Cybersecurity Advisory for Private Equity (CAPE)

Remote work, cloud adoption, and data integration and interoperability are among the trends changing how organizations use information technology. Change can open new doors—but sometimes to those who are not welcome. Attackers continuously evolve capabilities for hitting companies where it hurts most, and their motivations increasingly include the combination of ransomware and data exposure for extortion.

Private equity portfolios are an attractive target, with significant potential impact on value creation—not to mention the bottom line. In 2021, a ransomware attack cost $4.6 million, excluding ransom costs. These costs included in the $4.6 million include notification, lost business and response costs. And the average total cost of a breach increased 10% from the prior year (IBM, Cost of a Data Breach Report).

That’s why West Monroe created the Cybersecurity Advisory for Private Equity (CAPE) program. Combining expertise in breach investigation and infrastructure recovery/rebuild with deep private equity experience, we can quickly identify existing threats and produce business-centric recommendations for improving security posture and preventing future attacks. With more than 450 portfolio companies involved in the program to date, we have unparalleled insight into the cybersecurity risks that affect both company and fund performance.

Most CAPE activities take just a few hours, meaning less disruption for your portfolio company resources—and the ability for you to act sooner. In fact, by remediating issues before a ransomware attack occurs, the CAPE program can deliver up to a 16X return on investment.

Results You Can Expect

-

Protect financial and reputational assets with a strong cybersecurity strategy

-

Gain portfolio-wide insight into cybersecurity maturity and take action on your biggest risks

-

Reduce recovery costs and operational downtime in the event of an incident

-

Bolster your team with cybersecurity experts

-

Stay ahead of a rapidly evolving threat landscape

What We Offer

Assess cybersecurity maturity and develop a remediation plan

How well-prepared is your portfolio company to respond to cyber threats? We’ll help you find out, with a rapid but comprehensive review of cybersecurity risk and maturity, including resiliency against ransomware, data breaches, business email compromise, and impersonation attacks. Better yet, we’ll equip you for action. You’ll receive a prioritized roadmap of initiatives to remediate cybersecurity gaps and increase resiliency based on the specific threats to each portfolio company.

Analyze and harden Microsoft 365 and Google Workspace environments

Did you know that 82% of breaches involve a human element, and 35% of ransomware attacks involve the use of email (Verizon 2022 Data Breach Investigation Report)? That’s why we put particular emphasis on securing and hardening Microsoft 365 and Google Workspace collaboration environments.

Our experts have performed hands-on, secure implementation for hundreds of clients—expertise that enables us to identify potential compromise risks and configuration enhancements for these environments, including minimizing the amount of spam and reducing the likelihood of email compromise. We’ll also help implement high priority changes to quickly cut down on the likelihood of compromise.

Conduct cyber and dark web reconnaissance

We work directly with a cyber threat intelligence vendor to search your portfolio company’s digital footprint on both the dark and public web. Our analysis looks for potential exposure issues, such as leaked credentials or confidential company information—assets that an attacker could exploit to gain unauthorized access into the company’s environment.

Perform backup and recovery analysis and remediation

Inadequate backup tools and/or coverage can increase the risk of data loss due to data corruption or malicious activity. We take a close look at backup tool configurations, security features, storage locations, and other capabilities to identify and remediate any high-priority issues.

Review Active Directory domain services and harden the environment

Accounts with many elevated privileges can increase the risk of a security incident. We review group policy configurations and inspect memberships of privileged groups and directory permissions—and then help remediate high-priority gaps.

Scan for external vulnerabilities

Another key aspect of CAPE is automated vulnerability scanning. We use a third-party scanner to evaluate your portfolio company’s external networks, systems, and applications for known security vulnerabilities. Based on our observations, we recommend relevant remediation activities.

Provide ongoing check-ins and advice

Cybersecurity is an ever-evolving discipline—you need to keep your defenses well-honed. Our team will review key remediation initiatives established earlier, provide guidance for implementing recommendations, and help you develop a holistic view of security improvements required across your portfolio.

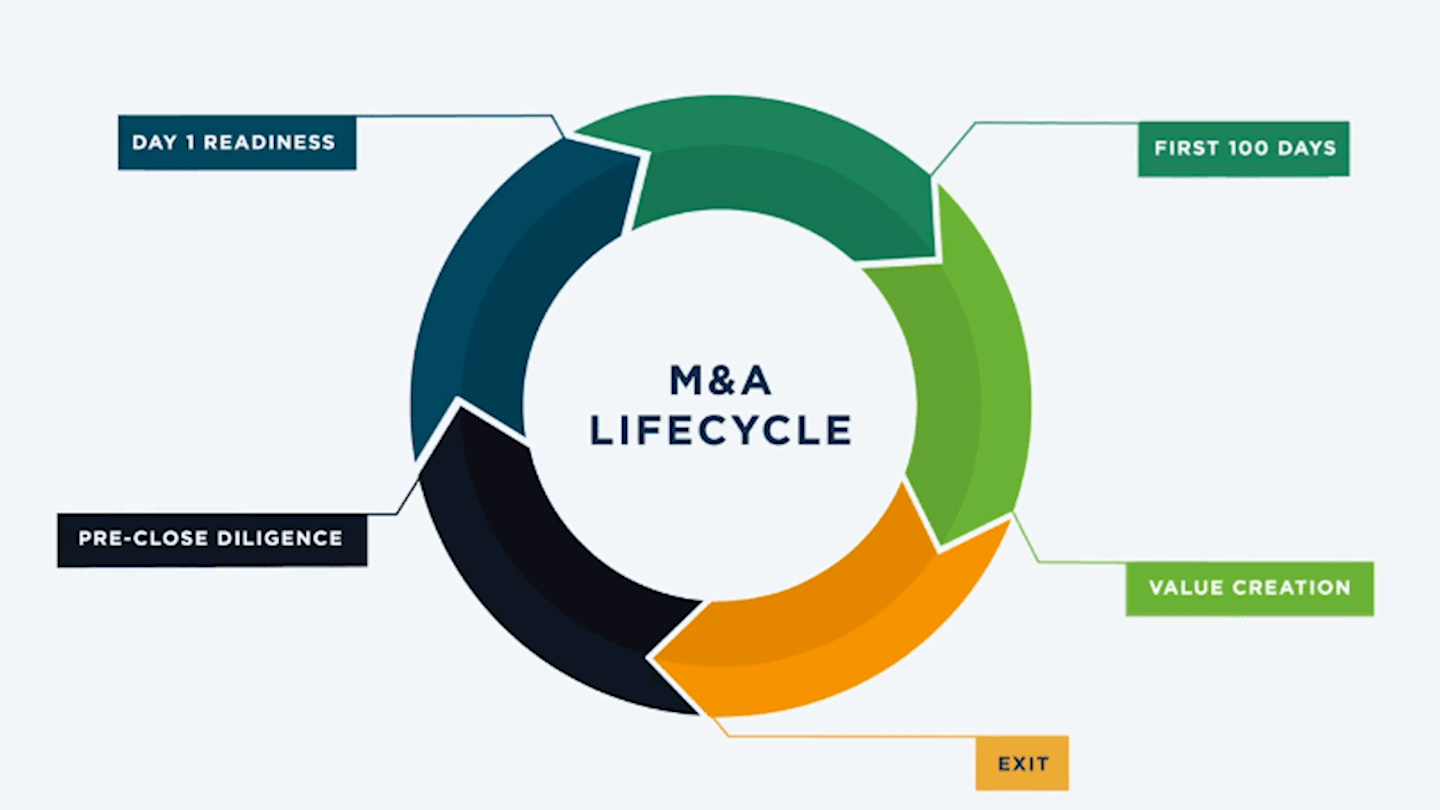

Using Intellio® to create value across the M&A lifecycle

Interested in easier, better M&A? Private equity firms that buy, build, and sell platforms can use West Monroe’s Intellio® suite to drive more value.