opportunity for utilities.

But the technical and logistical challenges are significant. EV infrastructure development is projected to achieve load growth as high as 15% by 2030 from today’s level, compared with flat to negative growth over the past 10 years. Where EV infrastructure gets deployed and when the new EV load occurs can have a direct impact on local infrastructure, potentially requiring costly upgrades on both the customer and utility side of the meter. To support and benefit from the promise of TE, utilities must establish systems to accommodate and shape EV load growth without compromising grid reliability.

Featured Content

Transportation Electrification: A Guide to Planning, Deployment, and Operations for Utilities

Read MoreTrends

September 2019 marked the first time an existing commercial gasoline station completely converted itself to an EV charging station. The Tacoma Park, Md., station’s 200-kilowatt chargers bring EV batteries to 80% capacity in 15 to 30 minutes for a cost of about $5. Driving the station’s shift to electric were a $786,000 grant from the Maryland Energy Administration and increased demand from the state’s 21,000 registered EVs. Equally significant was the announcement of iconic new EV models for 2020, including the electric Ford Mustang as well as the first electric pickup trucks from Tesla, Rivian, and Ford.

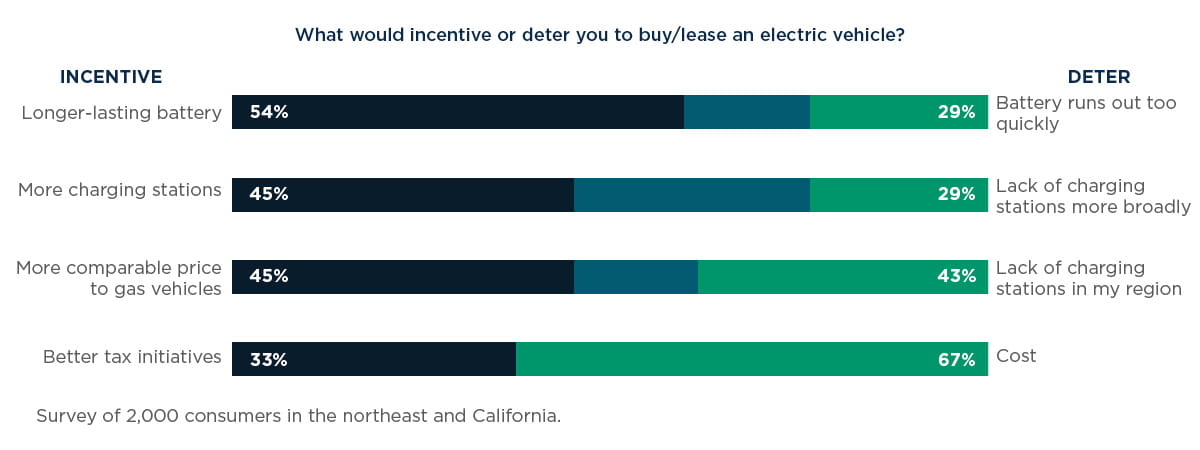

With a growing number of EV models on the market, prices are becoming increasingly competitive, and manufacturers making significant improvements in driving range. Additional stations will be needed countrywide to satisfy this increased demand. Electric passenger vehicles across the U.S. are forecast to reach 11% penetration by 2025 and 40% by 2040. Already in California and the Northeast, 16% of respondents to a recent survey of ours said they currently drive an EV; 59% said they would like their next vehicle to be electric, although 43% cited “a lack of charging stations in my region” as a deterrent to EV adoption.

Featured Content

Who is Leading The Charge on Electric Vehicles? A Survey of California & The Northeast

Read MoreBy 2030, the Edison Electric Institute predicts that there will be nearly 10 million charging stations across the country, including 7.5 million at residences and 1.2 million at workplaces. Capital spending on charging infrastructure is forecasted to reach $45 billion for residential, commercial, industrial, and mass transit segments—a significant portion of which will cover upgrading electric services to the customer site.

Taking action

As EV penetration rises, utilities can capitalize on new and growing sources of revenue and achieve that new load without T&D upgrades. For some utilities, the business case for supporting transportation electrification (TE) is clear and has been translated into regulatory filings and policy. Proponents of utility support of TE, for instance, often point out that the flexibility of EV loads can yield greater grid utilization, which has the net effect to

lower cost to all ratepayers through reduced annual rate increases. Other value streams include reducing emissions, reducing health care costs associated with poor air quality, and transportation fuel costs while creating jobs and boosting local economies.

Utilities need to plan for the burgeoning demand and assess impacts before approving new charging projects.

A workplace with 30 chargers could see a peak EV load above 1 MW, and a transit bus depot with 10 e-buses charging at 250 kW could add 2.5 MW of new load to the local feeder, with 3 to 6 MWh of additional consumption on the local network per day. Without a thorough TE strategy and a well-conceived plan, TE growth could compromise grid reliability.

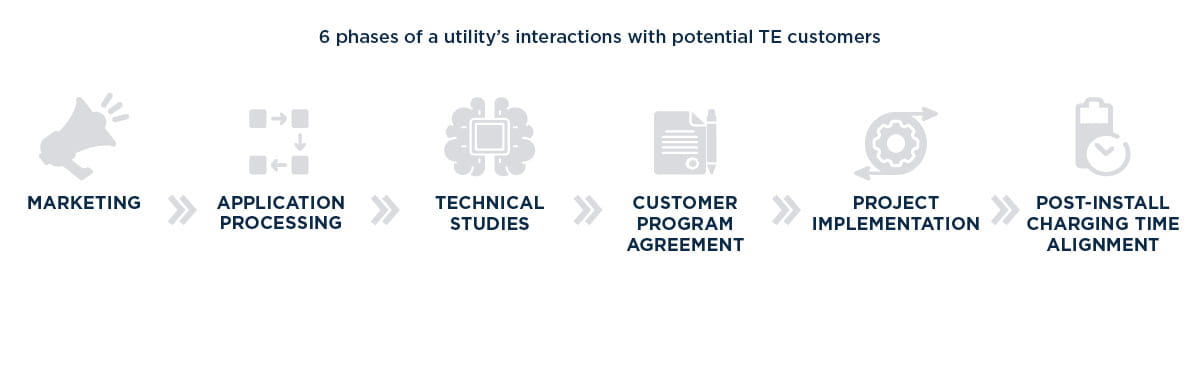

A vital element of the utility’s TE plan is integration, bringing together separate departmental workflows into a cohesive program. There are as many as six phases to a utility’s interactions with potential TE customers, including marketing, application processing, technical studies, customer program agreement, project implementation, and post-install charging time alignment.

Utilities can optimize process workflow by clearly defining key status points, team roles, and handoffs between stages, as well as by identifying bottlenecks between stages.

Education also plays a key role. With tools that provide fuel cost savings and total cost of ownership, utilities can better articulate the range of economic benefits to their clients.

TE programs should also align with the utility’s core objectives and existing grid modernization objectives. An optimized program can help the utility acquire valuable new flexible load, grow service offerings to customers, lower customer costs, and satisfy demand for sustainable energy options.

Chapter 5: Deliver a better customer experience

Mid-year update

As a result of COVID-19, many (though not all) utilities implemented a moratorium on utility disconnections – some at the direction of regulators and some at the behest of utility management. An attempt to pass a national moratorium on shutoffs did not pass in the U.S. Senate. By July 1, two-thirds of all states will have let their electric disconnect moratoria expire and 88% will by August. Many limited income customers are suffering from unprecedented financial hardship, and the timeline for a recovery in the economy is unclear. Collections should become an area of focus for utilities.

While COVID had a significant impact on customers and employees, it also accelerated many of the trends we highlighted in the beginning of the year, including utilities ability to understand and meet customers’ needs through investment in data and technology. Customers’ expectations and behaviors have shifted due to the pandemic, including the need for even more self-service and remote options for communications and outreach, but also a need for human connection. By investing in ways to meet these needs, utilities can create tangible value for the organization, like efficiency and productivity gains using technology to serve customers and freeing up employees to focus on higher-value tasks. Utilities must first spend time redefining customer segments with clear understanding of their goals, needs, and behaviors. Next, leaders will need to invest resources to collect and manage customer data, including key demographic and experiential data, and group them into different categories.

Finally, utilities should spend time tailoring different intervention strategies for the different groups of customers—ensuring contact center employees are aware, trained, and use correct processes. Having tailored approaches will both increase the potential for the utility to be paid, while also allowing additional opportunities to engage the customer, ultimately driving customer satisfaction—which will likely be important to regulators in what may be a contentious period. To that end, utilities should stay the course with their CRM-enabled customer experience transformations, which build deeper relationships with customers and, by proxy, regulators.

The challenge

Consumer expectations are rapidly changing. This is as true for utilities as it is in virtually any other sector, and the trend will continue to intensify. A streamlined digital customer experience that delivers usage data, outage notifications, self-service, bill payment, and other services are now table stakes for all customers. Utilities proactively moving to meet the future needs of their customers are focused on delivering more transparency and customer choice via expanded availability of advanced rates and programs, improved interconnection of consumers’ homes with solar or wind, providing data services to support C&I customers, and streamlined integration of EVs, including for residential customers and commercial and government fleets.

Utilities have traditionally enjoyed a competitive advantage via a stable, unchallenged customer base. However, new competitive threats from non-utility service providers will continue to increase and threaten these long-standing relationships. Once a relationship is established between a non-utility service providers and customers, other sales and services can be provided to the customer outside of the utility-customer relationship that in a best-case scenario represent a missed opportunity to utilities, and at worst will threaten long-term utility financial viability. In short, the focus on driving an improved customer experience has never been more vital to utilities.

The customer experience expertise developed as a result of an increased focus can be a significant competitive advantage over non-utility energy service providers, particularly as both consumers and C&I customers exercise choice and get involved in the energy value chain in new ways. Utilities have an inherent advantage and several insights into their existing customer base, but it must be leveraged to avoid disruption and revenue erosion.

Utilities are increasingly recognizing that it is not just about responding to customer needs that is changing the face of utility customer experience—which would demand dramatically improved customer service.

In many states, regulators are also driving better customer experience performance by evaluating proposed utility investments and rate-making, not only on their technical and financial merit but also on how the utility will improve the customer expertise as measured by data and external sources such as JD Power scores and other measures of engagement.

This emphasis on improved customer experience can be a significant challenge for an industry with a cost-recovery paradigm rather than consumer heritage. Companies that confront the challenge proactively can expect to reap not only competitive advantages but also productivity improvements, improved employee engagement, and other cost savings opportunities.

Trends

Externally, customer satisfaction with utilities is on the decline, according to the American Customer Satisfaction Index (ACSI).

ACSI’s index for utilities overall fell 2.7 percentage points to 73.2 in 2019. The score for natural gas utilities was considerably higher (78) than electricity (72), which rivaled the lowest score over the last 15 years. Cooperative utilities have the highest customer satisfaction (75) followed by investor-owned and municipal utilities, which tied at 73.

Respondents blamed higher prices, extreme weather and resulting outages, and an overall decline in electric power reliability as the reasons for their dissatisfaction.

They expressed frustration with a lack of websites and customer channels, billing clarity, employee cooperativeness and service, and assistance with energy-saving ideas.

Internally, many utilities are in the midst of an upgrade cycle for their customer information systems (CIS) that will deliver a modernized communication and information channels and choices that customers have come to expect. This, in turn, has led to two additional trends impacting customer experience: data analytics and cloud platforms.

Featured Content

Customer platforms for utilities: Choosing an 'evolution' over a 'big bang'

Read MoreUtilities focusing on modernizing their technology are beginning to understand the power of cloud computing versus the traditional on-premise license. These cloud platforms include collaboration, customer relationship management (CRM), marketing, field service, and other systems that allow employees to deliver a better experience to customers across segments and market areas. Additionally, as utilities bring analytics into their operations beyond usage trends to better understand their customers’ needs, internal analytics teams charged with providing coherent analysis continue to grow. This creates the ability to offer new energy services built with data to their customers.

Taking action

A growing number of utilities are poised to improve their customer experience performance using digital technology. Recent technological advances such as AMI have allowed utilities to gather data at unprecedented levels. This data can be used to deliver rich information to customers on their energy usage and behaviors and identify ways to improve efficiency. Sharing such information can foster customer appreciation and help forge stronger relationships.

Data can help pinpoint and even anticipate customers’ needs before they become frustrated or lodge complaints to regulators and local government officials. With this information, utilities can more efficiently help customers using automated technologies such as voice assistance services and omnichannel customer support (e.g., chat, text).

Customers increasingly prefer to use technology to help themselves, which is more efficient for both the utility and customers. Customers expect choice and personalization when they interact with companies, and automation is the enabler.

Automation can also go a long way toward streamlining the routine tasks that can inefficiently occupy employees such as reading meters and billing customers. In addition to delivering better service, data and automation initiatives can dramatically improve productivity and reduce costs while also improving overall employee engagement.

The myriad utilities that still run their business on CIS from decades ago can dramatically improve both efficiency and customer experience by adding a customer relationship management (CRM) system as an overlay. The platform-based systems, like Salesforce, Microsoft Dynamics, and Oracle Cloud CRM, are highly flexible and are relatively easy to integrate with existing CIS.

The path to improving the customer experience can best be summarized into four phases:

-

Define the customer journey. Understand the customer journey and touch points and eliminate friction in customer interactions.

-

Get to know the customer. Research customers using existing data, but also use qualitative methods such as focus groups.

-

Identify pain points. Understand how the change in customer expectations has changed their experience because of your technology or processes. Too often, processes remain static, resulting in poor experience that is reflected in JD Power ratings and higher call volumes (and costs) than desired.

-

Develop a long-term plan. This plan should be designed for transforming the customer experience, including the value anticipated and both the costs and people impact. Remember, quick solutions won’t fix a broken customer experience for the long term. To deliver a better experience, you must lay a solid foundation.

Chapter 6: Compete for talent

Mid-year update

The tide has turned in favor of employers given the historic unemployment figures—13.3% in May down from 14.7% in April. As it relates to hiring new talent, utilities have an unprecedented opportunity to fill difficult-to-fill roles. Of course, this recession has unevenly impacted different areas of the economy. Utilities may consider former employees from industries with strong safety cultures—such as airlines, construction, and manufacturing—for field positions and customer-focused industries – such as food, service, and retail—for customer service roles. With utilities becoming more used to remote work, they might also consider hiring workers in distant geographies for especially hard-to-fill positions, such as data scientists. To enable successful hiring and onboarding, attention should be paid to the talent acquisition and HR functions within the utility as they will have an elevated impact in the organization.

The challenge

To meet the challenges described in this outlook—embracing DERs and TE, combatting cyber threats, modernizing the grid, and improving the customer experience—utilities must attract and engage the right talent. The utility of the future cannot be built alone by workers of the past unless they are agile learners who can untether themselves from traditional ways and embrace new technologies. Current employees must be complemented by new talent such as data scientists, engineers, and analysts.

Like other long-established industries, utilities must compete for top talent with Amazon, Tesla, and other new economy companies that offer high-growth potential and the excitement of building something new. Utilities that succeed in attracting talent will be able to leverage data, integrate IoT, and transform themselves into the platform businesses of the future. Those that fail to attract talent will end up with wire and cable businesses that will offer little growth with increased people risks.

Trends

The good news for utilities is that potential job candidates view the industry favorably, according to a 2019 poll we conducted. Of 1,000 non-utility workers under the age of 40, more than 80% view utility careers positively, and nearly 70% would consider working for a utility. Meanwhile, utility workers report relatively high job satisfaction: 91% feel either highly satisfied (36%) or fairly satisfied (55%) with their careers.

Utility executives are less optimistic about the industry’s performance. A mere 6% believe their utility is excelling at recruiting younger employees and technical talent, and 48% believe their recruiting may not be enough to meet future needs.

It seems much of the underlying issue is that the utility itself is not creating the environment or culture to attract and retain the top talent of tomorrow. More than 60% of utility workers indicated that their workplace technology needs updating, and 42% of younger non-utility workers said that more flexible working arrangements would make utilities more attractive. We also found that employees believe that utility leaders need to place a much higher priority on employee experience, job satisfaction, and workplace culture.

Taking action

There are several key steps to winning the war for talent. The first is upskilling: expanding and updating the digital skills of the existing workforce. It is vital for the utility to identify and cultivate long-term employees who can adapt to new procedures and learn cutting-edge technologies. These employees can bridge the gap between old and new approaches. Digital training can help workers feel more engaged and aligned with the utility’s mission, enhancing job satisfaction, increasing retention, and yielding a more flexible workforce. Highly engaged employees are 36% more likely to stay with an organization.

As employees gain skills, the utility can begin redefining roles and departments, building in more flexibility, allowing more teamwork, and emphasizing opportunities to innovate. Within this structure, employees can pursue new interests and accomplishments.

Third, utilities must hire new talent, especially individuals with strong digital skills. To compete for talent against technology companies, some utilities are using marketing channels to change industry perceptions, focusing on the opportunity to build a new, clean, and efficient energy future. Utilities have a strong story to tell about their role in the future of our communities and the planet.

Finally, utilities must improve the employee experience by investing and by updating their policies and procedures. Top talent expects to use leading technology, creativity to be encouraged, and leaders to listen to them. And yet, utilities are struggling in these three areas.

Only 12% of employees said the utility they work for provides access to the best technology, 27% said creativity is encouraged, and 34% said leaders take their input seriously.

On policies, utilities must provide flexible work arrangements and align company culture to better accommodate the expectations of young workers. They need to emulate tech companies by offering more fluid career paths, providing opportunities to explore new areas and change job functions. Younger and highly skilled workers also want to work for a company that shares their values. Utilities have a prime opportunity to help them fulfill this ambition given the critical role the industry is playing in reshaping the way we generate and use energy. To compete for top talent, utilities should capitalize on this in a way that generates pride and ownership.

Conclusion

Utilities need to continue innovating in order to seize the opportunities that lie ahead. The pace of change, customer expectations, security threat landscape, and need for new infrastructure will only continue to grow. But without a workforce that possesses analytical, data science, and technology skills that are becoming more necessary in daily activities, the ability to keep up with growing expectations will be nearly impossible. Employees must have the digital skills and be empowered with modern technology to deliver a safe, reliable, and seamless experience that customers demand. Tackling these issues will be an ongoing battle for utilities throughout 2020 and beyond, and those who are proactive today will be set up best for success in the new decade.