April 2017 | Point of View

The financial impact of cloud vs. on-premises decisions

Looking beyond the business benefits to unearth the best financial decision for your portfolio company

The financial impact of cloud vs. on-premises decisions

Whether evaluating a target or overseeing improvement at an existing portfolio company, financial investors often must consider the requirements for upgrading or establishing new infrastructure and core business applications.

In today’s IT environment, that means deciding whether to build or maintain the necessary services on premises or buy services in the cloud.

While these decisions can be highly complex, financial investors need to understand the impact of both scenarios on financial performance. This white paper details the short- and long-term investment considerations of on-premises and cloud strategies. It also poses questions to help forecast costs accurately over the investment horizon.

While financial analysis is important … investors should think in broader terms: Which investment scenario best positions the company to achieve its growth objectives while maintaining its EBITDA target? ”

Why a cloud vs on-premise financial analysis is important

Acquisitions, mergers, and carve-out transactions often involve establishing new infrastructure or core business applications—whether due to the significantly larger or more diverse operations of a merged organization, or the need to stand up a new enterprise created from a carve-out. Even portfolio companies that are not in transition may need to update or change the IT environment to enable growth or strategic objectives. In such cases, one of the first questions will be: Should the new infrastructure and/or applications reside internally or in the cloud?

The question sets off a complex decision process—one where cost is a factor, but usually not the only factor. The decision to migrate operations to the cloud is often as much about flexibility and agility to enable competitive advantage and rapid growth potential as it is about operating versus capital cost (or other factors).

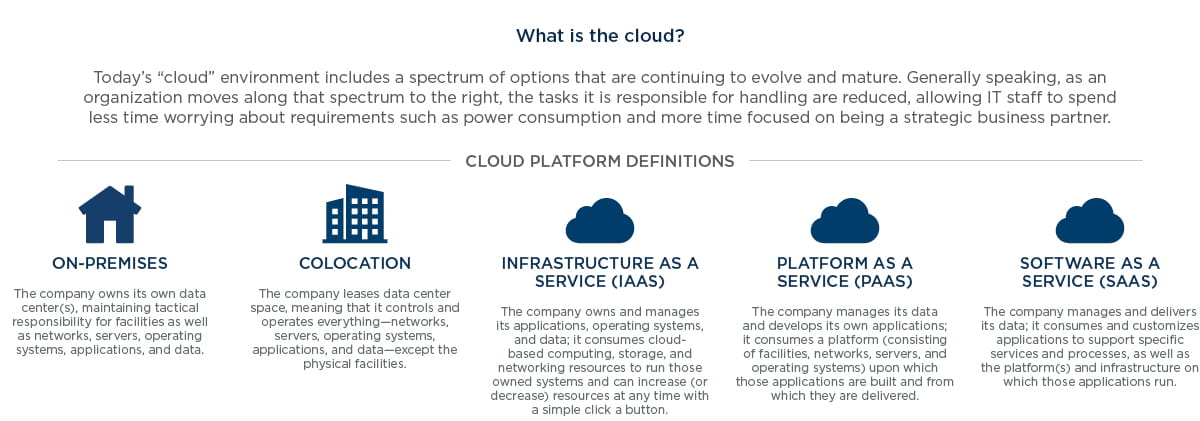

Today’s “cloud” represents a spectrum of options that are continuing to develop and mature, and many organizations implement a hybrid model of both cloud and on-premises solutions. See ”What is the Cloud?” to consider the complex and evolving nature of this area when making these decisions.

On the surface, the key economics of cloud operations—lower capital expenditures and potentially higher operating costs—seem contradictory for a financial investor seeking to maximize EBITDA. The right answer, though, might not be quite that simple. Experience shows that it is important to run the numbers and understand the financial impact of each particular scenario, and then to consider that in combination with other factors that are relevant to the business strategy.

While cloud vendors can articulate the business benefits of moving to the cloud, they won’t be as adept when it comes to determining the financial impact, particularly in a private equity scenario with its unique considerations. Thus, financial buyers must do their own legwork to understand the impact on their investment.

The decision to migrate operations to the cloud, versus keeping operations on-premise, is often as much about flexibility and agility to enable competitive advantage and rapid growth potential as it is about operating versus capital cost. ”

While cloud vendors can articulate the business benefits of moving to the cloud, they won’t be as adept when it comes to determining the financial impact, particularly in a private equity scenario with its unique considerations. Thus, financial buyers must do their own legwork to understand the impact on their investment.

The cloud: Financial opportunities and cautions you may not have considered

For financial buyers evaluating cloud versus on-premises strategies for targets or portfolio companies, the cloud offers several opportunities but comes with areas of caution as well.

Opportunities

Speed to operational day one. Companies operating in a cloud environment typically spend less time procuring and implementing data architectures for customer and operational insights, system integration, and data migration for new or combined operations. In addition, their IT staff can spend more time on initiatives that drive business value and less time running basic operations.

Efficiency in divestiture. As the investment period comes to an end, the transition of technology and services can be significantly shorter for operations running in the cloud. This can reduce the complexity of the transaction services agreement, including the time period and overall cost specific to technology and systems.

Management of portfolio risk. In an environment of increased regulatory scrutiny, organizations can take advantage of today’s mature cloud services technologies, processes, and certifications to help reduce their cybersecurity risk profile. These environments and pools of expertise are difficult and expensive to replicate internally.

Business scalability. Cloud infrastructure enables a business to adapt its IT services quickly and as needed. With cloud pricing models based on consumption and scalable as a company grows, technology no longer inhibits speed of delivery or serves as an unknown cost of growth. Infrastructure can also easily be scaled to support activities like significant development efforts.

Areas of caution

Vendor management. Managing cloud vendors’ support levels and performance, and building flexibility into contracts, requires a level of vendor management maturity that some organizations do not possess, this is particularly true in multi-cloud environments, which are typical and add more vendors to the mix.

Sensitive data. While the security and regulatory compliance in the cloud is typically superior to many internal IT organizations, sensitive data is still a concern for cloud hosting. Organizations are accountable for breaches, not their cloud service providers, and they need to maintain adequate processes for auditing and reviewing cloud vendors or other third parties. Moving to the cloud does not remove this responsibility.

Added change management, skills, and training. Introducing cloud technologies presents a big change for IT staff. Cloud technologies and toolsets are constantly changing and improving, which may require an upfront effort to manage the change, as well as ongoing training for existing employees, or investment in managed services.

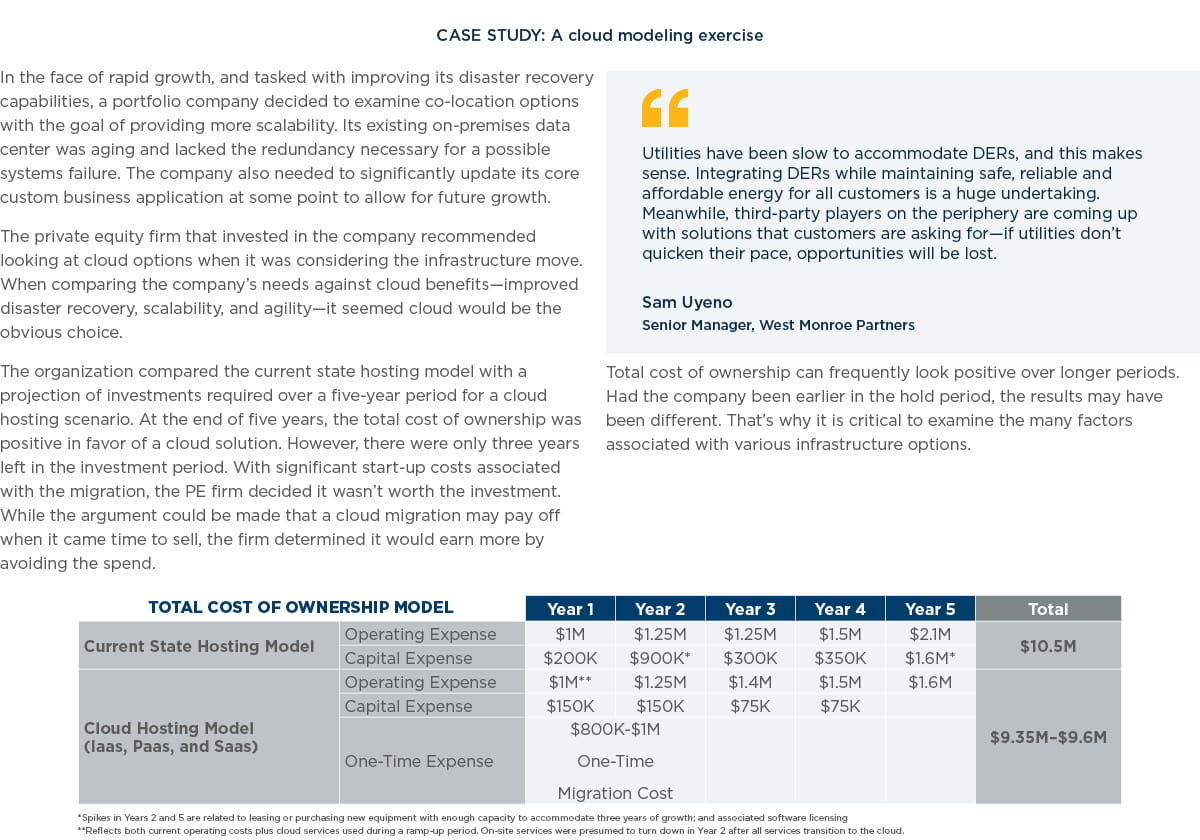

Cost. While many of the commoditized services in the technology environment may be cheaper to host in the cloud, the benefits of this model may not always include a positive total cost of ownership compared to on-premises models. (See “Case Study: A Cloud Modeling Exercise”).

Cloud vs. on-premises: Understanding the basic impact on EBITDA

Because EBITDA is a key driver in business valuation during a merger or acquisition, financial investors should understand the impact of cloud versus on-premises decisions on EBITDA—and in particular, the treatment of capital expenses and operating expenses related to building internal infrastructure versus moving it to the cloud.

In general, operating expenses reduce EBITDA. Since EBITDA is a measure of profitability before depreciation, capital expenses do not affect EBITDA. As a result, a scenario with lower operating expenses and higher capital expenses—characterizing the on-premises approach—would have a more positive impact on EBITDA. Accordingly, it is important to carefully assess and estimate both current and future operating costs.

Investors should also consider the cash required for upfront and ongoing capital expenses. While options with larger capital expenses may have a positive impact to EBITDA, these options also require more cash to support the on- premise systems. As a result, building internal infrastructure/software could tie up cash flow otherwise available to grow the business’s core operations.

A prudent investment decision starts with determining the present value of the discounted cash flows associated with both models throughout the investment horizon, with cash flows discounted at the weighted average cost of capital for all scenarios under consideration. The scenario with the greatest present value would forecast as the optimal investment scenario for the company— from an EBITDA perspective.

As with most investments, though, the cloud vs on-premise decision will involve more complexity than a simple present value calculation. As noted above, there will be cash-flow considerations, requiring a similar cash flow analysis of all scenarios. What are the current cash demands of the company? How could additional cash be spent to grow the business?

While this financial analysis is important to the investment thesis, investors should think in broader terms: Which investment scenario best positions the company to achieve its growth objectives while maintaining its EBITDA target? And what are the costs associated with risks transferred to the cloud vendor as opposed to being retained internally? What is the potential impact to EBITDA if these risks materialize?

Conclusion: A cloud vs on-premise analysis is time well spent

It is important to remember that for many organizations, particularly larger ones, a hybrid model that employs both cloud and on-premises systems and operations may make the most sense. It may also be necessary to run a hybrid model during a transition period, for example, when there is significant investment in legacy systems and/or custom applications. This will extend the analysis beyond a cloud versus on-premises comparison.

Every company has unique operations and needs— and the factors that determine the appropriateness of on-premise or cloud-based infrastructure and applications will be unique to the company, as well. For financial investors, costs and impact on EBITDA will be key factors in this equation. Many financial buyers dislike the idea of adding operating expenses, but often these costs, when invested the right way, make more sense than on-premises capital expenditure, both in the short and long term. Spending time to understand the costs and financial implications of each scenario is time well spent and potentially a source of greater value down the road.